The Census Bureau released its monthly new residential construction report for March 2019. The report shows a multifamily housing construction market with a strong level of completions but some weakness in the development pipeline.

Note that the construction market has recently been impacted by severe winter weather in much of the country. In addition, the partial government shutdown early in the year affected the ability of the Census Bureau to collect its data in a timely manner. The effects of both of these situations may still be rippling through the data being reported, making underlying trends harder to spot. It may be some time before the direction of the housing construction market is clear.

Permits soften

Nationally, permits for buildings with 5 or more units were down by 2.7 percent from February, to 425,000 units on a seasonally adjusted, annualized basis. The February figure itself was revised downward, but only by 2,000 units, from the preliminary value reported last month. Compared to the year-earlier level, permits for buildings with 5 or more units were down by 12.6 percent.

Another 36,000 permits were issued in March for buildings with 2 to 4 units, almost the same as last month’s figure

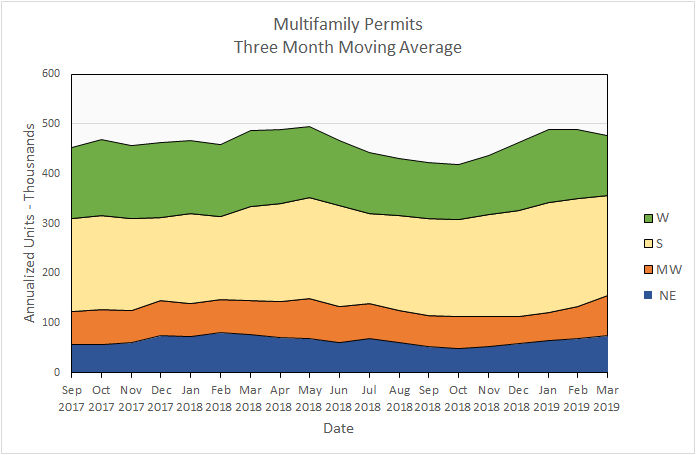

Regional data for multifamily housing is only reported for structures with two or more units. “Structures with 5 or more units” is not broken out as a separate category. Since the regional data is highly volatile and is frequently revised, it is examined here based on three month moving averages.

For the country as-a-whole, the three-month moving average for permits issued for multifamily housing In March was down by 2.5 percent from the February level and was down 1.9 percent from the level of March 2018. This is shown in the first chart, below. The strong recovery from last summer’s lull in permitting activity may have run its course and it may be a few months before a new pattern emerges.

On a month over month basis, the Northeast and the Midwest regions both saw an increase in permitting activity. The Midwest was up by 25 percent and the Northeast was up by 8 percent. However, the two larger regions were both down, the South by 8 percent and the West by 12 percent, resulting in the overall decline.

The 20 percent decline in permits in the West on a year-over-year basis drove the decline in the national number. By contrast, permits in the South were up by 6 percent and permits in the Midwest were up by 20 percent.

Multifamily housing construction starts are also soft

After last month’s rebound from the December-January slowdown, construction starts for buildings with 5 or more units were down 3.4 percent from February to a level of 337,000 on a seasonally adjusted, annualized basis. Compared to year-earlier levels, construction starts for buildings with 5 or more units were down by 22 percent. However, March 2018 was a very strong month for housing starts and that strength accentuated the weakness of the current month.

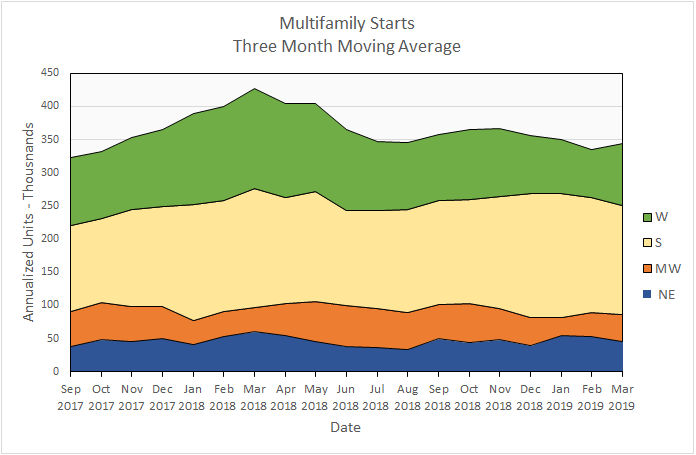

Multifamily housing construction starts (two or more units per building) were up 3 percent from their February levels for the country as a whole, based on three-month moving averages. The West rebounded from a weak February to post an increase in starts of 29 percent. The Midwest also posted a gain for the month, 15 percent in its case, but both the South and the Northeast saw starts decline.

On a year-over-year basis, starts were down 20 percent for the country as a whole. The three-month moving average of starts was at an annualized level of 344,000 units. Starts were down 39 percent in the West and 8 percent in the South. Only the Midwest showed a year-over-year increase with starts rising 10 percent.

The following chart shows the starts by region for the last 18 months.

Completions continue strong

After surging 45 percent last month, nation-wide completions of buildings with 5 or more units fell 25 percent this month. It would seem that the February figure, adjusted to 486,000 units in this report, was an anomaly. In any case, completions in March were reported to be 364,000 units on an annualized basis. While down for the month, this figure was actually 2 percent higher than the year-earlier level.

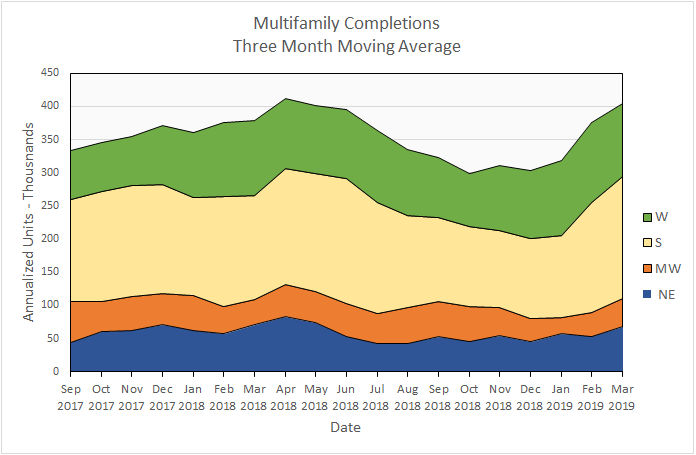

Nationally, completions for multifamily housing (two or more units) were up 7 percent month-over-month when comparing three-month moving averages. Completions were up by double digit percentages in all regions except for the West, where they fell by 10 percent.

On a year-over-year basis, the three-month moving average of completions was up by 7 percent. This increase was largely driven by the strength of the South, where completions rose by 17 percent. Completions were also strong in the Midwest but fell slightly in the Northeast and the West. Nationally, the three-month moving average for multifamily housing completions came in at 373,000 units on an annualized basis.

Completions by region for the past 18 months are shown in the chart below.

All data quoted are based on seasonally adjusted results and are subject to revision.