Recent reports from CoStar and from Real Capital Analytics (RCA) show that multifamily property values continued to increase through the end of 2020, despite the pandemic.

Defining the indices

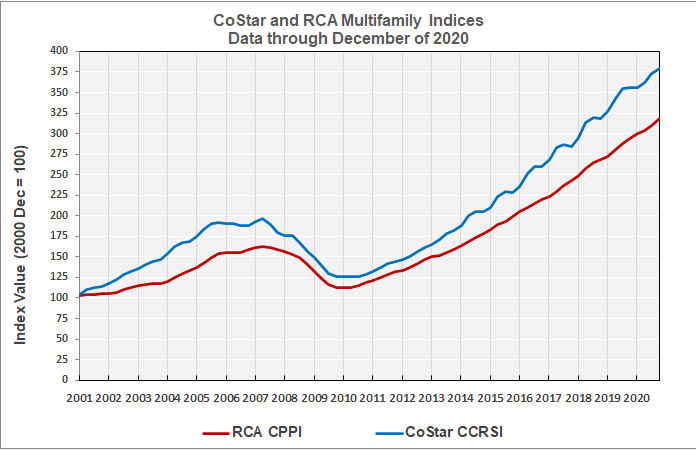

The CoStar report focuses on a relative measure of property values called the CoStar Commercial Repeat Sales Index (CCRSI). Real Capital Analytics calls their equivalent measure the Commercial Property Price Index (CPPI). Both indices are computed based on the resale of properties whose earlier sales prices and sales dates are known. The indices represent the relative change in the price of property over time rather than its absolute price.

Prices hold up

RCA reported that multifamily property values in December were 8.3 percent higher than their levels one year ago. This compares to a 7.3 percent annual increase for all commercial property types. Industrial properties saw the most rapid price appreciation with an 8.8 percent rise. Retail was the worst performing sector with a price decline of 4.3 percent for the year.

CoStar reported that its equal-weighted index of multifamily property values increased 6.5 percent in 2020. The index of industrial property values was the next best performer with an increase of 6.1 percent. The retail index was the worst performer, falling 0.5 percent for the year.

Comparing the indices

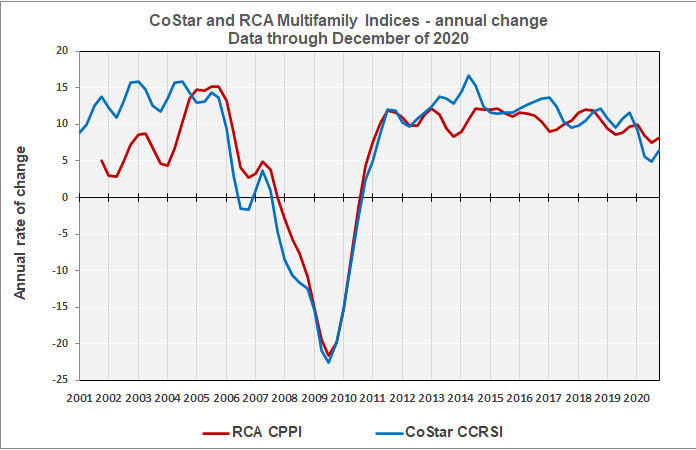

The first chart, below, plots the long-term changes in both the CoStar CCRSI and in the RCA CPPI for multifamily properties. In both cases, the values of the indices are normalized so that the December 2000 index reading is 100. The chart shows that the price histories defined by the two curves are similar, but there are two differences. The first is that the CoStar index history shows more seasonality. This shows up as ripples in the curve where prices tend to rise early in the year and then stagnate late in the year. The second difference is that the CoStar index shows more long-term price appreciation than does the RCA index.

The second chart, below, uses the same data but presents it differently. Rather than showing the total accumulated price appreciation represented by the indices, it shows how the one-year changes in the indices have varied over time. Looked at in this way, we can see that the greatest differences in the rates of price appreciation measured by the indices occurred before 2005. Since then, the price appreciation rates measured by the indices have become closer and have frequently overlapped.

Looking at regional differences

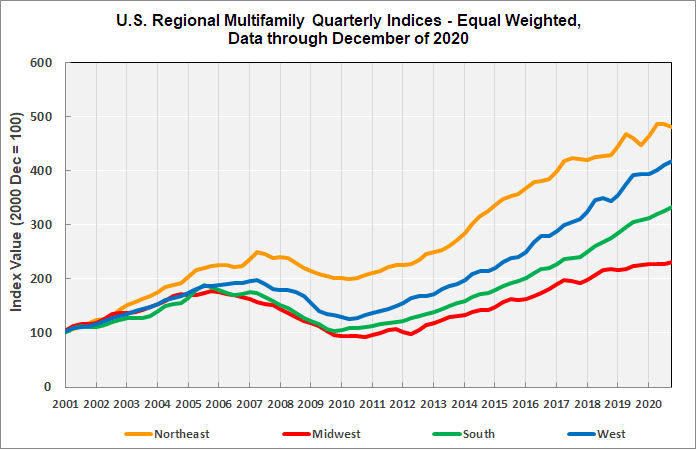

The dataset accompanying the CoStar report provides regional data for their CCRSI for multifamily properties. This is shown in the next chart, below. The chart shows that the best performing regions recently have been the South and the West. This is despite the West being home to many “gateway” cities like San Francisco, San Jose and Los Angeles which have seen rents drop and vacancies rise lately. The recent performances of the Northeast and Midwest have lagged by comparison.

By the numbers, the one-year index increase was 7.9 percent for the South and 6.1 percent for the West. The one-year index increase for the Northeast was 7.5 percent, while the one-year increase for the Midwest was 2.2 percent. The comparison for the Northeast benefited from the fact that the index for that region a year ago was relatively weak. Looking longer term, the five-year index increase was 70.5 percent for the South, 73.8 percent for the West, 34.7 percent for the Northeast and 43.0 percent for the Midwest.

Looking at market differences

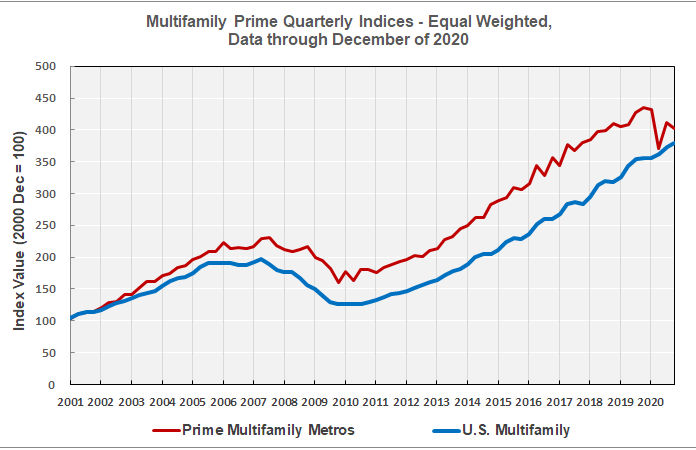

Both the CoStar and RCA reports provide some insight into recent performance differences between properties in the urban core and those in outlying areas. CoStar does this by looking at multifamily property value data from what it calls “prime metros” and comparing it to data for the country as-a-whole. RCA does this by looking at multifamily property value data for garden properties and comparing it to data for mid-rise and high-rise properties, which are presumably located in more urban areas.

Data from the CoStar report are summarized in the following chart. It shows that, while overall multifamily property values have been increasing over the past year, values in prime metros have not. After dropping sharply in Q2, values in prime metros experienced a partial rebound. However, the CCRSI for prime multifamily properties finished the year 7.4 percent lower than its year-earlier level.

The RCA report did not provide extensive historical data for comparing its two property types. However, it did provide an interesting chart, which it calls an investment momentum chart. This chart plots the year-over-year change in the CPPI for the property type against the year-over-year change in transaction volume. Garden properties saw a price gain of around 8.5 percent for the year while the transaction volume for this property type fell by around 26 percent. By contrast, mid/high-rise properties saw a slight price drop for the year while the transaction volume for these properties fell by around 32 percent.

The full reports discuss all commercial property types. The CoStar report also provides information on transaction volumes, but it does not break out multifamily transactions. The RCA report includes a graphic showing multifamily property value changes for 33 top metros. The CoStar report can be found here. Access to the RCA report can be obtained here.