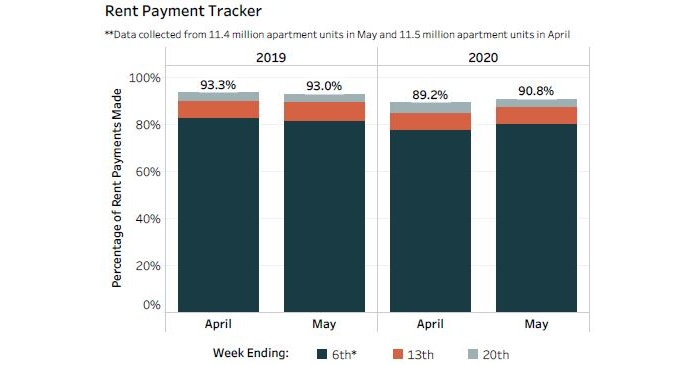

The NMHC rent tracker project has released its third reading on rent collections in the month of May. A total of 90.8 percent of residents had made a payment by May 20, 2020. This compares to 93.0 percent of residents who had made a payment by the same point in May 2019 and 89.2 percent who had made a payment by the same point last month.

Reviewing the results

The data was collected from 11.4 million occupied units managed using software from five major property management software providers. Those companies are Entrata, MRI, RealPage, ResMan and Yardi Systems. Representatives of the companies attended the webcast accompanying the release of the data and provided analysis of the results. Providing the operator’s perspective for this week’s webcast was Caroline Vary, partner and managing director of asset management at Jonathan Rose Company.

Elizabeth Francisco of ResMan said that rent collections have been better than expected in April and May. She noted that there are lots of factors that go into this result but said that “the bipartisan CARES act was meant to help Americans meet their basic need for food and shelter and I think that it is doing that, for the time being.” Flexibility on the part of operators is also helping. However, trouble may be coming by the end of the third quarter. The additional $600 per week unemployment payments provided by the CARES act will be gone by then. It is unknown if people will have jobs to go back to and if they will be making the same salary as before, even if they do have a job. Operators are already being impacted. Market rents have flatlined, concessions are going up and ancillary revenue from things like fees have fallen. Anxiety about the potentially strained condition of multifamily operators by the end of 2020 is probably merited.

Brian Zrimsek of MRI pointed out that, while lots of people have lost their jobs, so far they have been cushioned from the effects of those losses. Anecdotal stories are circulating about wait-staff who are staying away from work because they receive the same amount of money while unemployed. He said, “that can only last so long, and once that changes, then we will see more material impact on these (rent collection) numbers, but not until then.”

While the properties covered by the rent payment tracker do not include subsidized affordable housing, Jonathan Rose Company does operate in that space. In discussing the relative rent collection performance of the properties they manage, Vary said that the differences in results seem to be related more to property type than to geographic location. Their higher-end market rate properties and their section 8 properties are doing well, as are senior housing properties, even if the residents are poor. LIHTC properties are doing less well in terms of resident rental payments since the hard-hit residents of these properties must pay their rent on their own.

Vary said that they were able to improve rental payment performance at lower performing properties by contacting residents and asking them about their difficulties. For some, the reason for non-payment was as simple as being afraid to leave their unit to mail in their payment. Staff worked with these residents to help them set up for on-line payments. Staff also identified and informed residents about local resources that they could access to help them out financially.

Not spots

Greg Willett of RealPage discussed differences in performance by geographic region. He said that the patterns established early in the pandemic have been continuing. New York, New Orleans and Las Vegas have been the primary trouble spots. Los Angeles is also a concern.

RealPage also observed that class A high rise products were underperforming class A products in general. A closer examination of the data showed that some owners and operators of these properties had portions of them that were devoted to short term rentals. These units are not generating income now and some short term operators have shut down completely.

Chase Harrington of Entrata discussed how residents are choosing to pay. He said that 17 percent of residents made rent payment with their credit cards in April, up 3 percent on the year. This increase may be due to many operators choosing to absorb credit card fees, making this payment type more attractive to residents. At those properties, the rise in credit card payments is 7 percent.

What’s ahead

Looking ahead, Jeff Adler of Yardi suggested that it is unlikely that the enhanced unemployment benefits will be renewed. He discussed particular sub-markets where rents and occupancy are already being impacted. Between March and April, transacted rents fell by 5 to 6 percent in some localized situations, such as parts of New York City and Los Angeles. Orlando class A rents fell 3 percent and occupancy dropped 1.3 percent. On the other hand, Dallas, Atlanta, Raleigh and East Chicago had sequential rent declines of only 1 to 2 percent and occupancy declines of only 0.3 to 0.5 percent.

“Demand destruction” is the phrase Adler used to describe what is happening in the marketplace now. With people moving back home or finding roommates, the number of households looking to rent housing is falling. Companies are competing for the shrinking pool of available renters by reducing rents. He thinks that these trends will roll through the market for the next several months. He doesn’t expect this trend to reverse unless jobs come back strongly. However, he doesn’t expect the recovery in jobs to begin until August at the earliest.

The properties whose data is aggregated in the NMHC rent payment tracker come from professionally managed, larger, market-rate multifamily housing properties. They do not include single-family rentals, purpose-built student housing, subsidized affordable housing or privatized military housing.