Compared with earlier forecasts, Fannie Mae’s October economic and housing forecasts call for higher multifamily housing starts over the next 6 months while also anticipating lower GDP growth and higher inflation.

Housing: less single-family, more multifamily

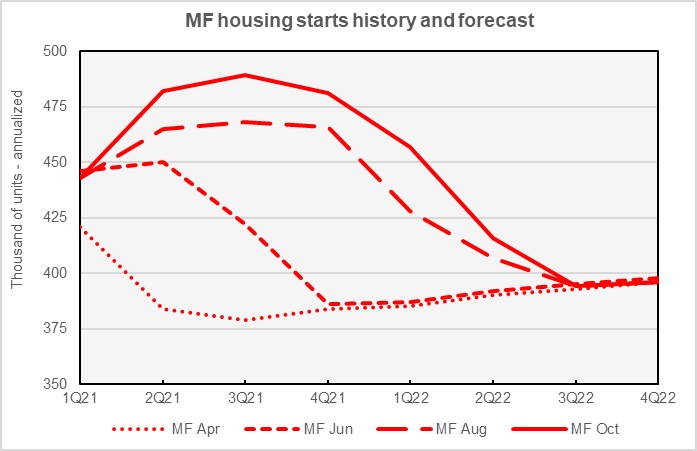

Fannie Mae now expects multifamily starts (2+ units per building) to be 474,000 units in 2021, up 22 percent from the number of units started in 2020. The forecasts for multifamily starts in 2022 is now 416,000 units, down 9,000 units from the level forecast last month.

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. The chart shows that, over the last 6 months, Fannie Mae has become increasingly optimistic about the number of multifamily housing starts, at least through the middle of next year.

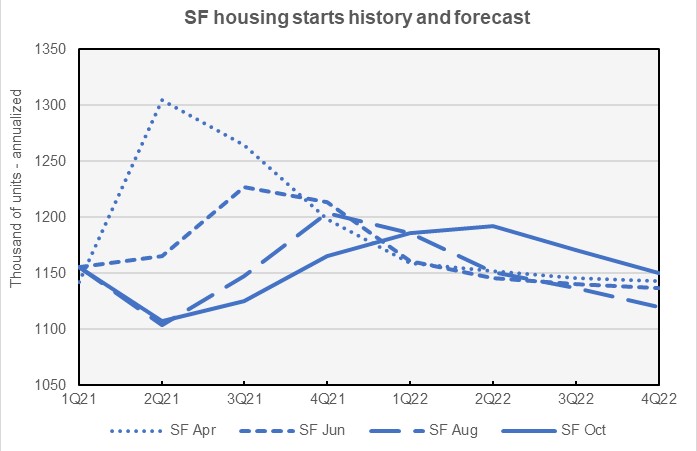

For 2021 as-a-whole, Fannie Mae now expects single family starts to be 1,139,000 units, down 4,000 units from the level forecast last month. However, their forecast for single-family starts in 2022 was raised for the second month in a row. It now stands at 1,175,000 units, up 16,000 units from the level forecast last month.

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts. The chart shows that Fannie Mae has become increasingly pessimistic about single-family housing starts in 2021.

Inflation forecast higher

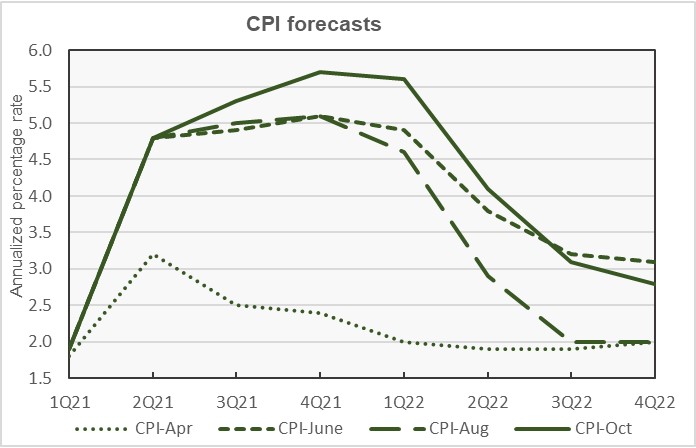

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts. The chart makes clear that expectations for inflation have risen sharply since the spring. The latest forecast raises the expected level of inflation again and extends the rise into 2022. As an example of rising inflationary expectations, Fannie Mae forecast Q2 2022 inflation to be 2.9 percent in August, but the forecast was raised to 3.4 percent in September and 4.1 percent in October.

In the discussion accompanying the forecast release, Fannie Mae cited increasing supply bottlenecks currently being experienced throughout the economy as contributing to the rise in prices.

GDP growth takes a hit

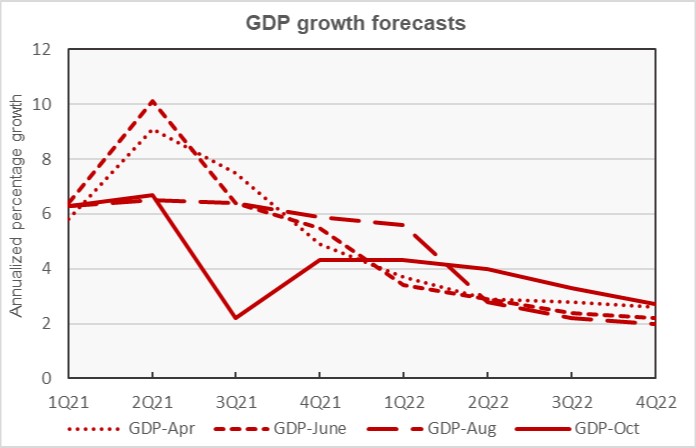

Stunted GDP growth is another symptom of the current supply problems in the economy. Its impact on the October GDP forecast is most apparent in the forecast for Q3 2021. Fannie Mae is now forecasting growth of only 2.2 percent for the quarter on an annualized basis. As recently as August, growth of 6.4 percent was forecasted for Q3. Fannie Mae’s changing expectations for GDP growth are illustrated in the next chart, below, which shows the current forecast for GDP, along with three earlier forecasts.

On an annual basis, Fannie Mae now expects GDP growth for 2021 to come in at 4.9 percent, down from a forecast of 5.4 percent last month. GDP growth for 2022 is now expected to be 3.6 percent, down from the 3.8 percent rate forecast last month.

Unemployment forecast slightly lower

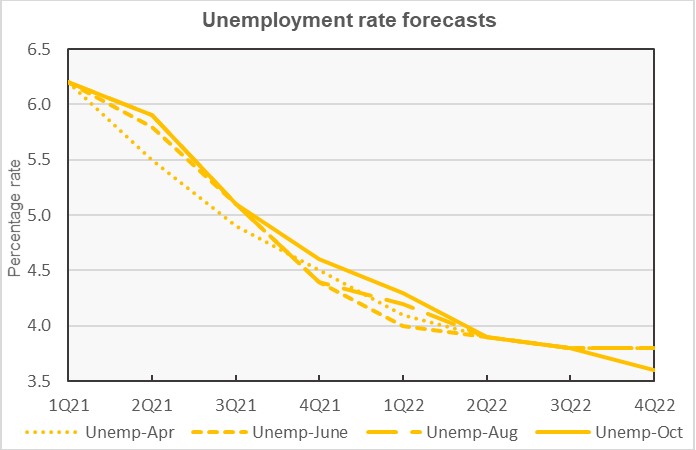

Fannie Mae’s forecasts for the unemployment have not experienced the large month-to-month revisions that have appeared in the other forecasts. However, the trend has been for unemployment expectations to rise in late 2021 and early 2022. This is shown in the final chart, below.

On an annual basis, both the September and October forecasts predicted an unemployment rate of 5.5 percent for 2021. However, the October forecast lowered the unemployment rate predicted for 2022 to 3.9 percent from the 4.1 percent predicted the month earlier.

The Fannie Mae Multifamily Market Commentary focused on the senior housing segment. While there have been recent challenges to this segment because of COVID, the massive coming increase in the number of people over the age of 75 make the longer term prospects for senior housing bright.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecasts.