A new report from the NMHC Research Foundation seeks to answer this question. The report analyzes data from the National Council of Real Estate Investment Fiduciaries (NCREIF) for the thirty year period between 1987 and 2016 to derive its conclusions. It compares apartment investing with other investments in commercial real estate including industrial, office and retail buildings.

The report compared the returns of the four types of commercial property for all possible 1, 3, 5, 7, 10 and 15 year holding periods within the 30 year time span studied. When all of these returns were averaged for each period length, it found that apartments were usually the best performing building type. The exception was for the 1 year holding period. In that case, retail buildings provided the highest average return.

The report includes charts showing the returns for 3, 5, 7,and 10 year holding periods on a yearly basis. The charts show that much of the relatively strong performance for apartment investing occurred early in the 30 year period studied. They show that the returns for the four building types (industrial, office, retail, apartments) seem to have converged in recent years. This may indicate that markets have become better at pricing commercial property in recent years or that apartments were relatively undervalued in the late 1980’s.

Factors affecting apartment investing returns

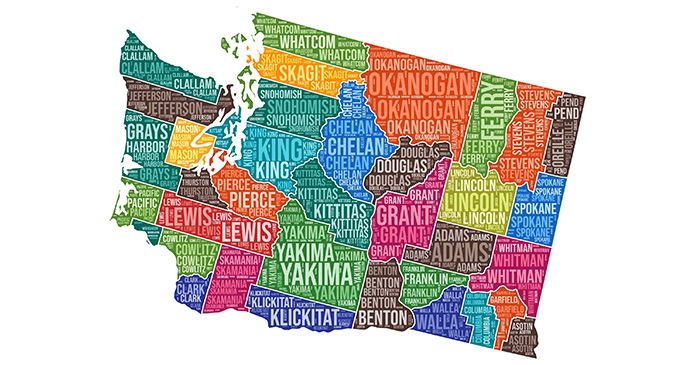

The report also examines the impact of other factors on returns. It looks at returns by region of the country. The report looks at the impact of total employment and of employment growth in the local market. It also looks at the impact of the annual capital expenditures for the different building types on their returns.

The NMHC Research Foundation was created in 2016 as a 501(c)(3) non-profit in order to produce research on the apartment industry. Dr. Mark J. Eppli of Marquette University and Dr. Charles C. Tu of the University of San Diego prepared the report.