It’s happening. Not good.

As of now, bills have been introduced in several states to block corporate ownership of single-family homes.

Arizona. Connecticut. Indiana. New Hampshire. New York. Oklahoma. Texas. Utah. Virginia.

Several of these have been filed just in...

Multifamily starts forecasts raised

Fannie Mae’s February housing forecast calls for multifamily starts to slow to start 2025 but to then rise through the end of 2026. The starts forecasts for every quarter in 2025 and 2026 were...

Preserving affordable housing in the Trump era

The United States is experiencing a rental housing crisis. There is a shortage of affordable housing, and many renters struggle to pay rent. Making matters worse, thousands of the nation’s affordable housing units are...

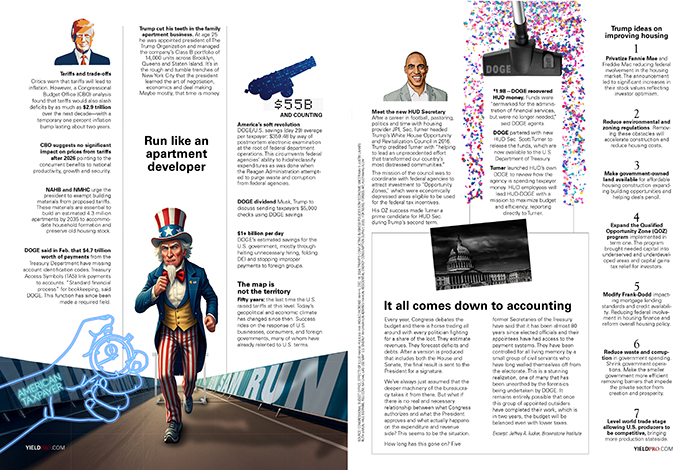

Run like an apartment developer

Tariffs and trade-offs

Critics warn that tariffs will lead to inflation. However, a Congressional Budget Office (CBO) analysis found that tariffs would also slash deficits by as much as $2.9 trillion over the next decade—with...

JLL with NexMetro Facilitates Equity Placement for a Portfolio Across Arizona, Colorado, and Texas

JLL Capital Markets announced that it has arranged a recapitalization of eight NexMetro assets with Stockbridge investing $65.9 million of preferred equity along existing assumable agency financing of $206 million.

This completes the second closing...

Apartment REITs (and some privates) lead new project starts

Confidence has returned to a small segment of the multifamily arena forecasting an end to the supply glut that has stymied both development and acquisitions over the past several years. Apartment REITs...

TIC Acquires Blue River Communities and Merges into Rêve Homes

Trilogy Investment Co. (TIC), a leading real estate investment and development firm specializing in build-to-rent (BTR), for-sale and lot development, alongside Seed Capital Investments of Duluth, Georgia, announces the strategic acquisition and integration of...

Red Stone Equity Partners Raises $1.43B of Equity in 2024

Red Stone Equity Partners LLC, a privately-owned real estate finance and investment company specializing in affordable multifamily fund management, announced that 2024 marked the most productive year in the Company's history as it surpassed...

Multifamily starts lower despite steady permits

Recent reports on new residential construction from the Census Bureau have been up and down in the number of multifamily starts reported. Last month’s report was up and this month’s report was down. This...

Multifamily developer confidence soft despite solid occupancy

Confidence in the market for new multifamily housing reflected mixed results year-over-year in the fourth quarter, according to the Multifamily Market Survey (MMS) released February 13 by the National Association of Home Builders (NAHB)....

Multifamily CMBS special servicing rate eases in January while loan losses surge

Trepp reported that special servicing rate for multifamily commercial mortgage-backed securities (CMBS) loans fell slightly in January, declining by 30 basis points. It had risen for 5 months in a row. The overall CMBS...

Rate of construction materials price rise is higher in January

The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction materials prices rose 0.3 percent month-over-month in January on a seasonally adjusted basis. The index of components and...

New boss, potential budget cuts for affordable housing

President Trump’s budget cut proposals for housing programs have raised concerns in the affordable housing industry. On the table are proposed reductions to the U.S. Department of Housing and Urban Development (HUD)...

TruAmerica Multifamily Launches Structured Finance Vertical Led by Industry Veteran Ash Baraghoush

TruAmerica Multifamily, a leader in multifamily investment, is pleased to announce the launch of its new Structured Finance vertical, a strategic initiative to complement its flagship value-add investment platform. To spearhead this effort, the...

Marcus & Millichap Brings in Chief Information Officer Evan Wayne

Marcus & Millichap has added Evan Wayne as chief information officer.

“Marcus & Millichap has been at the forefront of innovation, developing proprietary tools since our founding,” said Hessam Nadji, Marcus & Millichap’s president and...