The Bureau of Labor Statistics (BLS) recently released the Job Openings and Labor Turnover (JOLT) report for March. It shows that the labor market rebounded from a rocky February to return to job growth.

Defining the reports

For a discussion of the JOLT report and how it relates to the Employment Situation Report, please see the paragraph at the end of this article.

Construction jobs increase

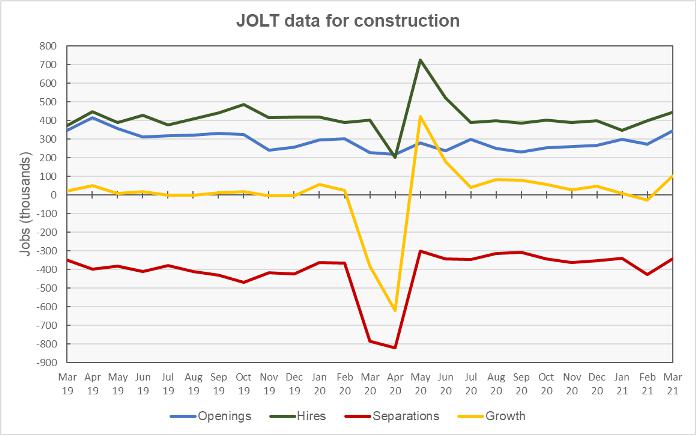

The first chart, below, shows the employment situation for the construction jobs market over the last 25 months. After a string of months with relatively steady hiring and separations resulting in modest employment growth, job growth turned negative in February as hiring remained stable but separations increased. However, in March, hiring increased while separations declined resulting in the strongest construction jobs growth since last June.

Openings for construction jobs rose 26 percent in March to 344,000 jobs. This was the highest level since May 2019. Hiring was also up during March, rising 11 percent to 445,000 jobs. A running total of jobs gains and losses since March 2020 indicates that all of the construction jobs lost during the shutdowns have now been made up.

Separations fell by 20 percent in March, driven by a 38 percent decline in layoffs. Voluntary separations rose during the month and represented 53 percent of separations, an indication that jobs are readily available to those looking to make a change.

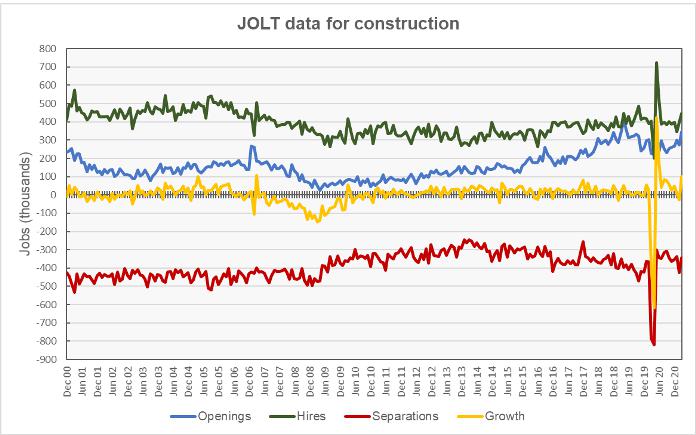

A longer-term look at the construction jobs market is given in the next chart, below. In the JOLT report, “openings” refers to the number of job openings at the end of the month while “hires” counts anyone hired during the month. That the number of hires greatly exceeded the number of openings in the first decade of this century indicates that workers were readily available and job openings were filled quickly. That the number of openings rose relative to the number of hires in the decade since the global financial crisis indicates that it is now taking longer to hire workers.

RERL jobs growth resumes

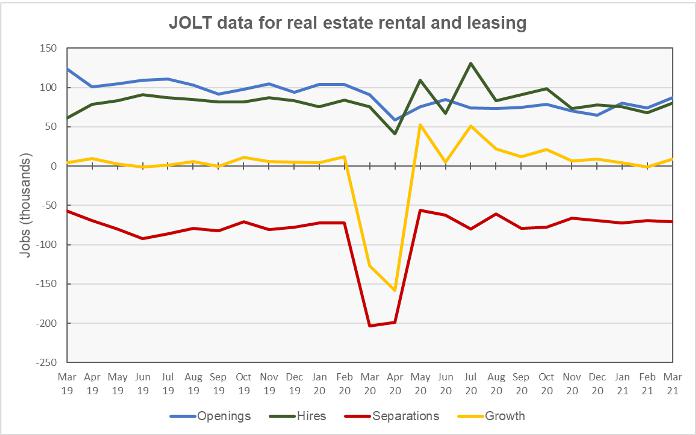

The last chart, below, shows the employment situation for the real estate and rental and leasing (RERL) jobs category. Employment growth in this jobs category also returned to positive territory in March as separations remained steady but hiring rose 18 percent to 80,000 jobs.

The 87,000 job openings at the end of March was the highest number for the RERL jobs category since February 2020. The number of openings at the end of the month exceeded the number of hires during the month, the usual pattern for this jobs category.

Involuntary separations comprised about one-third of total separations in the RERL jobs category in March, almost exactly the trailing 6-month average.

Despite the positive employment numbers for the month, the running total of jobs gains and losses since March 2020 indicates that 33 percent of the RERL jobs lost during the shutdowns have not come back.

The numbers given in the JOLT report are seasonally adjusted and are subject to revision. It is common for small adjustments to be made in subsequent reports, particularly to the data for the most recent month. The full current JOLT report can be found here.

The reports

The US labor market is dynamic with many people changing jobs in any given month. The JOLT report documents this dynamism by providing details about job openings, hiring and separations. However, it does not break down the jobs market into as fine categories as does the Employment Situation Report, which provides data on total employment and unemployment. For example, while the Employment Situation Report separates residential construction from other construction, the JOLT report does not. The Employment Situation Report separates residential property managers from other types of real estate and rental and leasing professionals but the JOLT report does not. However, the JOLT report provides a look at what is driving the employment gains (or losses) in broad employment categories.