The Census Bureau’s new residential construction report for August was the reverse of last month’s report with multifamily housing construction permits and completions falling sharply while starts jumped.

In single-family housing construction, the changes from July’s level of activity were less extreme. Single family permits fell 4 percent, starts rose 3 percent and completions fell less than 1 percent.

Multifamily housing permits plunge

The number of permits issued for buildings with 5 or more units in August was reported to be 571,000 units on a seasonally adjusted, annualized basis. This was down 19 percent (130,000 units) from July’s revised (+5,000 units) figure. Permits were down 15 percent from the level recorded in August 2021 and were down 9 percent from the trailing 12-month average.

In addition, 47,000 permits were issued in August for units in buildings with 2 to 4 units. This was down 5,000 units from the revised (-1,000 units) level for July. August permits for units in buildings with 2 to 4 units up 9 percent from the year-ago level but were 12 percent lower than the trailing 12-month average.

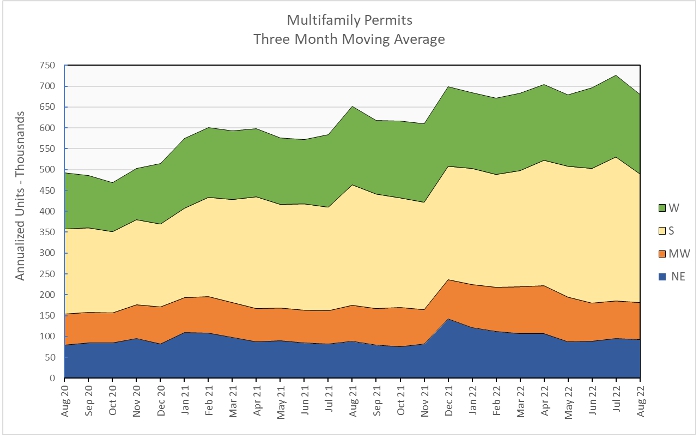

Regional data for multifamily housing is only reported for structures with two or more units. “Structures with 5 or more units” is not broken out as a separate category. Since the regional data is highly volatile and is frequently revised, it is examined here based on three-month moving averages. This averaging will tend to smooth out the month-to-month variations in the data.

Nationally, the three-month weighted moving average for permits issued for multifamily housing in August was down 6 percent from the level in July but was 5 percent higher than the level of August 2021. Permit issuance history is shown in the first chart, below. The three-month weighted moving average for permits came it at 681,000 units.

On a month over month basis, the three-month weighted moving average for multifamily permit issuance was unchanged in the Midwest but was down in other regions of the country. Permit issuance fell 2 percent in the West, 4 percent in the Northeast and 11 percent in the South.

When compared to year-earlier levels, the three-month weighted moving average of permits issued was up 7 percent in the South, 5 percent in the Northeast, 3 percent in the Midwest and 1 percent in the West.

The following chart shows the three-month weighted moving averages of permits by region for the last 25 months.

Multifamily housing construction starts rebound

The preliminary August figure for multifamily housing starts in buildings with 5 or more units was 621,000 units on a seasonally adjusted, annualized basis. This was reported to be up 29 percent (138,000 units) from the revised figure (-31,000 units) for July.

Compared to the level of August 2021, multifamily housing starts in buildings with 5 or more units were up 31 percent. The reported starts figure was 23 percent higher than the trailing 12-month average and 60 percent higher than the monthly average from 2019.

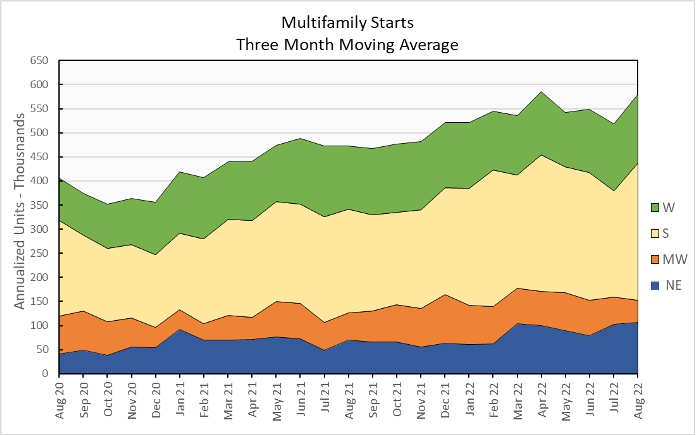

Multifamily housing construction starts (two or more units per building) in August were up 12 percent from their July level for the country as-a-whole, based on three-month weighted moving averages. Starts were up 29 percent in the South, 4 percent in the Northeast and 3 percent in the West. Starts fell 18 percent in the Midwest from the level of the prior month.

The three-month weighted moving average of starts was up 23 percent for the country-as-a-whole on a year-over-year basis. Compared to August 2021, starts were up 53 percent in the Northeast, 32 percent in the South and 9 percent in the West. Starts fell 18 percent in the Midwest.

The following chart shows the three-month weighted moving average of starts by region for the last 25 months.

Multifamily housing completions fall

The preliminary August multifamily housing unit completions figure in buildings with 5 or more units per building was 318,000 units on a seasonally adjusted, annualized basis. This was reported to be down 21 percent (83,000 units) from July’s revised (-11,000 units) figure.

Compared to August 2021, multifamily housing completions in buildings with 5 or more units per building were down 7 percent. Compared to the trailing 12-month average, completions were down 6 percent and compared to the monthly average for 2019, completions were down 8 percent.

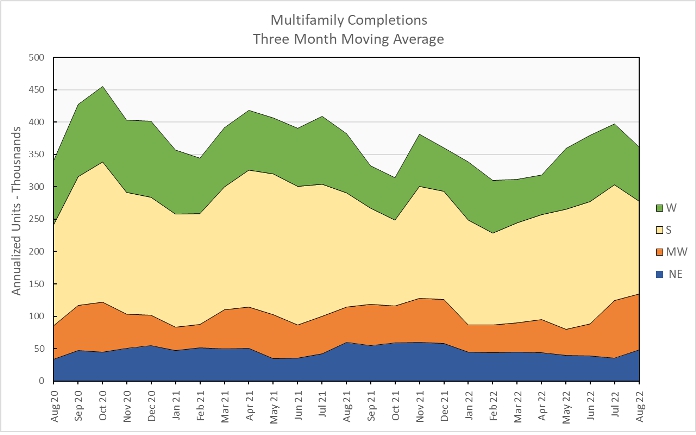

For the country as-a-whole, multifamily housing construction completions (two or more units per building) were down 9 percent month-over-month, comparing three-month weighted moving averages. The three-month weighted moving averages of completions was up 37 percent in the Northeast. However, completions were down 20 percent in the South, 11 percent in the West and 3 percent in the Midwest. The South region accounted for 40 percent of all completions.

On a year-over-year basis, the three-month weighted moving average of completions in buildings with 2 or more units per building was down 5 percent nationally. Completions were up 84 percent in the Midwest but fell 32 percent in the Northeast, 31 percent in the West and 5 percent in the South.

The three-month weighted moving average of completions by region for the past 25 months are shown in the chart below.

The number of multifamily units under construction was up again in August. Census reported that there were 873,000 units under construction in buildings with 5 or more units per building on a seasonally adjusted annualized basis. This is up by 28,000 units from the revised (-1,000 units) level of the month before. It is 27 percent, or 183,000 units, higher than the number of units under construction one year earlier. There have not been this many multifamily housing units under construction since 1973.

All data quoted are based on seasonally adjusted results and are subject to revision.