A new report from Trepp takes a look at the state of commercial real estate (CRE) lending in Q3 2021. While the report covers lending for all commercial property types, this article focuses on the health of loans on multifamily properties.

Measuring commercial mortgage stress

The most current information in the report on stress in CRE lending by banks dates from Q2 2021. Trepp reported that the delinquency rate on CRE loans was 1.1 percent in Q2. This was down from the level in Q4 2020, where delinquencies reached 1.3 percent, but up from the delinquency rate of around 0.6 percent that prevailed before the pandemic. Non-current loans, a more serious form of delinquency, were at 0.9 percent. For loans on multifamily properties, the delinquency rate in Q2 was 0.6 percent.

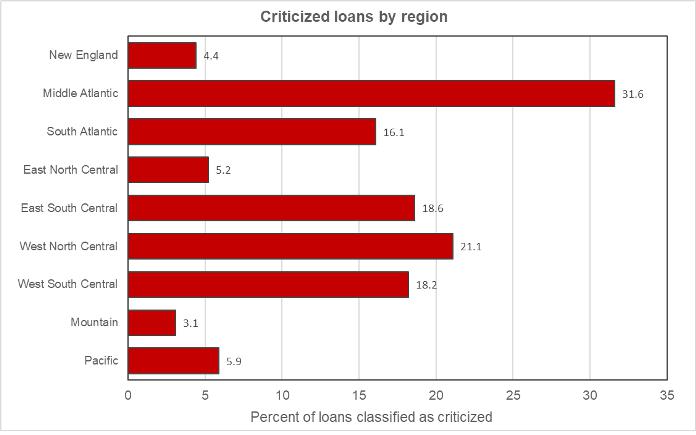

Trepp reported that CRE loans are measured on a risk scale, which measures 1 to 9. Loans with risk ratings of 6 or more are classified as “criticized” loans. Examining criticized loans gives a broader view of risk in outstanding CRE loans than just looking at delinquencies. The following chart gives the portion of loans classified as criticized in each of 9 geographic regions of the country.

Trepp speculates that the higher rates of criticized loans in some regions is related to the higher rates of COVID infections in those areas. If this is true, then shifts in the regions most affected by COVID as the winter arrives should show up in the loan stress data. We will look for this effect in future reports.

While CRE lending by commercial banks was down by 40 percent from its pre-COVID level, Trepp reported that lending for multifamily properties was down by half. Competition from government-sponsored enterprises like Fannie Mae and Freddie Mac was given as the reason that bank loan volumes had recovered to a lesser extent in this category of commercial property lending. To some extent, this conclusion is supported by data released by the Mortgage Bankers’ Association.

The CMBS sector is healing

The Trepp report discussed the change in the portion of commercial mortgage-backed securities (CMBS) loans that are under special servicing. The dollar volume of these loans had been running below $15 billion before the pandemic, but jumped as high as $55 billion in August 2020. However, between December 2020 and September 2021, the dollar value of loans under special servicing fell from $53 billion to $41 billion. CMBS loans under special servicing now represent only 7.5 percent of total loan value outstanding.

For CMBS loans on multifamily properties, the dollar value of loans under special servicing fell from $1.44 billion in December 2020 to $1.23 billion in September 2021. Multifamily CMBS loans under special servicing represent only 3 percent of total loan value outstanding. Only the industrial asset class has a lower portion of loan value under special servicing, at 0.42 percent.

The value of CMBS loans that are delinquent has also been trending downward. The $28.8 billion in private-label CMBS loans that were delinquent as of September 2021, is down 50 percent from the peak reached in June 2020 and down 32 percent from the level in December 2020. In September 2021, 5.3 percent of total private-label CMBS loan value was delinquent.

For CMBS loans on multifamily properties, the delinquency rate in September 2021 was 2.3 percent of total loan value outstanding. This was down from a level of 3.2 percent in December 2021.

The full report also contains survey information on CRE professionals’ expectations for the next 6 months and much more detailed information about loans under special servicing and the servicers of them. The report can be obtained here.