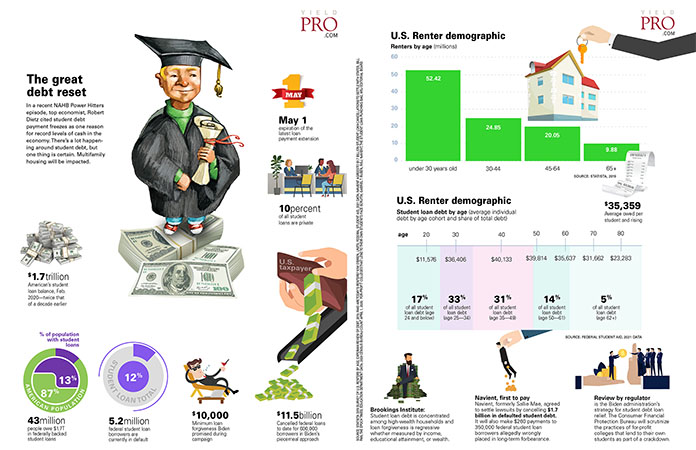

In a recent NAHB Power Hitters episode, top economist, Robert Dietz cited student debt payment freezes as one reason for record levels of cash in the economy. There’s a lot happening around student debt, but one thing is certain. Multifamily housing will be impacted.

$1.7 trillion. American’s student loan balance, Feb. 2020—twice that of a decade earlier

May 1. Expiration of the latest loan payment extension

10 percent of all student loans are private

43 million people owe $1.7T in federally backed student loans

5.2 million federal student loan borrowers are currently in default

$10,000 Minimum loan forgiveness Biden promised during campaign

$11.5 billion Cancelled federal loans to date for 600,000 borrowers in Biden’s piecemeal approach

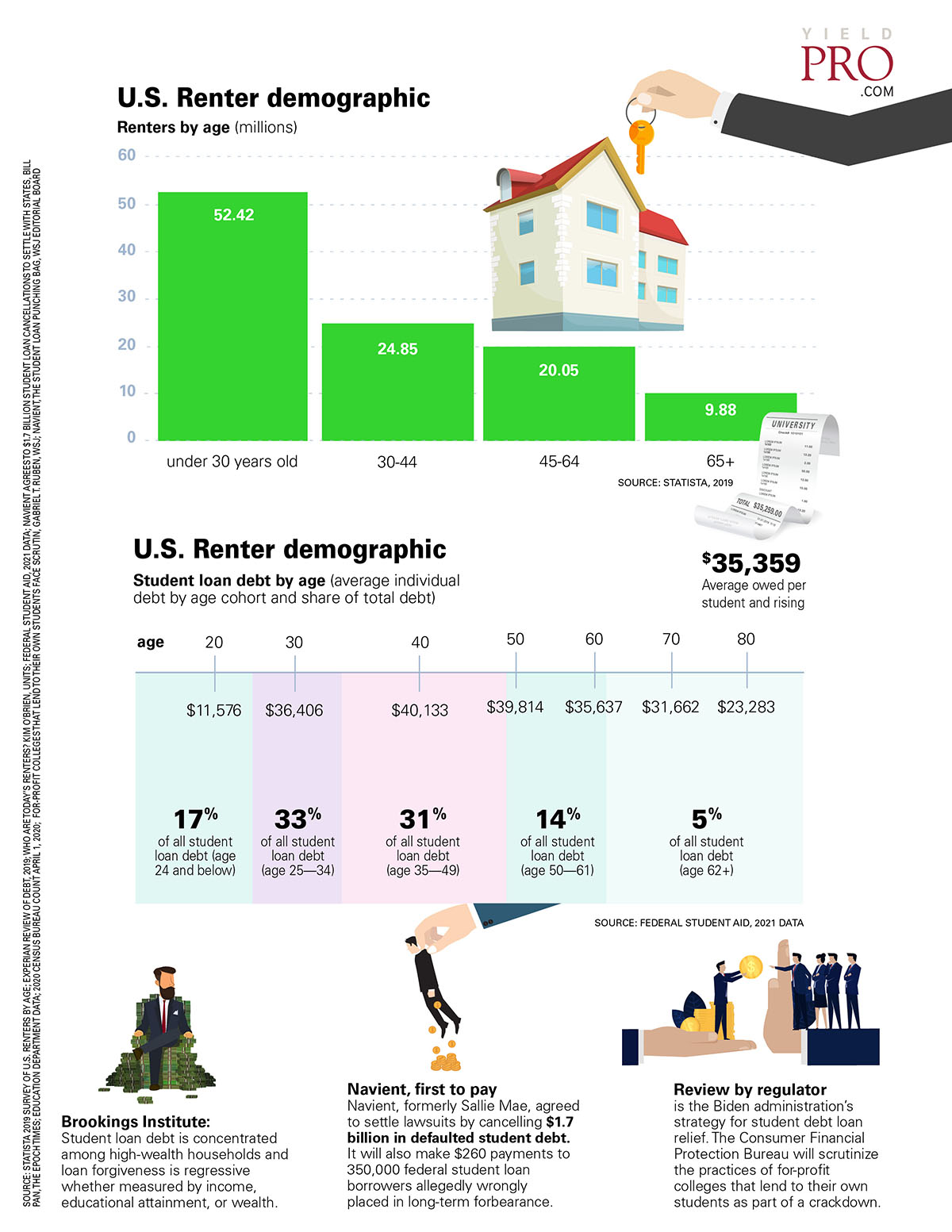

$35,359 Average owed per student and rising

Brookings Institute:

Student loan debt is concentrated among high-wealth households and loan forgiveness is regressive whether measured by income, educational attainment, or wealth.

Navient, first to pay

Navient, formerly Sallie Mae, agreed to settle lawsuits by cancelling $1.7 billion in defaulted student debt.

It will also make $260 payments to 350,000 federal student loan borrowers allegedly wrongly placed in long-term forbearance.

Review by regulator

Is the Biden administration’s strategy for student debt loan relief. The Consumer Financial Protection Bureau will scrutinize the practices of for-profit colleges that lend to their own students as part of a crackdown.