A pair of recent reports, one from CoStar and another from Real Capital Analytics (RCA), show that multifamily property continues to see price increases despite the pandemic.

Defining the indices

The CoStar report focuses on a relative measure of property values called the CoStar Commercial Repeat Sales Index (CCRSI). Real Capital Analytics calls their equivalent measure the Commercial Property Price Index (CPPI). Both indices are computed based on the resale of properties whose earlier sales prices and sales dates are known. The indices represent the relative change in the price of property over time rather than its absolute worth.

Comparing multifamily to the rest

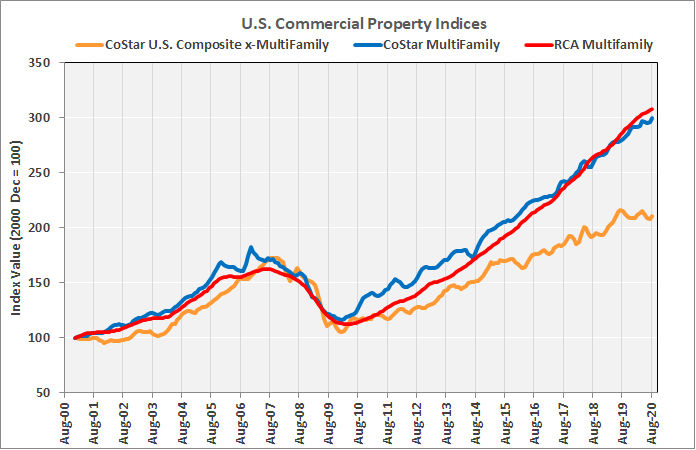

The first chart combines data from both reports to show how multifamily property values have changed over time relative to the values of other commercial property types. The data are normalized so that the index values for all property types are set to be 100 in December 2000. The change in the value of the index since then shows how the relative value of that property type has changed since.

The chart shows that the value of commercial property, excluding multifamily, has failed to grow recently. This is due to relative strength in industrial and, to a lesser extent, office properties being offset by weakness in retail and hospitality properties. It also shows that prices continue to rise for multifamily property, although the rate of increase may be down slightly from its recent level.

Being specific

Both the value-weighted CoStar index and the RCA index for multifamily property values have performed relatively well despite the pandemic. RCA reports that apartment property prices are up 1.2 percent over the last 3 months and up 7.4 percent for the last 12 months. CoStar reports that its value-weighted index is up 1.4 percent in the last 3 months and up 7.0 percent over the last 12 months. This compares to a 2.3 percent fall in the CoStar CCRSI for commercial property types, excluding multifamily, from its year-ago level.

CoStar also reported that transaction volume has dropped significantly this year. The transaction volume in the last 3 months is down by 39 percent from that in the same three months of last year. It is also noteworthy that “distressed” transaction volume has not risen. Distressed transactions represented about 1.2 percent of total transactions over the past 3 months, the same percentage as they were in the year-earlier period.

The full CoStar report can be found here. The RCA report can be downloaded here.