Fannie Mae’s February economic and housing forecasts call for marginally higher multifamily housing production in 2022 and 2023 than in earlier forecasts. Other forecasts for 2022 call for slightly lower GDP growth and slightly higher inflation than in earlier reports.

Housing forecast: multifamily flat, single-family down

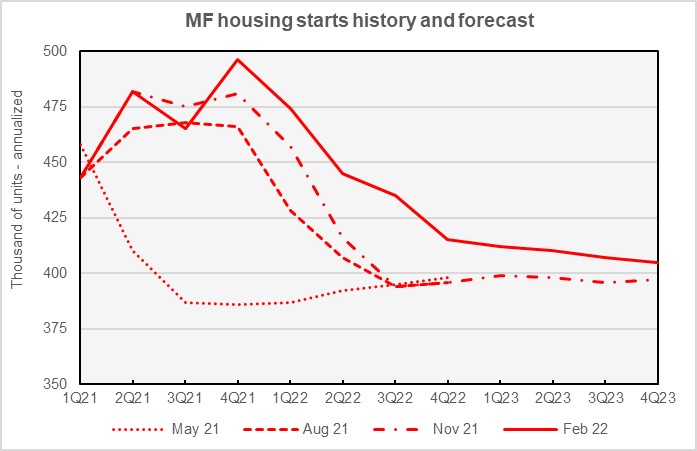

Fannie Mae now estimates that multifamily starts (2+ units per building) in 2021 will come in at 472,000 units, up 21 percent from the number of units started in 2020. This forecast is up 3,000 units from the level forecast last month. The forecast for multifamily starts in 2022 is 442,000 units, up 1,000 units from the level forecast last month, while the forecast for multifamily starts in 2023 was also revised upward by 1,000 units to 408,000 units.

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. The earlier forecasts were selected at 3-month intervals so that the evolving outlook for multifamily housing starts over the last 9 months would be apparent. The chart shows that Fannie Mae repeatedly revised their projection for multifamily housing starts for 2021 higher as the year progressed.

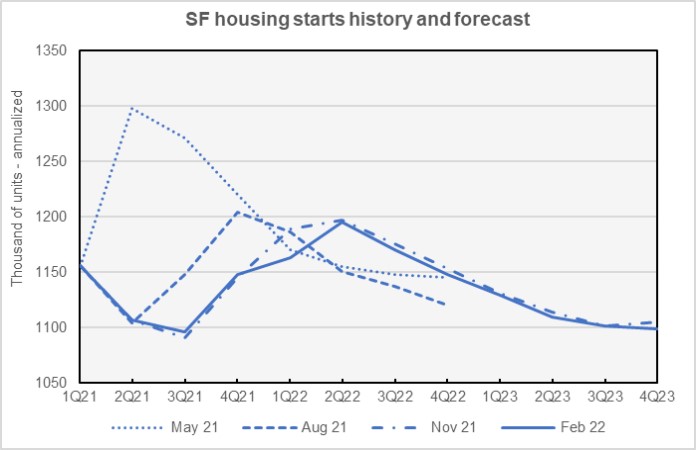

Fannie Mae now expects single-family starts to be 1,123,000 units in 2021, up 5,000 units from the level forecast last month. However, Fannie Mae’s lowered their forecast for single-family starts in 2022 by 53,000 units to a level of 1,139,000 units, while their forecast for single-family starts in 2023 was revised lower by 19,000 units to 1,110,000 units.

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts. The chart shows that Fannie Mae generally revised their estimates for single-family starts in 2021 downward as the year progressed, while increasing their estimates for starts in 2022. While the chart shows that the estimate for single-family starts in 2022 in February’s forecast is close to that in November’s forecast, it does not show that Fannie Mae had a more optimistic view of single-family housing starts for 2022 in its December and January forecasts.

Inflation forecast higher

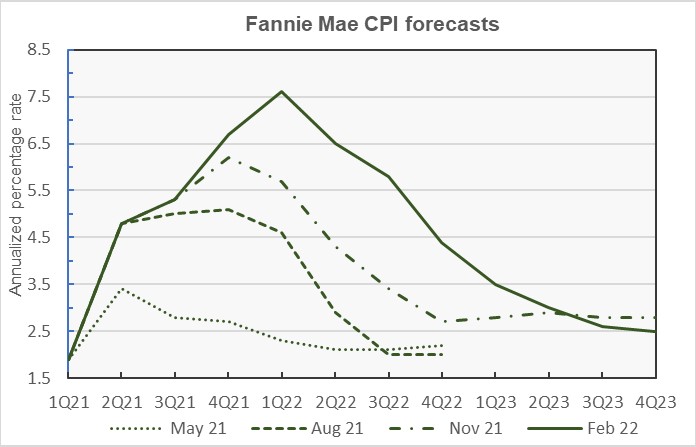

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

As 2021 progressed, Fannie Mae repeatedly revised their forecasts to call for higher inflation for a longer period. Compared to last month’s forecast, Fannie Mae now calls for inflation in 2022 to be between 0.4 and 0.6 percentage points higher in each quarter of the year. However, the inflation forecast for 2023 was revised down slightly.

GDP growth forecast revised modestly lower

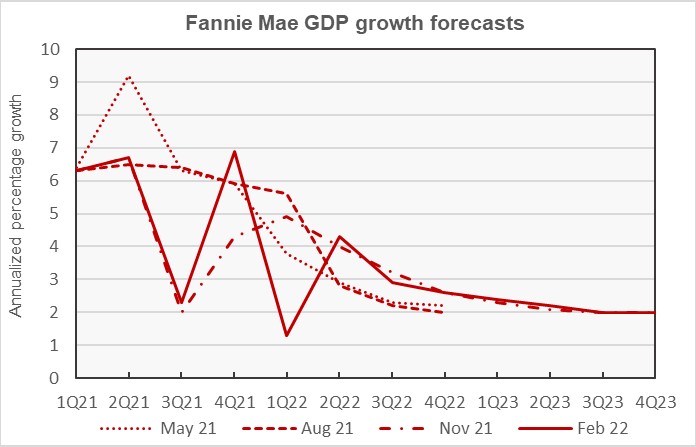

The next chart, below, shows Fannie Mae’s current forecast for the Gross Domestic Product (GDP) growth, along with three other recent forecasts.

Fannie Mae’s forecast for GDP growth in Q4 2021 was revised slightly upward this month with growth now expected to come in at an annualized rate of 6.9 percent. However, this growth was driven more by inventory accumulation than by current consumption or capital investment, so Fannie Mae does not expect it to be sustainable. In addition, effects of the Omicron wave and of rising interest rates in response to higher inflation, are expected to weigh on growth going forward.

The growth forecasts for Q1 and Q2 2022 were significantly revised in this report. The Q1 forecast fell from 3.4 percent to 1.3 percent while the Q2 forecast rose from 3.3 percent to 4.3 percent. The GDP forecasts for Q3 and Q4 2022 were revised slightly lower.

For the year 2022 as-a-whole, the GDP growth forecast was revised downward from 3.1 percent to 2.8 percent.

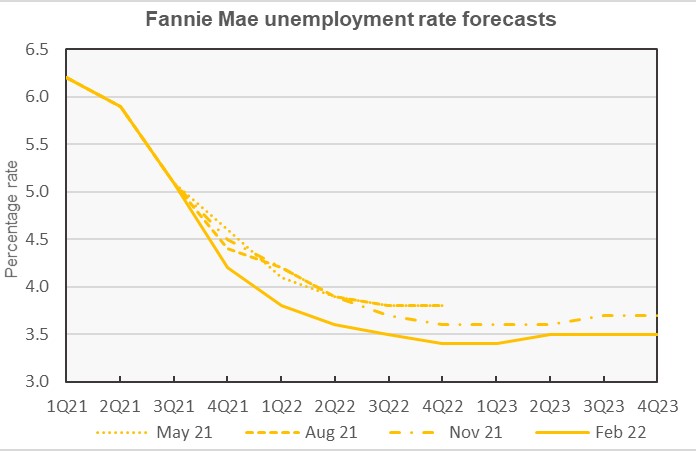

Unemployment rate forecast nearly unchanged

The next chart, below, shows Fannie Mae’s current forecast for the unemployment rate, along with three other recent forecasts. Generally, the unemployment rate has come down faster than Fannie Mae expected early in 2021. However, compared to last month’s forecast, the unemployment rate forecast for 2022 as-a-whole ticked up slightly from 3.5 percent to 3.6 percent.

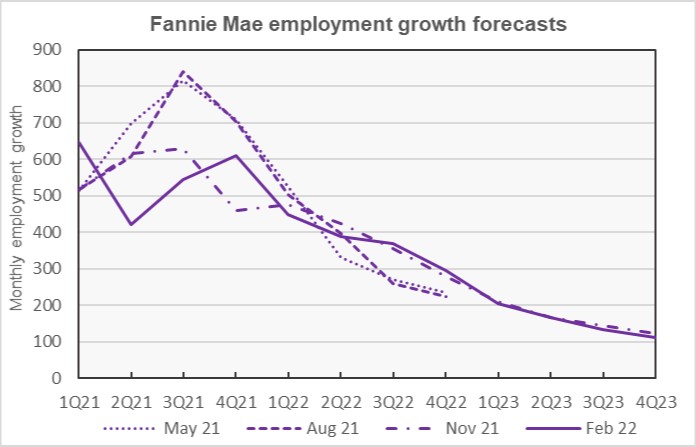

The unemployment rate depends both on the number of people working and also on the number of people choosing to participate in the labor market, so it only gives a partial view into the strength of the jobs market. Another key measure of market’s strength is the change in total non-farm employment. The current forecast for this metric is shown in the last chart, below, along with other recent forecasts.

Comparing the above two charts shows that, while the unemployment rate declined throughout 2021 in line with Fannie Mae’s forecasts, employment grew more slowly than they had projected. This implies that there were fewer people participating in the jobs market than they had expected. In fact, the labor force participation rate remains below its pre-pandemic level as people have been slow to return to the jobs market.

This month, population and employment statistics were revised to reflect the results of the 2020 census. This had the effect of raising the measured employment level in the economy. This adjustment partly explains the revision of employment growth in 2021 from 6.4 million jobs in January’s forecast report to 6.7 million jobs in February’s forecast.

The Fannie Mae Multifamily Market Commentary for February focused on how the rapid rise in apartment rents, and in inflation more generally, are decreasing apartment affordability. It also documented how rent delinquencies have changed compared to pre-pandemic times, with delinquencies rising by 3 percentage points or more in class B and class C apartment, and a little less in class A apartments. Delinquencies also rose by a little more than 3 percentage points in federally assisted properties, although the performance varied by the type of assistance provided.

Despite the rise in delinquencies and the exhaustion of Emergency Rental Assistance Program funds in many states, eviction levels remain below pre-pandemic rates in most jurisdictions. Las Vegas is an exception, with eviction levels currently running at 126 percent of the historical average.

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed economic and housing forecasts.