Fannie Mae’s November economic and housing forecasts predict that both multifamily and single-family housing starts will fall next year by more than they previously expected.

The November forecast is the first from Fannie Mae to provide predictions for 2024.

Multifamily starts forecast to fall in 2023

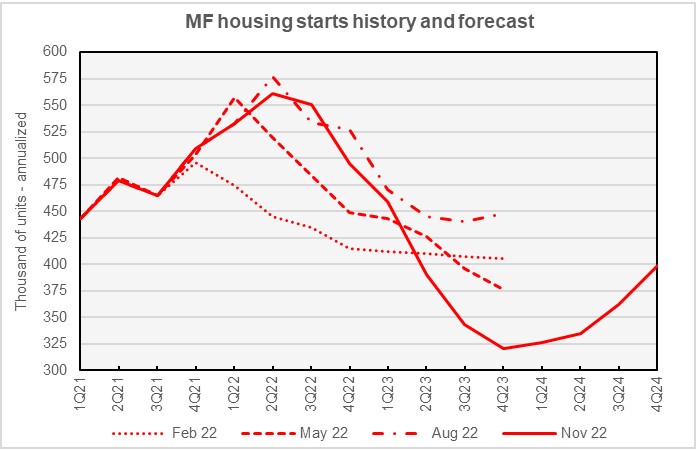

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The chart shows that Fannie Mae’s forecasters underestimated the strength of multifamily housing construction earlier in the year, causing them to frequently revise their outlook for 2022 multifamily housing starts higher.

While Fannie Mae has long been predicting an economic downturn in 2023, their more recent forecasts see it arriving earlier than they originally thought. This has resulted in their forecast housing construction downturn also arriving earlier, impacting their 2023 multifamily starts forecast. The current forecast revised the Q4 2023 annualized rate of multifamily housing starts down by 52,000 units to only 321,000 units. This is now forecast to be the low point of this housing construction cycle with starts rising throughout 2024.

Fannie Mae now expects multifamily starts (2+ units per building) for 2022 to come in at 535,000 units, down 7,000 units from the level forecast last month. The forecast for multifamily starts in 2023 is now 378,000 units, down 12,000 units from the level forecast last month, while the inaugural forecast for 2024 is 356,000 unit starts.

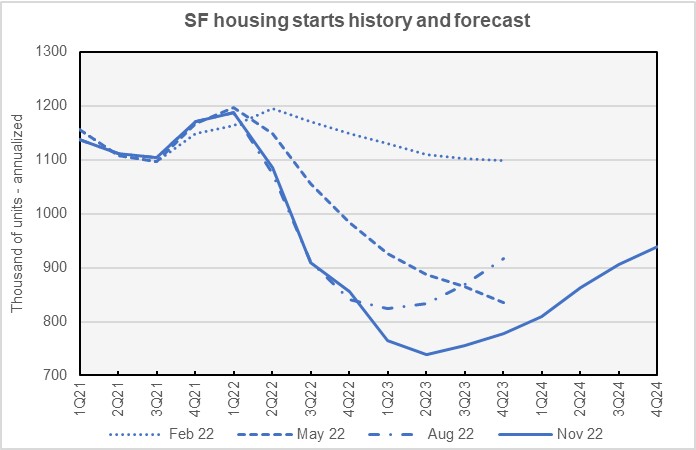

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Fannie Mae’s forecasters slightly bumped up their predicted numbers for single-family starts in Q3 2022 through Q1 2023 in this month’s forecast. However, they revised their forecast for single-family starts lower for the last three quarters of 2023 resulting in a drop in predicted starts for that year. Q2 2023 is now predicted to be the low point for housing starts with the number of starts predicted to rise for each quarter in the forecast horizon from that point on.

Fannie Mae now expects single-family starts to be 1,010,000 units in 2022, up 9,000 units from the level forecast last month. However, Fannie Mae lowered their forecast for single-family starts in 2023 by 8,000 units to a level of 759,000 units. Fannie Mae’s first take on single-family housing starts for 2024 has them coming in at 879,000 for the year but with the annualized rate of starts reaching 939,000 in Q4.

Fannie Mae sees earlier downturn

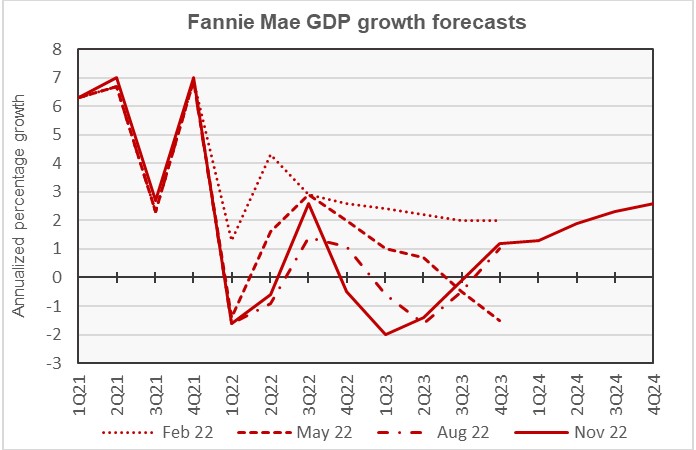

The next chart, below, shows Fannie Mae’s current forecast for the Gross Domestic Product (GDP) growth, along with three other recent forecasts.

The chart shows that the latest GDP forecast calls for the downturn to persist for 4 quarters, from Q4 2022 to Q3 2023. However, the annualize growth predicted is only marginally negative for the quarters at the beginning and end of this period. This is roughly the same as what was called for in last month’s forecast, but the above chart shows that the expected date for the downturn to start has moved earlier since the May forecast.

The full year forecast for GDP growth in 2022 is now back to no growth, up from a predicted drop of 0.1 percentage point of GDP in last month’s forecast. The full year GDP growth forecast for 2023 was revised downward by 0.1 percentage point to -0.6 percent. GDP growth in 2024 was predicted to be 2.0 percent.

Inflation forecast higher for longer

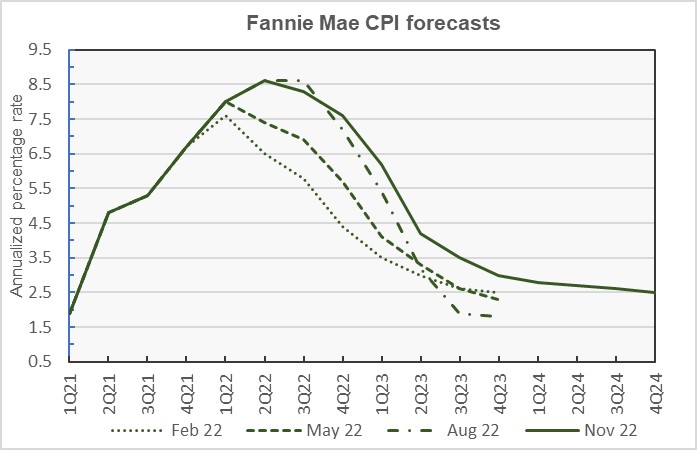

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

The rate of inflation predicted for every quarter of 2023 was revised higher in this month’s forecast and is now higher than was predicted for the same quarter in any previous forecast from Fannie Mae. While the October report of a drop in the rate of increase in the CPI in October could mean that peak inflation is now behind us, there have been false peaks before and only time will tell if the crest is now in the past.

The November forecast for year-over-year CPI growth in Q4 2022 was left unchanged at 7.6 percent. The year-over-year CPI forecast for Q4 2023 was revised upward from 2.5 percent to 3.0 percent, while that for Q4 2024 was predicted to be 2.5 percent.

Employment growth forecast lower

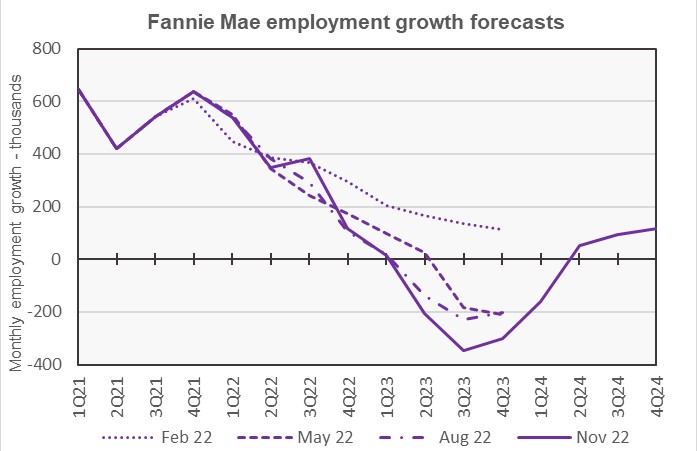

The next chart, below, shows Fannie Mae’s current forecast for the growth in employment, along with three other recent forecasts.

Revisions to the employment growth prediction in November’s forecast call for slightly more jobs to be created in late 2022 but for more jobs to be lost in late 2023. The net result is that Fannie Mae expects slightly more jobs in the economy by the end of 2023 that in last month’s forecast, but fewer than in any other prior forecast they have released.

The full year forecast for employment growth in 2022 was revised upward from 4.0 million jobs in last month’s forecast to 4.2 million jobs. The full-year employment growth forecast for 2023 was revised downward from a loss of 2.4 million jobs to a loss of 2.5 million jobs. The employment growth forecast for 2024 was for an increase of 300,000 jobs. For reference, the U.S. economy currently employs nearly 159 million people.

Commentary looks at renovations

The multifamily commentary this month looked at the history of apartment renovations over the past 2 years. It noted that, as the housing bubble inflated in the early years of this century, multifamily renovation-only projects were a relatively small portion of total multifamily construction projects. After 2011, renovation-only project’s share of total projects rose despite the total number of multifamily construction projects rising.

The commentary also looked at the number of renovations annually based on their dollar value. It divided them into renovations worth less than $1 million, renovations worth $1 million but less than $5 million and renovations worth $5 million or more. One pattern that emerges from the data is that the share of renovation projects with dollar values under $1 million undertaken in the first few years after the housing crash rose, mostly at the expense of the share of projects worth $5 million or more. However, the share of projects completed valued at $5 million or more peaked in 2017 but has been declining slowly since then.

Not surprisingly, higher dollar-value renovation projects tend to be for complexes with more units, on average.

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed forecasts and to the commentary.