Fannie Mae recently revised its economic outlook for 2021. The new forecast predicts significantly higher growth over the next two years than their last forecast from only one month ago. The economists at Fannie Mae attribute the anticipated better results to the availability of COVID vaccine(s), to the likelihood of a new stimulus bill being passed and to strong consumer spending data. They feel that these factors will outweigh the drag on the economy due to the rise in the number of new COVID cases and the lockdowns that are being imposed in response.

GDP up, unemployment down

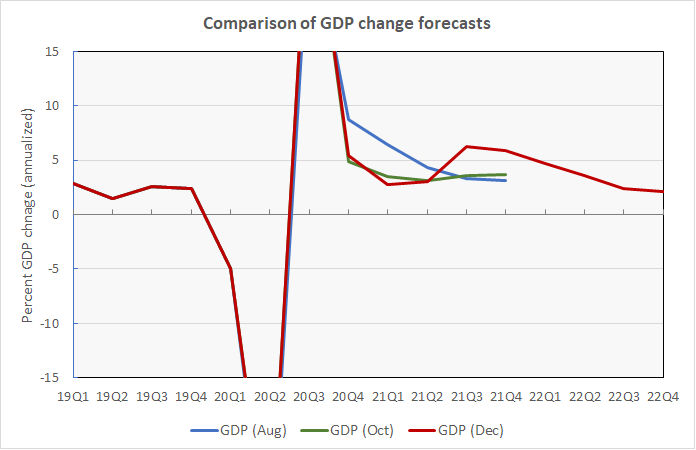

The first chart, below shows the recent history and the November and December forecasts from Fannie Mae for quarterly change in US GDP and for the national unemployment rate.

While the forecast for GDP changes over the first two quarters of 2021 are not materially different than the prior forecast, the forecast growth in Q3 2021 through Q1 2022 is remarkably higher. Fannie Mae now expects growth in Q3 2021 to be 6.3 percent on an annualized basis. That is fully 61 percent higher than the growth they forecast for that period only one month ago.

Fannie Mae is now also forecasting lower unemployment from the second half of 2021 through 2022, although this change is less dramatic than that for GDP. Their December forecast projects the unemployment rate to be 50 basis points lower in the Q4 2021 to Q2 2022 time frame than in their prior forecast.

For the full years 2021 and 2022, Fannie Mae is now forecasting GDP growth of 4.5 percent and 3.2 percent respectively. The unemployment rate is predicted to average 5.7 percent in 2021 before falling to 4.5 percent in 2022.

Inflation and interest rates lower

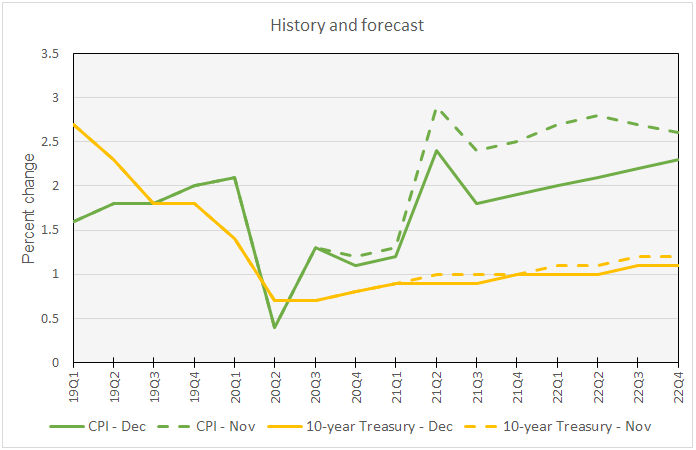

The second chart, below, shows the recent history and the November and December forecasts from Fannie Mae for inflation as measured by the consumer price index (CPI) and for interest rates as represented by the 10-year Treasury rate.

The December forecast projects significantly lower inflation starting in mid-2021 and continuing to late 2022 than in the November forecast. This is somewhat counterintuitive as the faster growth and lower unemployment predicted by the latest forecast typically leads to more inflationary pressures in the economy.

The new forecast also projects somewhat lower interest rates as measured by the 10-year Treasury yield. However, the reduction is less pronounced than for the CPI.

Fannie Mae now projects the CPI to increase by 2.3 percent in 2021 and by 2.5 percent in 2022. They project that the 10-year Treasury yield will average 0.9 percent in 2021 and 1.1 percent in 2022.

Housing start forecast not significantly changed

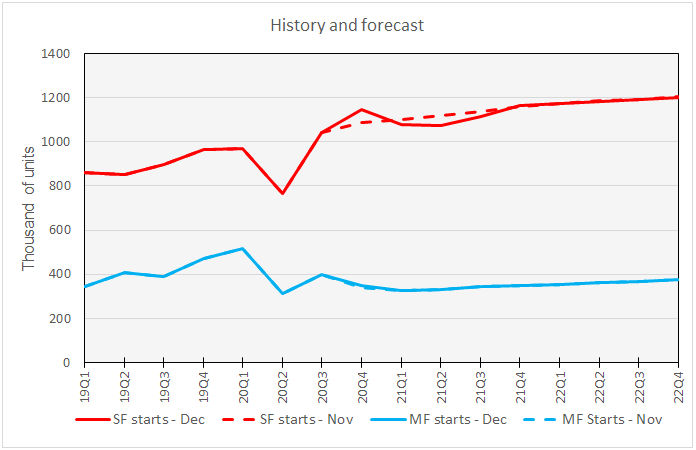

Fannie Mae’s forecasts for the housing construction market is shown in the final chart, below. Unlike the economic indicators forecasts, the housing construction forecasts did not change significantly from November to December. The new forecast for single-family housing construction moves start dates around a bit, but leaves the total number of projected starts for 2021 and 2022 nearly unchanged. The forecast for multifamily housing starts is unchanged from the last forecast.

Fannie Mae forecasts 1,129,000 single family housing starts in 2021 and 1,188,000 starts in 2022. They forecast 338,000 multifamily (2+ units per building) starts in 2021 and 364,000 starts in 2022.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecast.