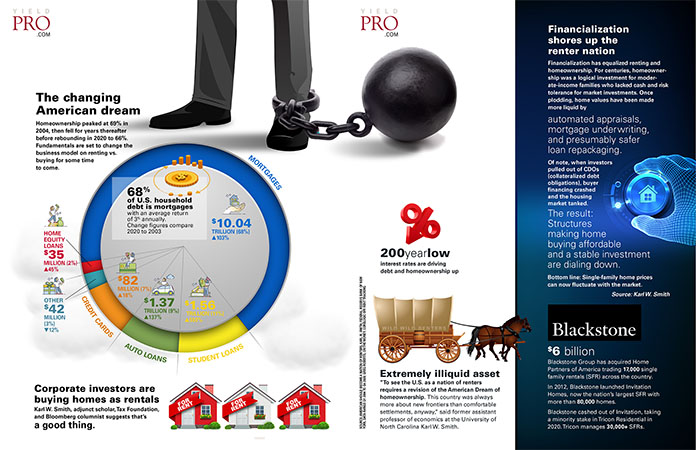

Homeownership peaked at 69% in 2004, then fell for years thereafter before rebounding in 2020 to 66%. Fundamentals are set to change the business model on renting vs. buying for some time to come.

Corporate investors are buying homes as rentals

Karl W. Smith, adjunct scholar, Tax Foundation, and Bloomberg columnist suggests that’s a good thing.

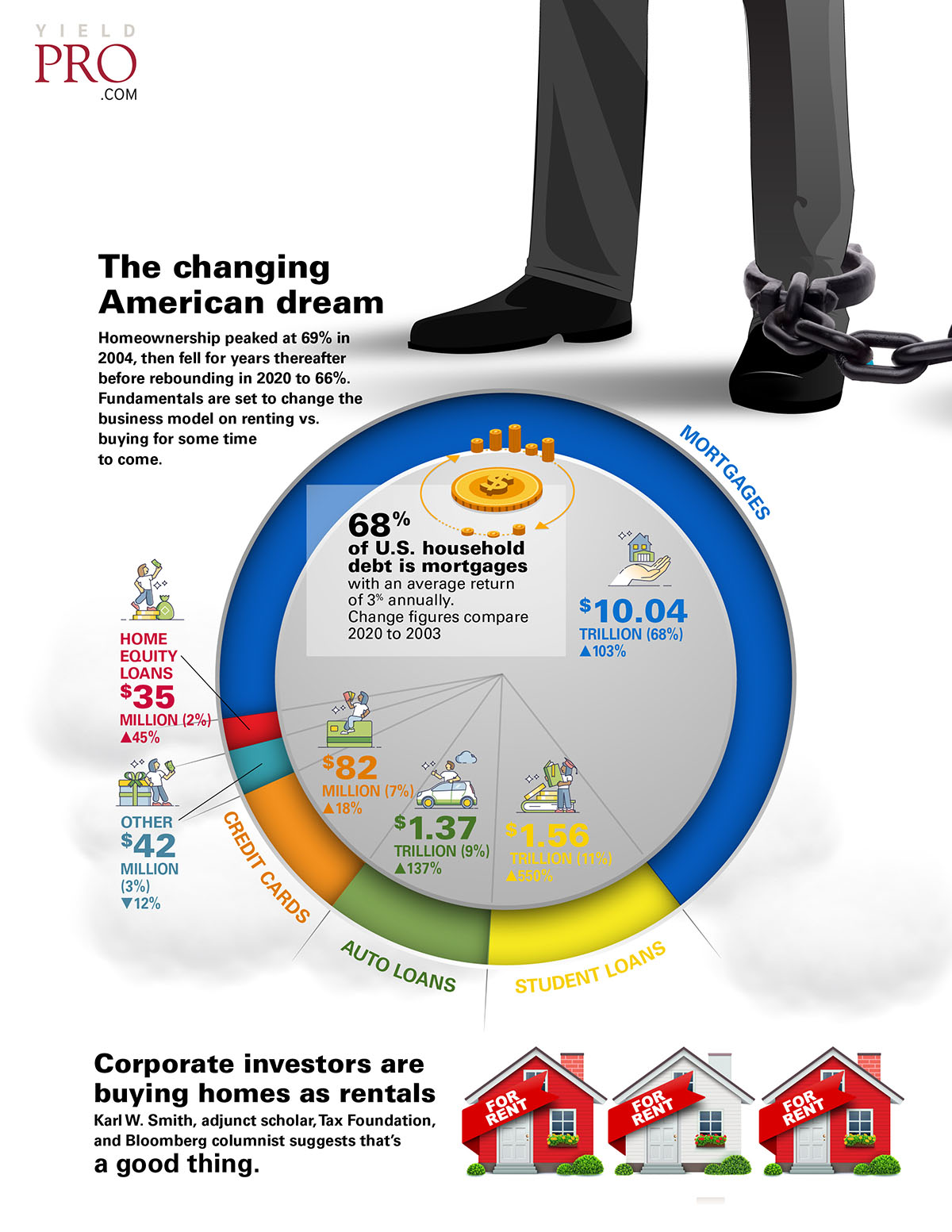

200 year low

Interest rates are driving debt and homeownership up

Extremely illiquid asset

“To see the U.S. as a nation of renters requires a revision of the American Dream of homeownership. This country was always more about new frontiers than comfortable settlements, anyway,” said former assistant professor of economics at the University of North Carolina Karl W. Smith.

Financialization shores up the renter nation

Financialization has equalized renting and homeownership. For centuries, homeownership was a logical investment for moderate-income families who lacked cash and risk tolerance for market investments. Once plodding, home values have been made more liquid by automated appraisals, mortgage underwriting, and presumably safer loan repackaging.

Of note, when investors pulled out of CDOs (collateralized debt obligations), buyer financing crashed and the housing market tanked.

The result: Structures making home buying affordable and a stable investment are dialing down.

Bottom line: Single-family home prices can now fluctuate with the market. Source: Karl W. Smith

Blackstone

$6 billion

Blackstone Group has acquired Home Partners of America trading 17,000 single family rentals (SFR) across the country.

In 2012, Blackstone launched Invitation Homes, now the nation’s largest SFR with more than 80,000 homes.

Blackstone cashed out of Invitation, taking a minority stake in Tricon Residential in 2020. Tricon manages 30,000+ SFRs.