Fannie Mae’s December economic and housing forecasts predict a larger decline in multifamily housing starts over the next two years than in earlier forecasts. The single-family housing starts forecast was revised higher for 2023 but lower for 2024.

Multifamily starts forecast declines

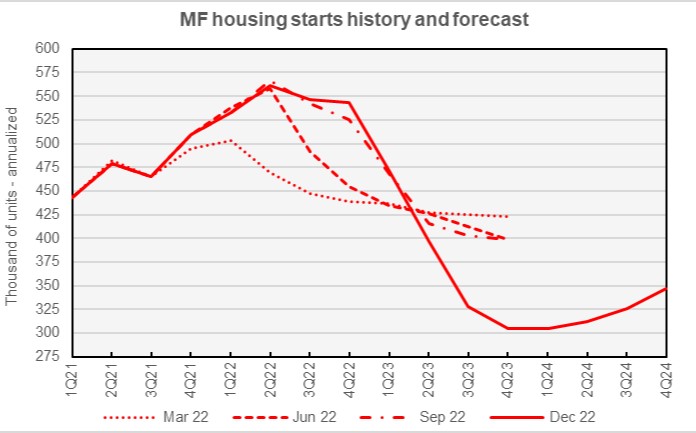

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The chart shows that multifamily housing starts in 2022 were much stronger than Fannie Mae’s forecasters had estimated early in the year. The March 2022 forecast had expected only 465,000 multifamily housing starts in 2022 while the December forecast is calling for 546,000 starts in the year. However, Fannie Mae’s outlook for 2023 has weakened since August as prospect for the Federal Reserve achieving a soft landing for the economy while taming inflation have dimmed.

Fannie Mae’s current forecast anticipates that the economy will not see negative GDP growth until Q1 2023, one quarter later than in their two most recent forecasts. Along with this revision, their forecast for when the downturn in multifamily housing starts will begin has also changed. The current forecast for starts in Q4 2022 is now at the highest level of any of their forecasts from this year at 543,000 starts at an annualized rate. By contrast, the forecasts for starts in Q3 2023 through Q4 2024 were all revised lower. The forecast for starts in Q4 2023 is now the lowest it has been in any of the forecasts released in 2022 at only 305,000 starts, annualized.

Fannie Mae now expects multifamily starts (2+ units per building) for 2022 to come in at 546,000 units, up 11,000 units from the level forecast last month. The forecast for multifamily starts in 2023 is now 376,000 units, down 2,000 units from the level forecast last month, and the forecast for 2024 is 322,000 units, down 34,000 units from last month’s forecast.

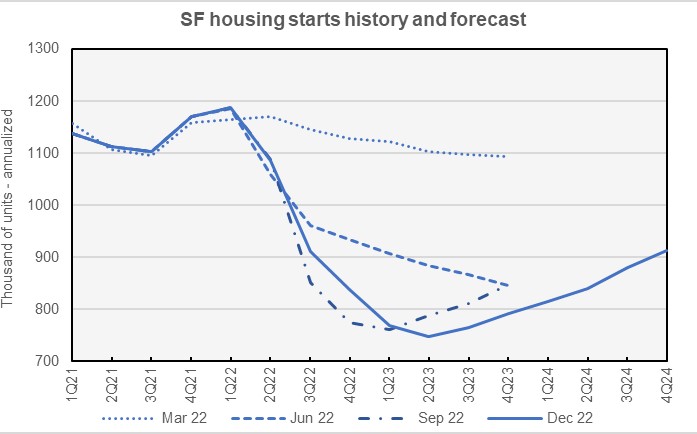

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Fannie Mae’s forecasters bumped up their predicted numbers for single-family starts in Q1 2023 through Q1 2024 in this month’s forecast. However, they revised their forecast for single-family starts lower for the last three quarters of 2024, so they expect the downturn in single-family housing starts to come on more gradually but to persist longer than they had previously thought. They now expect the low point in single-family housing starts to occur in Q2 2023 at a level of 748,000 units, annualized.

Fannie Mae expects single-family starts to be 1,006,000 units in 2022, down 4,000 units from the level forecast last month. However, Fannie Mae raised their forecast for single-family starts in 2023 by 10,000 units to a level of 769,000 units. Fannie Mae’s lowered their forecast for single-family starts in 2024 by 17,000 units to a level of 862,000 units.

GDP expected to fall in 2023

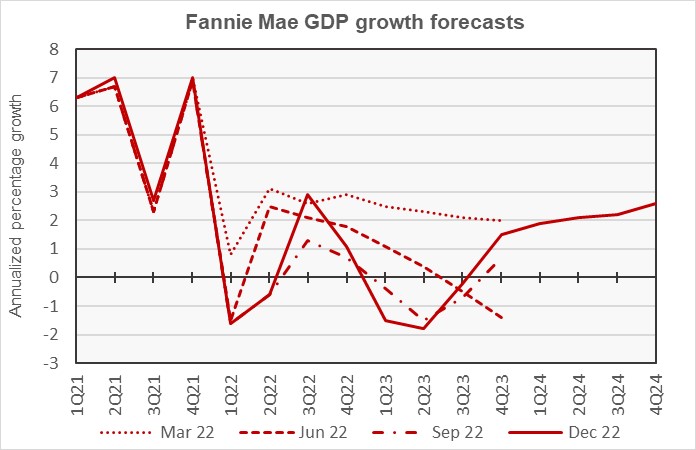

The next chart, below, shows Fannie Mae’s current forecast for the Gross Domestic Product (GDP) growth, along with three other recent forecasts.

The chart shows that the latest forecast calls for the downturn in GDP to begin in Q1 2023 and to persist for three quarters, although GDP growth is expected to be only marginally negative in Q3 2023.

The full year forecast for GDP growth in 2022 is now for growth of 0.4 percent, up from a forecast of no growth last month. The full year forecast for 2023 was revised upward by 0.1 percentage point to -0.5 percent. The full year forecast for 2024 was revised upward by 0.2 percentage points to 2.2 percent.

Inflation forecast lower

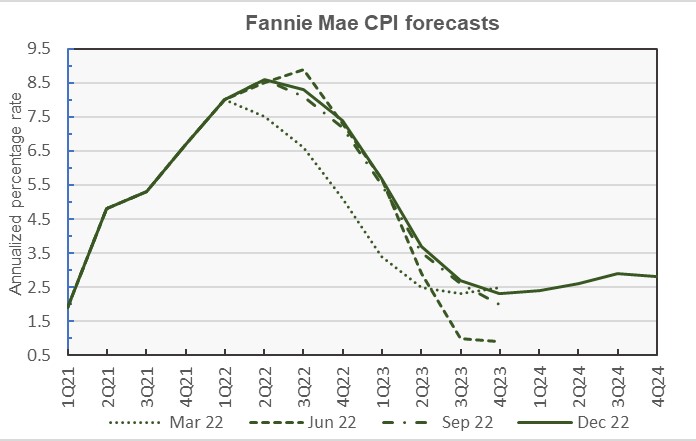

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Fannie Mae is now forecasting that peak inflation for this cycle occurred in Q2 2022. The rates of inflation predicted for every quarter from Q4 2022 through Q2 2024 were revised lower in this month’s report. Interestingly, Fannie Mae is now forecasting that inflation will move slightly higher in late 2024 and remain above the Federal Reserve’s 2.0 percent target.

The December forecast for year-over-year CPI growth in Q4 2022 was revised downward by 0.2 percentage points to 7.4 percent. The year-over-year CPI forecast for Q4 2023 was revised downward from 3.0 percent to 2.3 percent, while that for Q4 2024 was revised upward by 0.3 percentage points to 2.8 percent.

Employment growth forecast lower

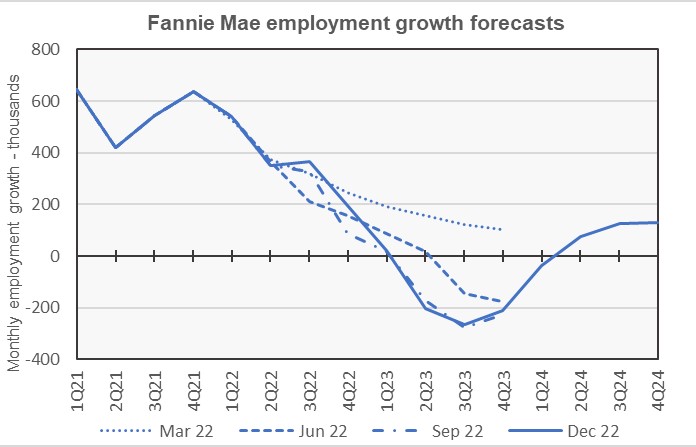

The next chart, below, shows Fannie Mae’s current forecast for the growth in employment, along with three other recent forecasts.

While the loss of jobs predicted in December’s forecast is worse than what was predicted in forecasts from early in the year, it is better than what was predicted in the Fannie Mae’s forecasts from October and November. Fannie Mae’s forecasters expect that employment will fall starting in Q1 2023 with losses continuing through Q1 2024. However, the level of losses predicted in the current forecast is smaller than in any other forecast since July.

The full year forecast for employment growth in 2022 was revised upward from 4.2 million jobs in last month’s forecast to 4.3 million jobs. The full-year employment forecast for 2023 was revised upward from a loss of 2.5 million jobs to a loss of 2.0 million jobs. The employment growth forecast for 2024 was revised upward from a gain of 300,000 jobs to a gain of 900,000 jobs. For reference, the U.S. economy currently employs 158 million people.

Commentary looks at senior housing demographics

The multifamily commentary this month looked at the aging of the U.S. population and the current construction trends for senior housing. It notes that the population of people aged 75 and older is expected to grow from 23.3 million people currently to 34.6 million by 2033 and to 46.9 million by 2046. As a portion of the U.S. population, the share of people 75 years old and older is expected to rise from 7 percent currently to 12.5 percent by 2046. In addition to the country-wide statistics, the commentary discussed where seniors are living now and how the growth in senior population is expected to vary by metro area.

The report also looks at current senior housing construction activity. By looking at the rate of growth in the senior population in a metro and comparing it to the current senior housing construction activity in that metro, the report projects which metros are underbuilding their stock of senior housing. Houston, San Antonio, Seattle and Denver lead the list.

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed forecasts and to the commentary.