The latest rent report from Apartment List shows strongly positive rent growth for the country as-a-whole. In addition, rents were up for the month in all of the 50 largest metro areas.

Rents jump in June

Apartment List reported that the national average rent growth was 2.3 percent for the month of June, matching the preliminary rate of rent growth reported last month. The national average rent growth was 8.4 percent year-over-year, a record for the Apartment List data set, which goes back to 2017.

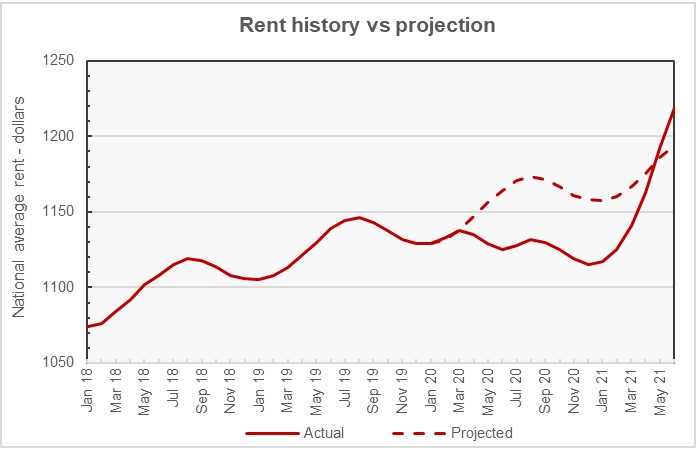

The first chart, below, is a reconstruction of a chart which appeared in the Apartment List report. It shows the national average rent growth since January 2018. It is clear from the chart that rent changes over the course of a year have a regular, cyclical pattern. Apartment List used that cyclical pattern to project what the national average rent would have been if that pattern had continued without the market disruptions caused by the pandemic. They then plotted this projection against the actual national rent history. The chart shows that the recent surge in rents has resulted in the national average rent now exceeding the level that it would have been expected to be in the absence of the pandemic. Rents have now more than made up the ground that they lost last year.

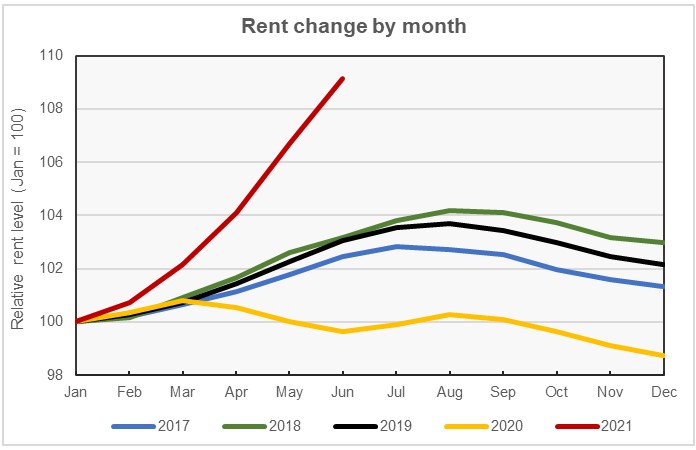

The second chart, below, shows the annual pattern of rent growth for the years for which Apartment List has data. In each year, the level of rent in January of that year is set to a value of 100, so that the difference in the rates of rent growth through the year are apparent. The chart makes clear how different the rent growth patterns in the years 2020 and 2021 are from those of the three preceding years. While rent growth was sub-par in 2020, it has risen sharply in 2021.

Core versus metro

Apartment List provides the underlying data they collected in compiling their report and that data was used to create the tables, below. The tables look at the 50 largest metropolitan statistical areas by population as defined by the US Census Bureau and identify the top 10 metros for year-over-year rent increases and the bottom 10 metros for year-over-year rent decreases. They provide the average monthly rent in the metro, the annual percentage change in rent (YoY Metro) along with the percentage change from the prior month’s rent level (MoM Metro). They also list the year-over-year percentage change in rent for the core city in each metro area (YoY Core).

The first table shows the 10 metros with the largest annual rent decreases. For most of the metros, the rent drop in the core city of the metro area greatly exceeds that of the metro area as-a-whole. This is consistent with reports that renters have been fleeing the urban core for suburbs or exurbs. The other thing to note from this chart is that all of these metro areas experienced strong rent growth during the month.

| Metro | Metro Rent | YoY Metro | MoM Metro | YoY Core |

| San Jose | $2,343 | -5.0 | 2.1 | -4.2 |

| San Francisco | $2,207 | -4.4 | 2.4 | -10.2 |

| New York | $1,778 | 1.7 | 2.2 | -3.0 |

| Washington DC | $1,795 | 2.0 | 2.5 | -3.6 |

| Seattle | $1,759 | 2.1 | 3.5 | -3.9 |

| Minneapolis | $1,298 | 2.4 | 1.2 | -2.8 |

| Boston | $1,878 | 4.4 | 3.2 | 1.7 |

| Louisville | $958 | 4.6 | 2.0 | 5.5 |

| Los Angeles | $1,952 | 4.7 | 1.7 | 0.3 |

| Chicago | $1,332 | 5.1 | 2.5 | 1.5 |

The major metros with the largest year-over-year rent increases are listed in the next table, below. While these metros have seen much higher rates of rent growth than those listed in the first table, they also started out from a lower rent level before the recent run-up in rents. However, the strong rent growth in these metros has brought their rents much closer to those of the generally more expensive metros listed in the first table.

The metros listed in this table are usually centered around smaller cities than are the metros listed in the table above. This may account for their core cities doing relatively well.

| Metro | Metro Rent | YoY Metro | MoM Metro | YoY Core |

| Inland Empire* | $1,887 | 22.4 | 2.1 | 13.4 |

| Tampa | $1,481 | 19.5 | 4.4 | 20.3 |

| Phoenix | $1,519 | 19.1 | 3.2 | 17.0 |

| Rochester, NY | $1,171 | 19.0 | 2.9 | 14.9 |

| Sacramento | $1,813 | 17.4 | 2.5 | 12.3 |

| Las Vegas | $1,433 | 17.1 | 2.1 | 16.0 |

| Jacksonville | $1,360 | 16.7 | 3.7 | 16.0 |

| Memphis | $1,150 | 16.5 | 2.9 | 15.2 |

| Virginia Beach | $1,469 | 15.9 | 2.7 | 20.0 |

| Atlanta | $1,397 | 15.2 | 3.0 | 10.9 |

*Riverside-San Bernardino-Ontario

The complete Apartment List report covers many more metros and contains some interesting charts illustrating how rents have changed over time in the hardest hit markets. It also provides readers with the opportunity to download their data sets. It can be found here.