The latest version of the Census Bureau’s Pulse Survey shows that the portion of renters who are current on their rent payments is up since we last reported on the survey results.

What is the Pulse Survey?

The Pulse Survey is an experimental program that the Census Bureau has been running to assess how the population of the country is dealing with the fallout from COVID-19. The current survey, designated Week 25, collected data from February 17 through March 1.

This survey asks a variety of questions about how the respondents are coping financially including questions about paying for housing. A difficulty in using the survey is that the results are presented based on the number of adults (18+) responding in a certain way, not on the number of households. Different households could have different numbers of adult members. When looking at housing, a view from the perspective of households would have made more sense.

One of the questions that the Pulse Survey asks of renters is whether they are facing a rent delinquency. While some say that they occupy their housing without paying rent and some did not report whether they are current on their payments, the majority of respondents answered the question Yes or No. The portion of respondents who pay rent saying that they have a rent delinquency has varied from survey to survey.

The week 13 Pulse Survey taken in the last week of August 2020 – 15.3 percent were not current.

The week 16 Pulse Survey taken in early October 2020 – 16.2 percent were not current.

The week 21 Pulse Survey taken in mid-December 2020 – 19.2 percent were not current.

The week 22 Pulse Survey taken in early to mid-January 2021 – 20.8 percent were not current.

The week 25 Pulse Survey taken in late February 2021 – 18.5 percent were not current.

For reference, the NMHC rent tracker showed that 93.5 percent of renters at 11.6 million professionally managed apartments had made at least a partial rent payment for February by the end of the month. Note that making a partial payment does not mean that the renter is current. Also, the units covered by the rent tracker represent only about 29 percent of the approximately 40 million occupied rental housing units in the United States. Many of the rental units not covered by the rent tracker are multifamily properties owned by smaller operators, and many more are single family rentals.

Looking at the details

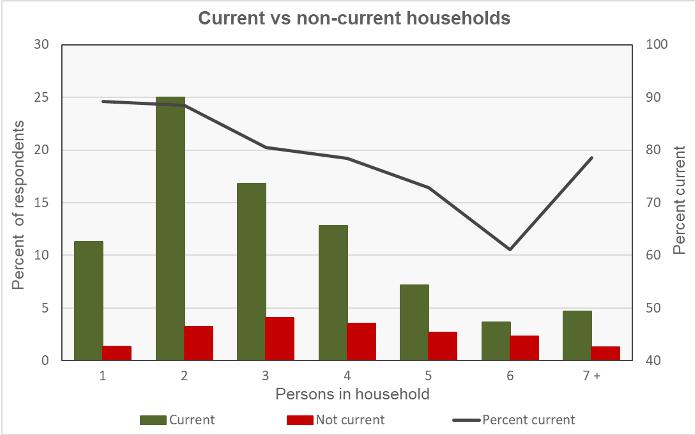

The Pulse Survey asked a series of questions to determine the characteristics of the different households responding to the survey. One question was how many people are in the household. The responses are shown in the first chart, below. The bars show the percentage of respondents who are in a household of a particular size and who responded a certain way. The chart shows that households with more people are generally more likely to be behind on their rent.

Of the respondents who reported being current on the rent, 36 percent said that they had children in the household. Of those reporting being behind on the rent, 61 percent reported having children in the household.

Of the respondents who reported being current on the rent, 62 percent said that they were employed, but 53 percent reported that a household member had experienced a loss of employment income. Of those reporting being behind on the rent, 42 percent said that they were employed, while 81 percent reported that a household member had experienced a loss of employment income.

For reference, for the US population as a whole, as of February 2021, 61.4 percent of adults were considered to be part of the labor force and 57.6 percent of adults were actively employed, according to the Bureau of Labor Statistics.

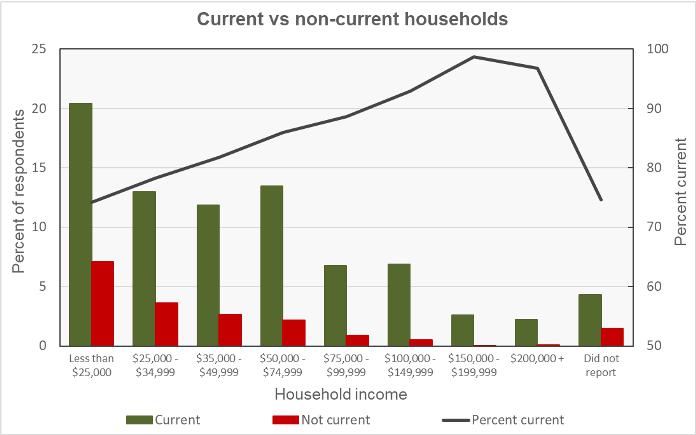

The final chart shows the current/not current status of the respondents by household income level. Similar to the first chart, the bars show the percentage of all respondents who are in a particular income category and who reported that they were either current or behind on their rent. Not surprisingly, a much higher percentage of respondents who were behind on their rent reported having lower incomes.

The last time we looked at the Pulse Survey results, Congress had just passed a $900 billion COVID relief bill, although it had not then had enough time to take effect. The improvement in the portion of residents who were current on their rent in this survey may indicate that the supplemental income and rent assistance provided by that bill are now having a positive effect on renter’s ability to pay the rent.