Wednesday, the Urban Land Institute (ULI) presented its most recent semi-annual real estate economic forecast, which extends through 2020. The ULI forecast is based on the median of the forecasts of 48 economists or analysts at 36 real estate organizations. It predicts that the current economic expansion will continue for the next three years, but that the rate of growth will moderate.

Predictions for the economy

The ULI real estate economic forecast predicts that GDP growth will rise from 2.3 percent in 2017 to 2.8 percent in 2018. GDP growth is then expected to fall to 2.5 percent in 2019 and 2.0 percent in 2020.

The unemployment rate is predicted to fall to 3.9 percent in 2018 as the economy is expected to add 2.2 million jobs. Unemployment is predicted to be 3.8 percent in 2019 with the addition of 1.89 million jobs. Unemployment is then forecast to rise to 4.1 percent in 2020 when the economy is predicted to add only 1.38 million jobs, a number which will not keep up with the growth of the labor force.

All of the above economic predictions are more optimistic than those made in the last forecast six months ago and the passage of tax reform was cited as a cause.

The ULI real estate economic forecast predicts inflation as measured by the Consumer Price Index (CPI) will rise to 2.3 percent in 2018 and to 2.5 percent in 2019. Inflation is then projected to fall slightly to 2.45 percent in 2020.

Interest rates as measured by the 10 year treasury note are expected to rise to 3.1 percent in 2018 and to 3.4 percent in 2019. They are predicted to remain at 3.4 percent into 2020.

Predictions for apartments

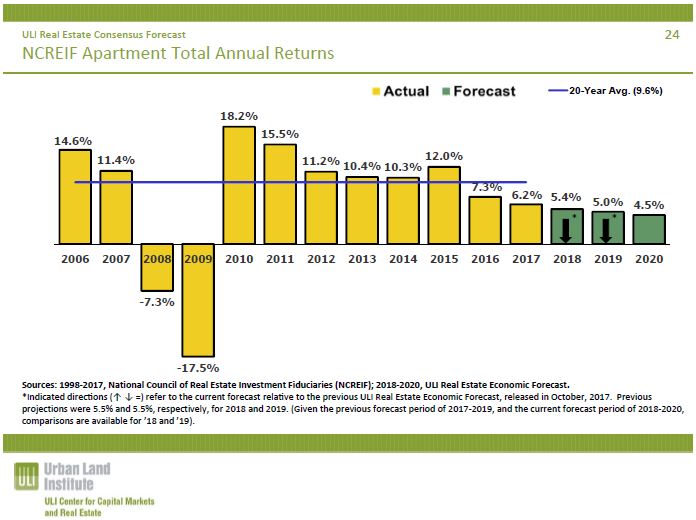

NCREIF returns for apartments are expected to be 5.4 percent. This is below predicted returns for the industrial real estate sector but above those predicted for the retail real estate sector. Forecast returns for apartments are expected to be somewhat lower by 2020 and have been revised downward since the last ULI forecast was released. The forecast summary appears in the following chart.

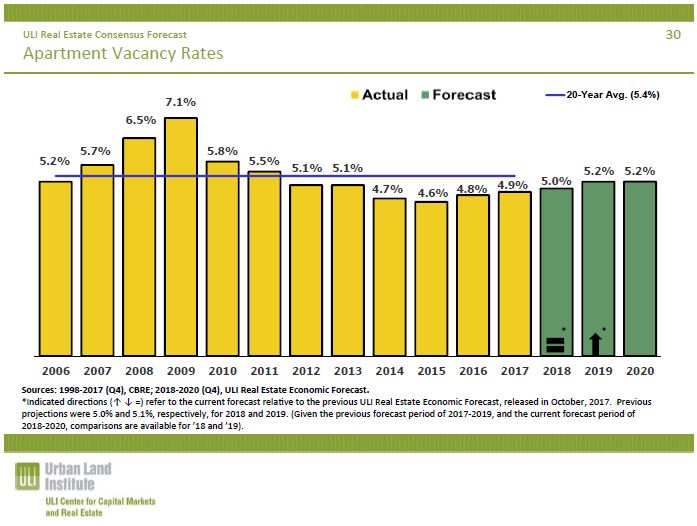

The ULI real estate economic forecast predicts gradually rising vacancy rates for apartments. Vacancy rates are expected to be 5.0 percent in 2018. Vacancy rates are predicted to rise to 5.2 percent in 2019 and to remain at that level in 2020.

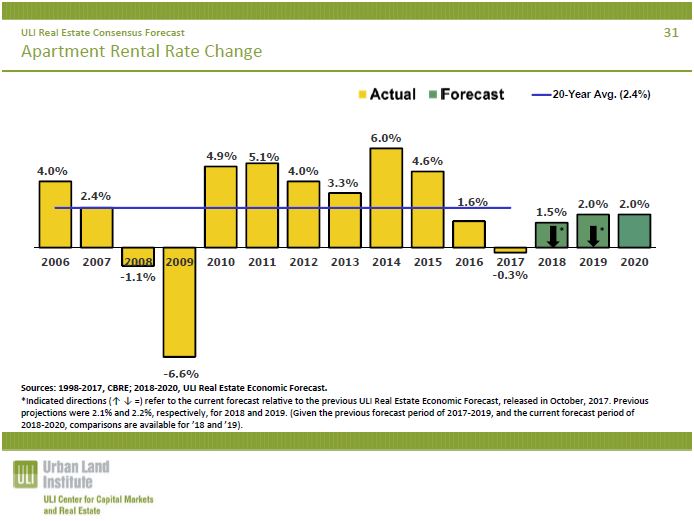

ULI data indicate that apartment rents fell in 2017 after several years of strong increases. The ULI forecast predicts that positive rent growth will return in 2018, with rents rising 1.5 percent. Rents are predicted to rise by 2.0 percent in both 2019 and in 2020.

Keeping an eye on the competition

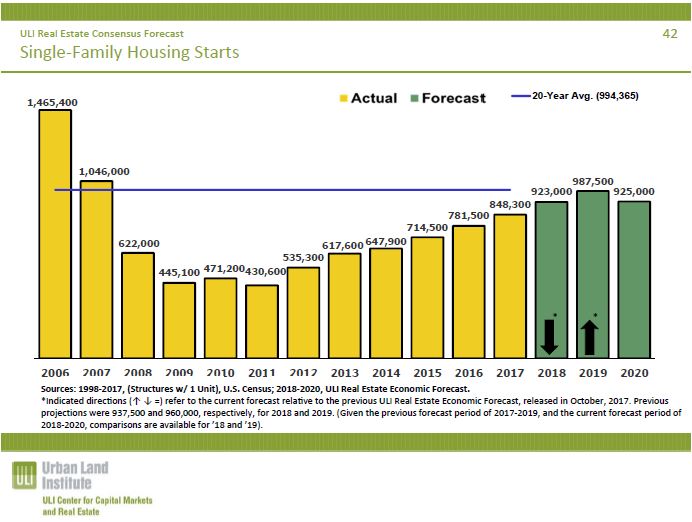

While not strictly on the topic of the apartment market, the ULI forecast also looked at the future of the market for single family homes. It predicts that single family home production will remain strong for the next three years.