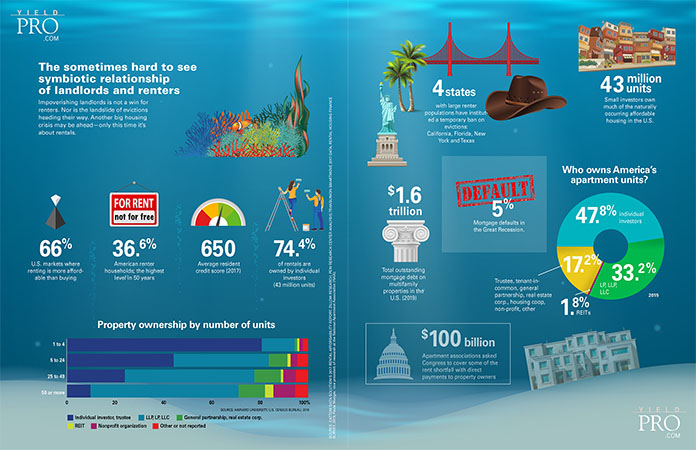

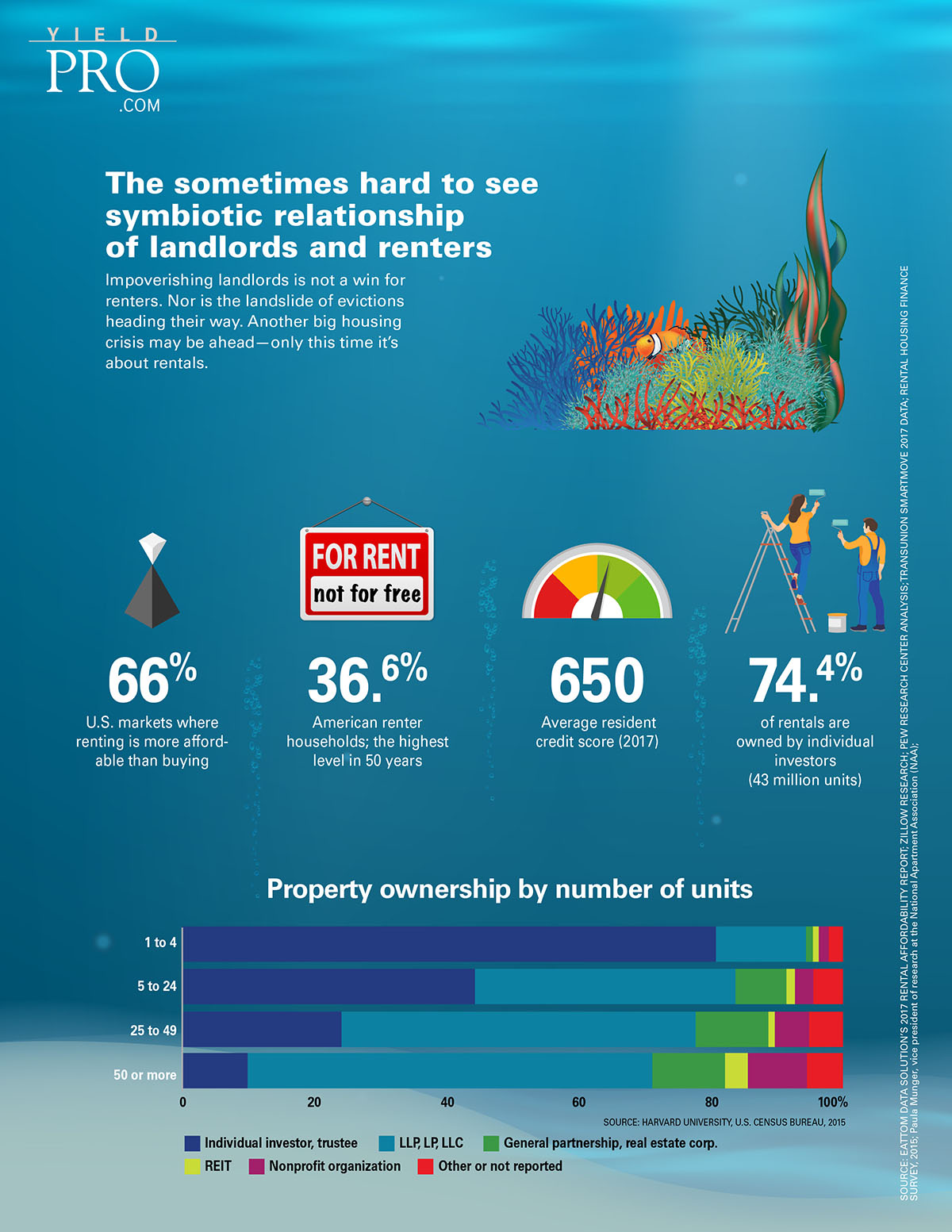

The sometimes hard to see symbiotic relationship of landlords and renters

Impoverishing landlords is not a win for renters. Nor is the landslide of evictions heading their way. Another big housing crisis may be ahead—only this time it’s about rentals.

- 66% U.S. markets where renting is more affordable than buying

- 6% American renter households; the highest level in 50 years

- 650 Average resident credit score (2017)

- 4% of rentals are owned by individual investors (43 million units)

4 states with large renter populations have instituted a temporary ban on evictions: California, Florida, New York and Texas

43 million units

Small investors own much of the naturally occurring affordable housing in the U.S.

$1.6 trillion

Total outstanding mortgage debt on multifamily properties in the U.S. (2019)

5% Mortgage defaults in the Great Recession.

Who owns America’s apartment units?

- 8% individual investors

- 2% LP, LLP, LLC

- 2% Trustee, tenant-in-common, general partnership, real estate corp., housing coop, non-profit, other

- 8% REITs

$100 billion

Apartment associations asked Congress to cover some of the rent shortfall with direct payments to property owners