A Mortgage Bankers Association (MBA) report on multifamily and other commercial mortgage debt shows that the GSEs accounted for 96 percent of the increase in multifamily mortgage debt outstanding in Q4.

Unlike the MBA report on their mortgage origination index, which only gives a relative sense of the levels of new mortgages being created, this report gives the net dollar value of mortgages outstanding.

The MBA reported that multifamily mortgage debt outstanding rose by $41.8 billion in Q4, up from the $31.0 billion increase recorded in Q3. Total multifamily mortgage debt rose by 2.5 percent in the quarter, reaching a level of $1.69 trillion. At the end of Q4, multifamily mortgage debt outstanding was up $127.9 billion (8.2 percent) from its year-earlier level.

The total of all commercial mortgage debt, including multifamily debt, outstanding at the end of Q4 rose 5.8 percent from its year-earlier level to $3.88 trillion.

Dominating the market

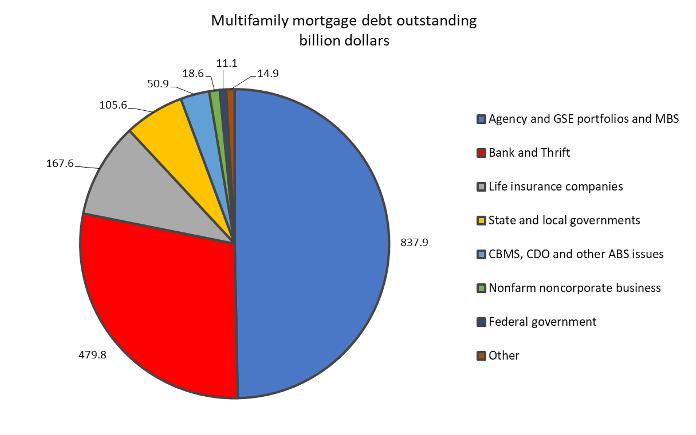

The shares of multifamily mortgage debt held by various classes of suppliers are shown in the first chart, below.

Of the $41.8 billion increase in multifamily mortgage debt outstanding in the quarter, fully $40.2 billion, was held by “Agency and GSE portfolios and MBS”. These are agencies, like the Federal Housing Administration and Government Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac, who buy up mortgages and sell some of the debt as Mortgage-Backed Securities (MBS). At the end of Q4, the GSEs holdings of multifamily mortgage debt rose to 49.7 percent of the total outstanding.

Banks and Thrifts, the second largest holders of multifamily mortgages, increased their multifamily mortgage holdings by $1.36 billion during Q4. However, their share of the outstanding debt slid again in Q4, falling to 28.4 percent.

Life insurance companies’ share of the multifamily mortgage debt outstanding also slid in Q4, falling to 9.9 percent. Life Insurance companies reduced their direct mortgage holdings by $494 million in the quarter to a level of $167.6 billion. However, this figure does not account for the mortgage debt these companies hold through commercial mortgage-backed securities (CMBS).

State and local governments held 6.3 percent of outstanding multifamily mortgage debt at the end of Q4, totaling $105.6 billion.

The level of outstanding CMBS, CDO (collateralized debt obligations) and other ABS (asset backed securities) issues of multifamily mortgage debt fell in Q4 by $893 million. Their share of the debt outstanding dropped to 3.0 percent.

Reducing exposure

The other issuers of multifamily mortgage debt listed by the MBA hold less than 2.6 percent of outstanding debt. All of them except REITs saw their share of outstanding debt fall. REITs’ share rose from 0.29 percent to 0.32 percent as they increased their holdings by $760 million.

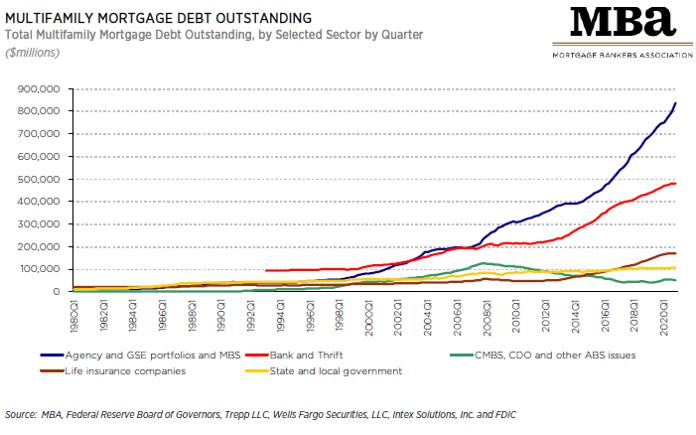

The growing market share of the lenders with implicit government backing is illustrated in the next chart, below, reproduced from the MBA report. It shows how the multifamily mortgage debt market has come to depend on the GSEs since the housing crash.

The report does not cover loans for acquisition, development or construction, or loans collateralized by owner-occupied commercial properties. The full report also includes information on mortgage debt outstanding for other commercial property types. The full report can be found here.