As high-net-worth (HNW) investors and family offices mull this year’s opportunities in commercial real estate, they might want to keep the multifamily mantra in mind.

For several years, industry players have consistently preached about the attractiveness of multifamily properties for HNW investors and family offices.

Indeed, a recent NREI survey shows that, once again, multifamily ranks as the most in-favor asset class among HNW investors. For 2020, the multifamily sector should remain a rich environment for HNW investors and family offices, experts say.

More than ever, multifamily should be on the radar of HNW investors and family offices because of the sector’s continued resilience compared with other asset classes, says Ari Rastegar, founder and CEO of Austin, Texas-based real estate investment firm Rastegar Property Co.

“Take into account that millennials are drawn to homeownership less than prior generations, mostly resulting from an evolving workforce, and multifamily appears to be a sound investment where you can still find value and minimize risk,” Rastegar says.

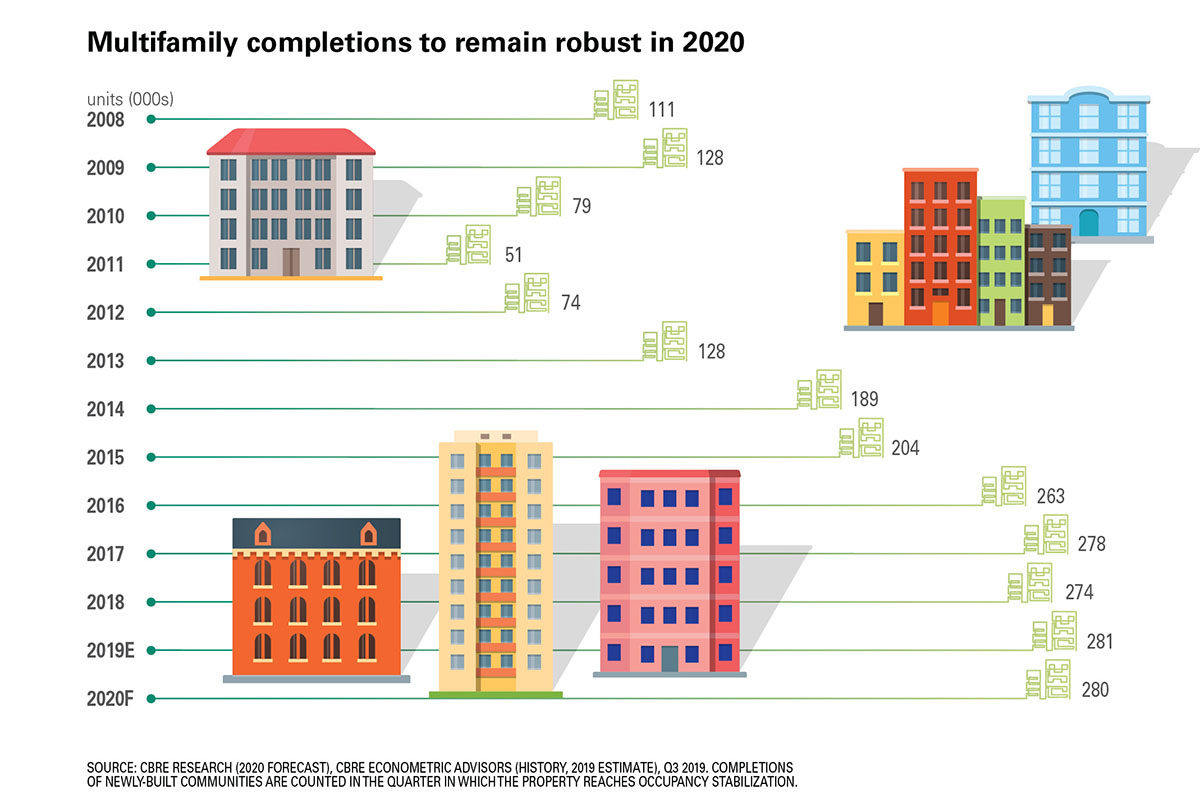

A 2020 outlook from commercial real estate services company CBRE underscores Rastegar’s viewpoint. The report says that despite new supply projected to exceed demand in 2020, multifamily is positioned for “continued favorable performance.”

Even in the face of heightened supply levels, multifamily demand “will remain sufficient enough to absorb most of new supply and to lower concessions in oversupplied markets,” according to the report.

CBRE predicts the overall multifamily vacancy rate in the U.S. will rise by 20 basis points to 4.5 percent this year, still below the long-term average of 5.1 percent. Meanwhile, rent growth will dip to about 2.4 percent, slightly under the long-term average of 2.6 percent.

“Purchasing multifamily property and leveraging it conservatively with cheap 10-year, fixed-rate debt is an attractive strategy for 2020,” says Ian Formigle, VP of investments at CrowdStreet, an online platform for commercial real estate investing. “If you can find a solid multifamily asset in a growing location, this strategy can insulate you against uncertain risk over the next few years and position you to exit during the next cycle.”

To capitalize on the sector’s anticipated healthy fundamentals in 2020, which locations should HNW investors and family offices weigh for their multifamily money?

This year’s best multifamily opportunities will be found in suburban markets and smaller metro areas, as well as in major metros like Atlanta, Austin, Texas, Boston and Phoenix, according to CBRE research.

Thanks to solid market performance and robust investment returns, suburban markets will reign as the best bet in 2020 for multifamily investors, the firm’s data shows. In making that assessment, CBRE cites lower vacancy rates and higher rent growth in suburban markets compared with their urban counterparts.

Spotting the winners

On a metro-wide basis, several regions stand out. A 2018 report from the National Council of Real Estate Investment Fiduciaries (NCREIF) ranked Las Vegas, Phoenix and Sacramento, Calif. among the top five metro areas for outperformance in the multifamily category in terms of annual investment returns.

That trend could continue into 2020. Real estate data provider Yardi Matrix expects Las Vegas (7.3 percent), Phoenix (6.4 percent) and Sacramento (5.9 percent) to wind up being among the leading markets for year-over-year rent growth for 2019. Other cities making the top tier included Seattle (6.4 percent); Boston (6.2 percent); Charlotte, N.C. (6.0 percent); Raleigh, N.C. (5.8 percent); and Austin and Nashville, Tenn. (5.4 percent each).

In a report covering the fourth quarter of 2019, Marcus & Millichap says the resurgence of the Las Vegas market should propel its apartment rental sector into 2020.

“The economic strength of Las Vegas has shined through in recent years, as this late-recovery market has been able to attract more residents and record strong job gains,” the report notes.

As for Phoenix, Marcus & Millichap researchers write that apartment supply will start to outstrip demand, with inventory set to spike by 35 percent this year.

However, the market’s fundamentals remain favorable, boding well for growth in rental rates, according to the company’s fourth-quarter report on the Phoenix market.

To the northwest of Phoenix, a shortage of housing persists in Sacramento, foreshadowing a strong multifamily sector in 2020 as developers struggle to catch up with demand, Marcus & Millichap says in its fourth-quarter market report.

If 2019 rent growth is any indication, markets like Las Vegas, Phoenix and Sacramento appear promising for HNW investors and family offices in 2020.

“Fundamentally, occupier demand is strong, and rents continue to grow in most segments,” Yardi Matrix researchers write in a November 2019 report examining the multifamily sector. “Meanwhile, property values are at all-time highs and debt markets are functioning smoothly, with healthy deal flow and few delinquencies.”

Thinking small

Smaller metro areas are also worth a look in 2020, based on CBRE’s forecast. In 2019, more than half of multifamily properties purchased in the U.S. have been in secondary and tertiary markets, according to Marcus & Millichap.

Smaller metro areas singled out by CBRE as potential candidates for outperformance this year include Albuquerque, N.M.; Birmingham, Ala.; Colorado Springs, Colo.; Greensboro, N.C.; Memphis, Tenn.; Dayton, Ohio; and Tucson, Ariz. These seven metros notched year-over-year apartment rent growth of at least 4.0 percent as of the third quarter of 2019, according to CBRE.

Meanwhile, markets that multifamily investors should approach cautiously in 2020 include New York City, California, Illinois and Oregon. In these places, rent control laws—which critics say stifle investment in apartments—are either on the books or in the works, CBRE notes.

No matter the geographic location, multifamily assets generally keep chugging along. The NCREIF report shows the 10-year return rate for multifamily properties in the U.S. stood at 7.52 percent—above the hotel and office sectors, but below the industrial and retail sectors.

“Apartments have had a good run over the last 10 years, and the demographics still offer very favorable and compelling trends for multifamily to continue to dominate the real estate investment space,” says Durant Bell, EVP of HNW relations and business development at apartment investment and management firm Bell Partners Inc., based in Greensboro, N.C.

Author John Egan, NREI Online