The Harvard Joint Center for Housing Studies (JCHS) released the latest version of its report, “The state of the nation’s housing.” This annual report has been produced since 1988 and examines the conditions in both the for-sale housing and the rental housing parts of the market. Here are the report highlights regarding the rental housing sector of the market.

Changes in renter demographics

The report notes changes in the renter population. The number of renter households declined in 2017 by 180k as home ownership rebounded somewhat. Higher income households (50k+) accounted for the majority of renter growth in last 5 years.

In metro areas, the lowest income residents (under $25k) have been moving out of the highest density areas to moderate and low-density areas. However, people are moving less in general. Only 11 percent of households moved in 2017, a record low.

More people now live with roommates.

New rental housing construction goes big

The report stated that 378,000 new rental units were completed in 2017, 42,000 of which were single-family homes built for the rental market. The single-family rental homes were double their share of new rental units in 1988.

Most–97 percent–of new market-rate apartments in 2016 were built in metro areas, with two-third of these units in the principal city of the metro area. Half of new units were in buildings of 50 or more units. This compares to only 13 percent of new units in larger buildings in 1999. Amenities continue to expand; 89 percent of new units have in-unit laundry.

Market conditions soften a bit

The share of new apartments rented within 3 months dropped from an average of 63 percent in 2013-2014 to 55 percent in 2017. Nationally, the vacancy rate for all rental housing units was 7.2 percent but the vacancy rate for professionally managed apartments was only 4.8 percent. The vacancy rate was slightly higher than this for class A apartments but was only 4.4 percent for class C apartments, the lowest rate for them since 2001.

Nationally, rent charged for all types of rental housing units was up 3.7 percent year-over-year through April, 2018. For professionally managed apartments, rent was up 2.6 percent Q1, 2018. Over the same period the year before, this same category of rents increased 2.8 percent. The West was the region with the fastest apartment rent growth, coming in at 3.4 percent. Of the 150 apartment markets tracked by RealPage, 67 of them saw rent increases of less than the 2.2 percent rate of inflation.

Affordability remains a concern

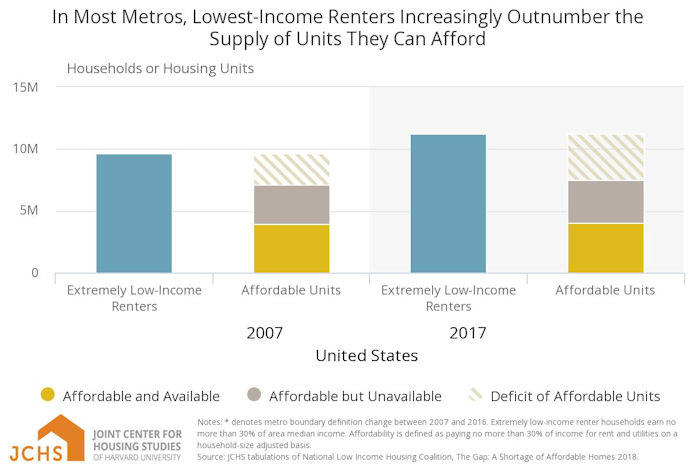

Between 2007 and 2016, the number of extremely low-income rental households increased faster than the increase in the number of units affordable to them. The National Low Income Housing Coalition reports that there was a national shortage of 7.2 million of these units in 2016. They contend that affordable units are being lost to tear-downs, conversions or upgrades. Not enough older units are filtering down into the affordable class nor are enough new affordable units being built to make up for this loss and for the increase in demand.

Investment returns remain solid

The growth of NOI for investment grade rental housing dropped to 3.4 percent in the year to Q1, 2018. Growth of NOI had been as high as 10 percent as the market continued to recover from the trough of the recent housing downturn.

Price appreciation for apartment buildings remains strong at 11 percent. Appreciation is fastest in the mid-rise to high-rise market segment, but even the garden-style apartment segment performed better than single-family homes. Inflation adjusted prices of single-family homes still have not returned to 2006 levels.

The report expects the apartment market to soften somewhat because of increasing vacancies and shifts in rentership. However, the market will be supported by the trends of millennials forming households and baby boomers shifting to renting.

The full report can be found here.