The “Week 45” edition of the Census Bureau’s Pulse Survey shows that the portion of renters who are behind on their rent payments has grown since we last reported on this survey.

What is the Pulse Survey?

The Pulse Survey is an experimental program that the Census Bureau started shortly after economic shutdowns were imposed in response to COVID-19. It was designed to assess how the population of the country was faring under the economic stress caused by the reaction to the pandemic. The current survey, designated Week 45, posed questions which are part of what Census calls Phase 3.4 of the survey.

The Week 45 survey collected data from April 27 to May 9, 2022. This is 4 weeks after the period in which the “Week 44” survey data was collected. The renter portion of the survey covers renters of both multifamily and of single-family properties.

Tracking delinquencies

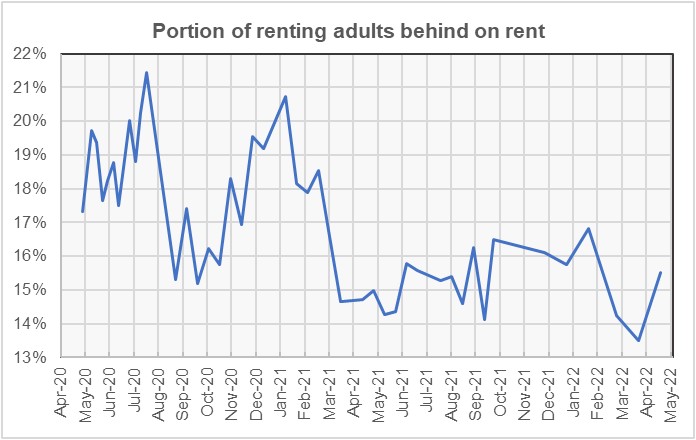

Renters in all phases of the survey have been asked whether they are behind on their rent. While some say that they occupy their housing without paying rent and some did not report whether they are current on their payments, the majority of respondents answered the question Yes or No. The first chart, below, shows the history of responses to this question. Note that the “Week 45” survey was taken 102 weeks after the initial Pulse Survey.

The chart shows a rise in the portion of renters who reported being behind on their rent payments, rebounding from a survey low reported last month. The increase in rent delinquencies this month puts the level in the middle of the range it has occupied for the last year. While we don’t have survey data from before the pandemic to which to compare it, this may just be the “normal” portion of renters who do not pay their rent on time.

Seeking help

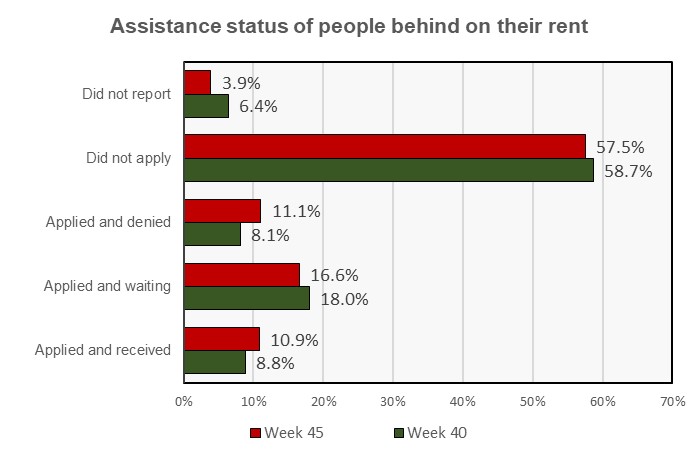

A new question introduced in Phase 3.3 asked whether the respondent had sought government assistance in paying their rent. A comparison of the responses in the “Week 40” survey, when the question was first asked, and those in the “Week 45” survey taken 20 weeks later is illustrated in the next chart, below.

The chart shows the sorts of trends that one would expect. Over time, more of the people who are behind on their rent would be expected to apply for assistance. This is reflected in the declining portion of respondents who said that they have not applied for assistance. The chart also shows that a greater portion of the respondents have either received assistance or been told that they have been denied and that fewer respondents are waiting to hear one way or the other. However, given that there is a 20 week span between these two surveys, it is somewhat surprising that the changes aren’t more significant.

The Pulse Survey identified a little under 3.5 million adults who have received emergency rental assistance.

Profiling the participants

Of the respondents who reported being current on their rent, 34 percent said that they had children in the household. Of those reporting being behind on their rent, 52 percent reported having children in the household.

Of the respondents who reported being current on their rent, 84 percent said that they or a household member had experienced no loss of employment income over the prior 4 weeks. Of those reporting being behind on their rent, 39 percent reported that they or a household member had experienced a loss of employment income.

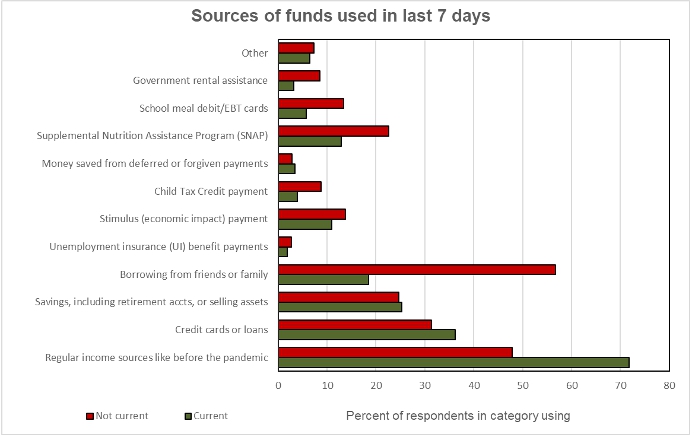

The final chart shows the sources of the funds survey respondents used to meet spending needs. Many of the differences between the people who are current on their rent and those who are behind are as one would expect: the former are more likely to rely on regular sources of income while the latter are more likely to rely on borrowing and on government assistance.