Two recent reports from the Bureau of Labor Statistics (BLS) describe the current labor situation. They are the Employment Situation Report for November and the Job Openings and Labor Turnover (JOLT) report for October. They show a slowly recovering labor market.

Total employment coming back

The BLS reported that the US unemployment rate dropped to 6.7 percent in November as total non-farm employment rose by 245,000. At the same time, the labor force participation rate decreased 0.2 percent to 61.5 percent of the adult population, reversing most of last month’s increase.

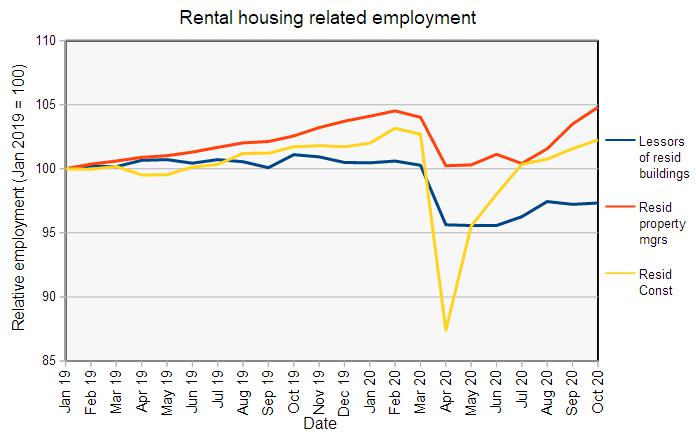

The BLS also reported more detailed employment information on three job categories of interest to the multifamily industry. These are employment as residential construction workers, as residential property managers and as lessors of residential buildings. The first chart, below, show the employment in these job categories relative to its level in January 2019.

The chart shows that residential construction employment was most heavily impacted when the COVID-19 inspired lockdowns were imposed earlier in the year. However, in the last few months, residential construction employment has rebounded strongly. While the employment figure for October is still considered preliminary, it places residential construction employment within 1 percent of the recent high it reached in January 2020.

Employment for residential property managers has bounced back even more strongly. It is now fractionally above the recent high that it reached in January 2020. The preliminary figure for October puts employment in this category up 1.2 percent for the month and 2.2 percent higher than its year-earlier level.

By contrast, employment for lessors of residential buildings has been slower to recover. This follows a long-term trend of sluggish, if any, growth for this category. Its level of employment is not only lower than its year-earlier level but also lower than its level of 20 years ago. For month of October, employment of lessors of residential buildings was up 0.1 percent from September. However, employment was down 9.6 percent compared to October 2019.

Examining the details

The JOLT report has more detail about openings, hiring and separations, but it breaks the jobs market into coarser categories. Therefore, while the Employment Situation Report separates residential construction from other construction, the JOLT report does not. The JOLT report also gathers all rental and leasing employment, even for non-residential property into a single category. However, the JOLT report provides a look under the covers on how the employment gains (or losses) came about.

Overall labor market

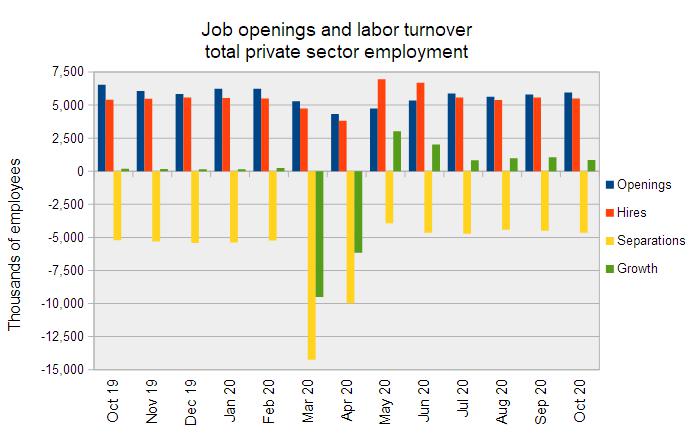

The JOLT report shows that the overall private labor market has a high number of hires and separations even in a “normal” labor market, such as existed in 2019. The net gains or losses in employment are based on small differences between these two large numbers.

The latest report shows that the labor market continues to chip away at the massive losses in employment which took place in March and April. This is shown in the first chart, below.

The last two month’s data had shown the recovery in jobs accelerating from the low pace it had reached in July. However, the preliminary data for October shows jobs growth, while still strongly positive, slowing down to near July’s level. While the number of job openings in October increased to its highest level since February, the pace of hiring declined slightly. At the same time, the number of separations was up for the month, so both separations and hiring contributed to the decline in number of jobs added. The increase in separations was driven almost entirely by an increase in involuntary separations (layoffs).

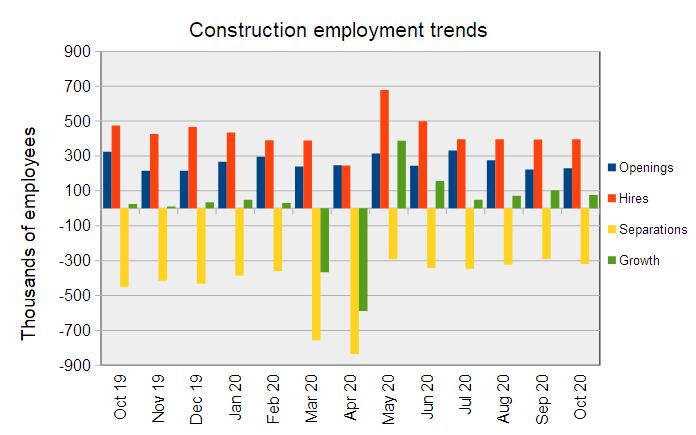

Construction jobs growth slows

The second chart shows the employment situation for the construction jobs market. This market tracks the overall labor market pattern, with a decline in the growth of employment in October after two months of increases. However, the decline in the growth of employment for the construction jobs market was driven even more by a rise in involuntary separations than for the overall jobs market. For this category, hiring was up marginally and voluntary separations declined nearly 20 percent so the rise in involuntary separations accounted for all of the decline in employment growth.

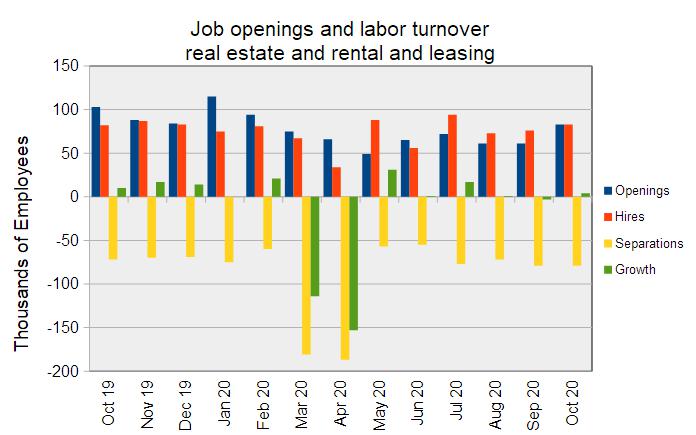

RERL recovering slowly

The real estate and rental and leasing (RERL) jobs category, which includes people who manage multifamily properties, experienced a return to jobs growth in October after a net loss in jobs in September, according to the JOLT data. This is shown in the next chart, below.

The return to growth for this jobs category was driven entirely by a pick-up in hiring. Separations were unchanged for the month, with a 25 percent jump in voluntary separations (quits) being offset by a decline in other separations. Given that job openings were up 36 percent for the month, the surge in job openings may be encouraging people to seek new opportunities.

The numbers given in the JOLT and Employment Situation reports are seasonally adjusted and are subject to revision. It is common for small adjustments to be made in subsequent reports, particularly to the data for the most recent month. The full current JOLT report can be found here. The current Employment Situation report can be found here.