The latest Employment Situation Report from the Bureau of Labor Statistics shows that 3 out of the 4 jobs categories we track that are of interest to builders and operators of multifamily housing had flat or lower employment in July.

Total employment growth up for the month

The BLS reported that the US unemployment rate fell sharply to 5.4 percent in July, with total non-farm employment increasing by 943,000 jobs. Government jobs, which account for about 15 percent of employment in the country, represented over 25 percent of employment growth in July.

The labor force participation rate rose slightly to 61.7 percent in July but remains, 1.6 percent (4.2 million people) lower than its level before the pandemic. The number of people employed on non-farm payrolls is still 5.7 million lower than it was before the pandemic.

The BLS reported more detailed employment information on four job categories of interest to the multifamily industry. These are employment as residential construction workers, as specialty trades within residential construction, as residential property managers and as lessors of residential buildings. As usual, some of the data is reported with a month delay, so the latest figures for the latter two categories are for the month of June.

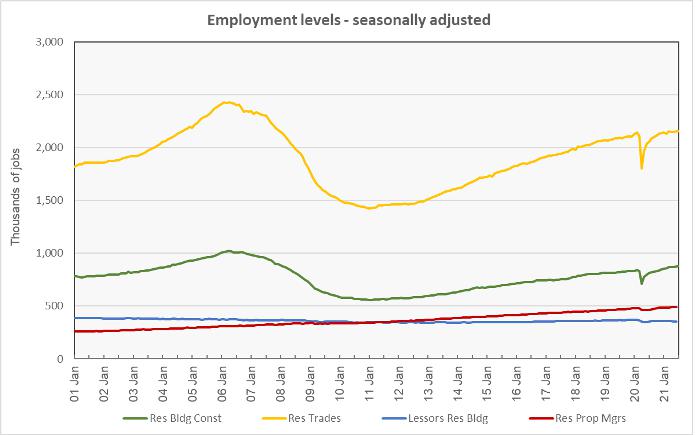

The first chart shows the long-term history of the levels of employment in these four categories of the multifamily jobs market.

Construction jobs rise

Employment in residential building construction in July, usually with general contractors, was reported to be up 8,300 (1.0 percent) from the revised employment level for June at 882,500 jobs. This is despite June’s preliminary figure being adjusted upward by 1,300 jobs. Employment in this category is now 5.1 percent higher than its level in February 2020, before the effects of the pandemic were felt.

Employment in residential building trades, i.e. plumbers, electricians, etc., in July was reported to be unchanged from June’s revised figure at a level of 2,157,200 jobs. However, June’s preliminary employment figure was revised downward by 2,000 jobs, so July’s preliminary figure is lower than the figure given for June in last month’s report. The employment level in this category is now 0.7 percent above its level in February 2020.

Total employment in these two categories of residential construction jobs combined was up 0.5 percent in July from the revised level of the month before and was 1.7 percent above its level in February 2020.

Apartment operations jobs reported down

Employment for residential property managers in June was reported to be down by 300 jobs (0.1 percent) from its level for May at 490,600 jobs. However, the May jobs figure was revised downward by 200 jobs so the preliminary figure for June is down by 500 jobs from the preliminary figure for May. Employment was up from its February 2020 level by 1.8 percent.

Employment for lessors of residential buildings fell again in June, dropping by 800 jobs (0.2 percent) to a level of 354,700 jobs. This is despite May’s preliminary figure being revised downward by 200 jobs. Employment in this category is now down 3.9 percent from its pre-pandemic level.

Total employment in these two categories combined is now 0.5 percent below its level in February 2020.

Its all relative

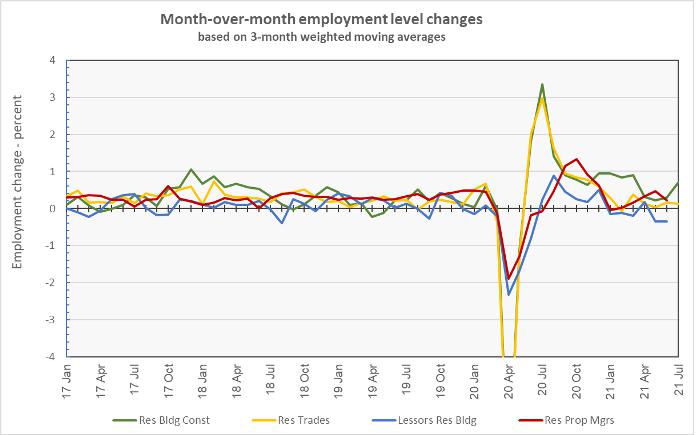

The final chart, below, presents the employment data in a slightly different format. It focuses on the monthly change in employment levels, based on weighted three-month moving averages. This shows more clearly the magnitudes of the jobs gains and losses for the the four categories of the multifamily jobs market that we track.

The numbers given in the Employment Situation report are seasonally adjusted and are subject to revision. It is common for small adjustments to be made in subsequent reports, particularly to the data for the most recent month. The current Employment Situation report can be found here.