The Federal Home Loan Mortgage Corporation (Freddie Mac) recently released its Apartment Market Investment Index (AIMI) for Q3, 2018. It showed a decrease in the attractiveness of investing in the multifamily property market.

The market in a number

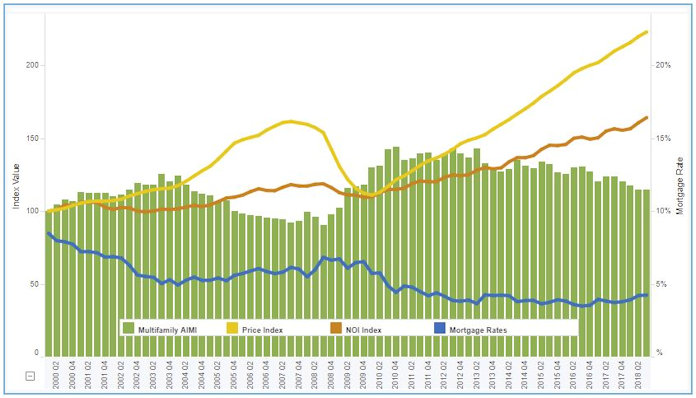

Freddie Mac developed the AIMI as a quick way to assess the changing attractiveness of investing in multifamily properties in a given market over time. It is derived from three market variables: the interest rate on multifamily mortgages, the growth rate in multifamily property prices and the growth rate in multifamily net operating income (NOI). The higher the value of the AIMI, the more attractive an investment in multifamily property is said to be. Higher growth in NOI results in a higher AIMI while higher multifamily mortgage interest rates or higher growth rates in multifamily property prices result in a lower AIMI.

The AIMI calculation does not take into account other factors such as growth in the renter population, job growth or the rate of construction of new units, so it provides a simplistic look at the multifamily property market at best. Still, it is instructive to look at the variables that feed into the AIMI calculations. A chart showing these variables is shown below.

Affordability on the decline

On a year over year basis, AIMI is down by 7.2 percent for the nation as a whole. This continues a trend which has been in place since 2012 and has been driven by rising property prices and, more recently, by rising mortgage interest rates. This is despite an annual growth rate in NOI of 4.9 percent, much higher than the historical average rate of increase in NOI of 2.0 percent. However, the annual growth in property prices is 6.3 percent, meaning that the return on investment for newly purchased rental property would be under pressure even if mortgage interest rates were not rising. Unfortunately for multifamily property investors, they are.

While the AIMI gives only a partial view of the state of the multifamily property market, it does indicate that conditions for investors are becoming less attractive generally. More care may be required in order to find investments that will provide solid returns.

The entire report can be found here.