The Bureau of Labor Statistics (BLS) released its producer price index report for June 2020. It showed that overall prices for processed goods for intermediate demand rose by 0.9 percent. A 7.2 percent jump in energy prices accounted for much of the increase. Excluding food and energy, the price index for processed goods for intermediate demand was up by 0.5 percent for the month. The full index was 5.0 percent lower than its year-ago level.

By contrast, the BLS price index of materials and components for construction was up 0.4 percent from May, before seasonal adjustment. It was 1.1 percent higher than its year-earlier level.

For reference, the changes in these indices compare with a 0.6 percent rise in the all-items consumer price index (CPI-U) for the 12 months ending in June. The monthly increase in the index was also 0.6 percent in June after declines in the previous three months. The increase was driven by a 5.1 percent monthly jump in the cost of energy products. The energy cost index is still down by 12.6 percent over the past 12 months.

Real average weekly earnings for all employees was down by 2.3 percent for the month of June but were still up by 4.6 percent over the last 12 months. The weekly earning statistics are being roiled by changes in the mix of job types in the economy due to COVID related shutdowns and re-openings.

Yield Pro (PRO) compiled the BLS reported price changes for our standard list of construction commodities. These are commodities whose prices directly impact the cost of constructing an apartment building. The two right hand columns of the table provide the percent change in the price of the commodity from a year earlier (12 Mo PC Change) and the percent change in price from March 2020 (1 Mo PC Change). If no price data is available for a given commodity, the change is listed as N/A.

| Commodity | 12 Mo PC Change | 1 Mo PC Change |

| Softwood lumber | 18.6 | 11.0 |

| Hardwood lumber | -7.1 | -0.9 |

| General millworks | 1.3 | -0.3 |

| Soft plywood products | -4.2 | 2.4 |

| Hot rolled steel bars, plates and structural shapes | -12.3 | -1.9 |

| Copper wire and cable | N/A | N/A |

| Power wire and cable | -5.9 | -1.4 |

| Builder’s hardware | 2.4 | 0.2 |

| Plumbing fixtures and fittings | 2.4 | 0.0 |

| Enameled iron and metal sanitary ware | -9.3 | -12.5 |

| Furnaces and heaters | 3.1 | 0.8 |

| Sheet metal products | -0.4 | 0.0 |

| Electrical Lighting fixtures | 7.9 | 0.1 |

| Nails | -0.8 | -1.1 |

| Major appliances | 1.3 | 1.0 |

| Flat glass | 0.4 | 0.0 |

| Ready mix concrete | 1.4 | -0.1 |

| Asphalt roofing and siding | 1.9 | 1.3 |

| Gypsum products | 0.8 | -0.3 |

| Mineral wool insulation | 2.4 | -1.0 |

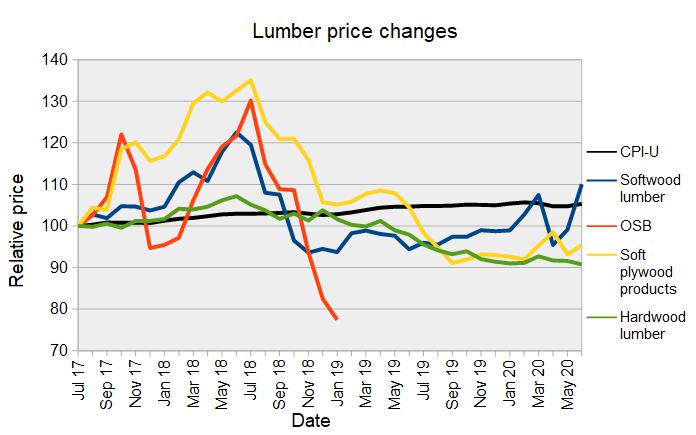

Lumber prices have taken a leap recently. Reports indicate that a drop in production due to COVID-19 restrictions and a rise in demand due to furloughed workers taking on home-improvement projects triggered the price increases. The recent uptick in construction activity may also be putting pressure on framing lumber prices. At the same time, the price jump to date has been less pronounced in soft plywood products so this will be something to keep an eye on in upcoming reports.

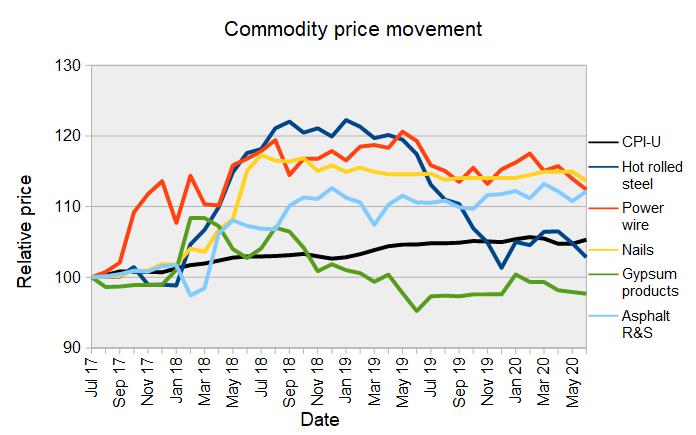

The second chart, below, shows the recent price history of several other construction materials. Unlike lumber, the prices of these construction materials have generally trended lower in recent months.

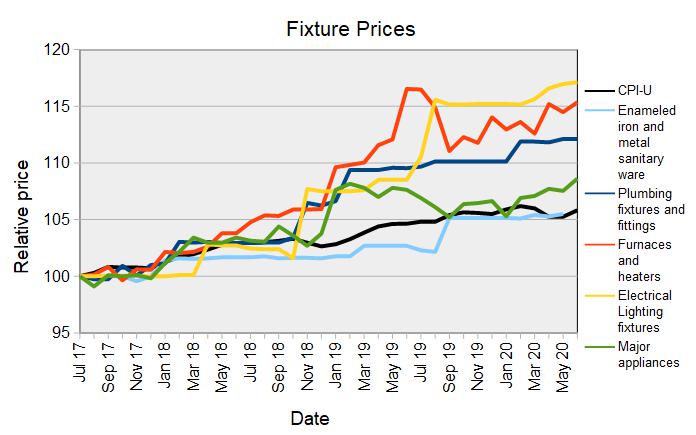

Price changes for several of the more finished goods from our sample are illustrated in the final chart, below. Electrical lighting fixtures again showed the largest annual price increase in this report with a rise of 7.9 percent, largely due to a surge in their prices last summer. In recent months, the prices of these construction materials have been trending higher.

The full BLS report can be found here.