ZOOM

- video conferencing, San Jose, Calif.

- $664 million revenue growth May to June, driving Y/Y profits from $5.5 million to $186 million

AMAZON

- e-commerce, Seattle, Wash.

- $90 billion total revenue Q2, Amazon handled half of all online sales, 14 percent of all retail sales

BIG BOX

- brick and mortar, digital Target, Walmart, Home Depot

- 24% Y/Y revenue gain for Target; Walmart 97 percent spike in e-commerce Q2; Home Depot 9 percent increase in revenue.

PELOTON

- smart exercise equipment, New York, N.Y.

- 1 million members, doubled Y/Y. Revenue nearly tripled to $607 million in Q2.

VIDEO GAMES

- Xbox, PlayStation, Microsoft, Sony

- 200% Sony doubled sales in Q4. Activision Blizzard revenue rose 38 percent Q/Q.

GUNS

- guns, ammo national sales spike

- 95% increase in gun sales. Ammo sales 139 percent up Y/Y. Five million are first time gun buyers and sales were only slowed by inventory and background check backlog.

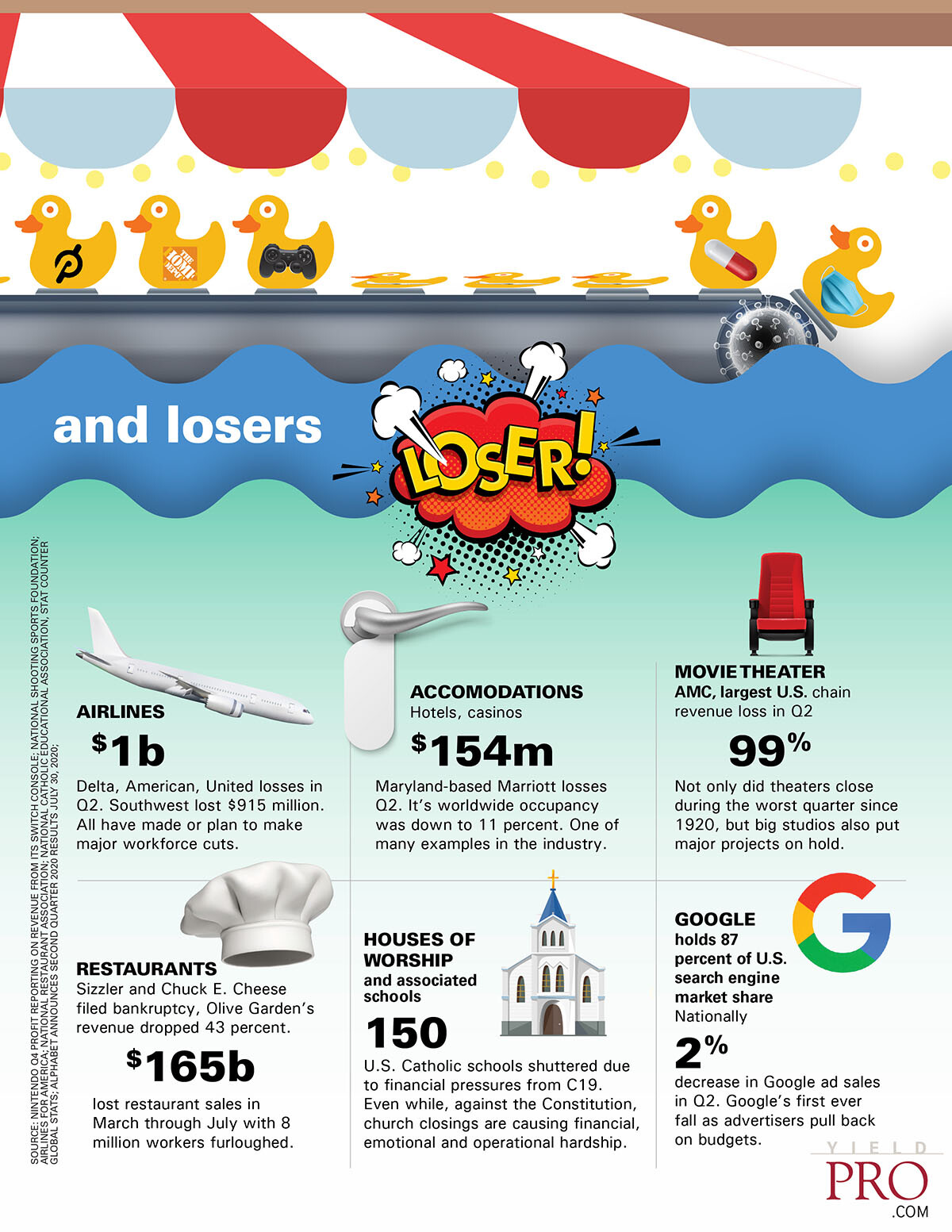

AIRLINES

- $1 billion. Delta, American, United losses in Q2. Southwest lost $915 million. All have made or plan to make major workforce cuts.

ACCOMMODATIONS

- Hotels, casinos

- $154 million Maryland-based Marriott losses Q2. It’s worldwide occupancy was down to 11 percent. One of many examples in the industry.

MOVIE THEATER

- AMC, largest U.S. chain revenue loss in Q2

- 99% Not only did theaters close during the worst quarter since 1920, but big studios also put major projects on hold.

RESTAURANTS

- Sizzler and Chuck E. Cheese filed bankruptcy; Olive Garden’s revenue dropped 43 percent.

- $165 billion lost restaurant sales in March through July with 8 million workers furloughed.

HOUSES OF WORSHIP and associated schools

- 150 U.S. Catholic schools shuttered due to financial pressures from C19. Even while, against the Constitution, church closings are causing financial, emotional and operational hardship.

- holds 87 percent of U.S. search engine market share nationally

- 2% decrease in Google ad sales in Q2. Google’s first ever fall as advertisers pull back on budgets.