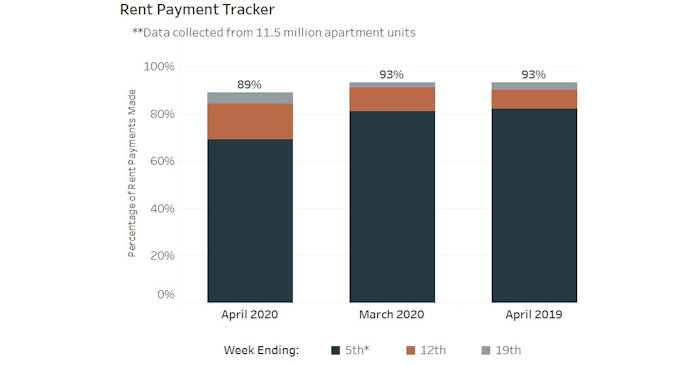

As part of its project to track rent payments being made during the corona virus shutdown, NMHC reported that an additional 5 percent of renters made at least a partial payment of their April rent during the third week of the month. This brings the portion of renters who have at least partially paid their rent in April to 89 percent. This compares with 93 percent of renters who had made a rent payment during the same time in April of last year and also 93 percent who had made a rent payment at this point in March 2020.

The release of the rent payment data was accompanied by a webcast with representatives of the property management software providers who supplied the data, as well as with two executives representing apartment managers. This week, the apartment managers were represented by Lilli Dunn of Bell Partners and Robert Hart of TruAmerica.

Again this week, the webinar participants expressed satisfaction that rent collections in April have gone as well as they have. One reason cited for this is that the property managers have been flexible in arranging payment terms with residents. Dunn said that about 10 percent of Bell Partners’ residents had arranged a payment plan while Hart said that this was the case for about one third of TruAmerica’s residents. Elizabeth Francisco of ResMan said that about 30 percent of residents tracked by their systems had arranged a payment plan. Chase Harrington of Entrata said that payment plans at their customers’ properties had increased by 400 percent.

Jeff Adler of Yardi Systems cited another reason for the relatively strong payment performance in April: April rents are largely paid with March earnings. While these earnings were not strongly impacted by the virus-related shutdowns, the high levels of job losses caused by the shutdowns will have a greater impact on residents’ ability to pay rent in May. Although their income losses will be partly offset by unemployment payments and payments from the CARES act, it is not clear that this support will be received by the time May rent payments are due. We will get an early indication of how that will play out when NMHC next reports on rent collections on May 8.

Your results may vary

While rent payments have been surprisingly good so far on a national basis, not all regions are performing the same. Greg Willett of RealPage said that three markets with challenges are New York, New Orleans and Las Vegas. The first two were hard hit by the virus and the third was hit by the collapse of tourism. Hart said that California has been a challenging market with collections there lagging the rest of the country. He thought that this had as much to do with residents’ attitudes, with local talk of rent strikes, as it did with economic conditions. Dunn said that collections were doing well at their Florida properties. This is despite the prediction that this would be a region hard hit by the tourism downturn.

Two other areas of weakness were mentioned. Dunn cited, and Willett and Adler confirmed, lower collections from corporate clients, even if they continue to occupy units. This was attributed to corporations trying to preserve their cash. The other area where revenues have been impacted is for ancillary retail within properties.

The NMHC project enlists the support of five major providers of property management system software to provide data on the units being managed by their software. These companies are Entrata, MRI, RealPage, ResMan and Yardi Systems. In total, 11.5 million units are covered by their systems. While this represents around half of the rental apartments in the county, these are the more professionally managed units. Small operators are not generally covered in this survey and their experience may be significantly different.

The NMHC rent tracker page may be found here.