Two reports from Trepp show small improvements in the multifamily CMBS market with declines in both the CMBS delinquency rate and the special servicing rate.

CBMS delinquency rate unchanged overall

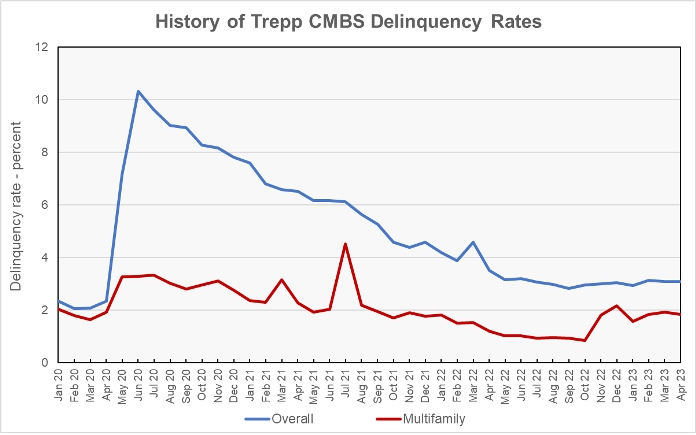

One monthly Trepp report focuses on the portion of the loans that are 30 or more days delinquent. The current report provides data through April 2023. It only looks at CMBS loans but breaks out results by the type of property covered by the loans.

Trepp found that the overall delinquency rate of CMBS loans in April was 3.09 percent. This matches last month’s level as property types with improving delinquency rates were offset by property types with degrading delinquency rates.

The delinquency rate on loans on multifamily property was 1.83 percent, down from 1.91 percent in March but nearly unchanged from the 1.83 percent rate reported for February. One year ago, the delinquency rate on CMBS loans for multifamily property was 1.20 percent.

The other property types whose CMBS loan delinquencies were examined were industrial, lodging, office and retail. Delinquency rates for retail and lodging both improved slightly for the month while rates for industrial and office rose slightly. Lodging CMBS delinquencies fell from 4.41 percent to 4.23 percent. CMBS loans on retail properties again had the highest delinquency rate in April at 6.11 percent, but this was down from the 6.23 percent rate reported for March. Delinquencies on CMBS loans for office properties rose to 2.77 percent, up from 2.61 percent in March. Industrial CMBS delinquencies rose to 0.40 percent from 0.37 percent, reversing last month’s change.

The history of the overall and multifamily CMBS delinquency rates as reported by Trepp since January 2020 is illustrated in the chart, below.

CMBS special servicing rates edge higher

Trepp also issued a report on special servicing rates in April for CMBS loans. It found that overall special servicing rates rose to 5.62 percent, up from 5.55 percent the month before.

Special servicing rates on CMBS loans on multifamily property fell marginally to 3.01 percent in April from the 3.04 percent rate reported for March. One year ago, this rate was 1.49 percent.

Special servicing rates on CMBS loans on industrial properties were unchanged from last month at 0.39 percent while rates on retail properties fell 68 basis points to 10.89 percent. Rates on lodging properties rose 16 basis points to 6.47 percent while rates on office properties rose 62 basis points to 5.39 percent.

The full Trepp delinquency report can be found here while the Trepp report on special servicing rates can be found here.