The National Association of Homebuilders (NAHB) has introduced a pair of new indexes assessing sentiment within the multifamily industry. These new indexes are a redesigned version of NAHB’s Multifamily Market Survey.

Creating the scale

The surveys ask respondents to rate conditions as poor, fair or good. A balance of poor and good ratings would result in a rating value of 50 on a 100-point scale. Ratings above 50 indicate that more respondents found market conditions to be good than poor. Ratings below 50 indicate that more respondents found market conditions to be poor.

Relating results

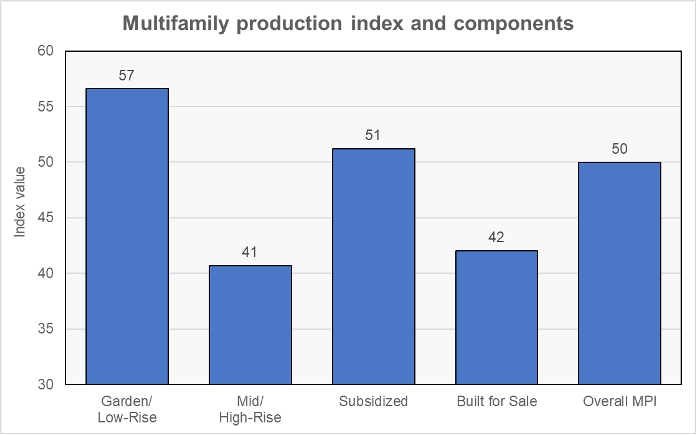

The first index is called the Multifamily Production Index (MPI). It assesses sentiment regarding conditions for production of multifamily housing based on starts. Respondents rate conditions for each of 4 sub-markets: garden/low rise, mid/high-rise, subsidized and built for sale multifamily housing. A weighted average of the 4 subindexes is used to create the overall MPI. The Q1 2023 results are illustrated in the following chart.

Respondents judged conditions to be mildly positive for garden/low-rise apartments commonly found in the suburbs. They judged conditions to be mildly negative for mid/high-rise apartments more commonly found in big cities and for for-sale multifamily (condos). They judged conditions to be nearly neutral for subsidized multifamily housing.

Overall market conditions are felt to be neutral with good and poor ratings balancing each other out.

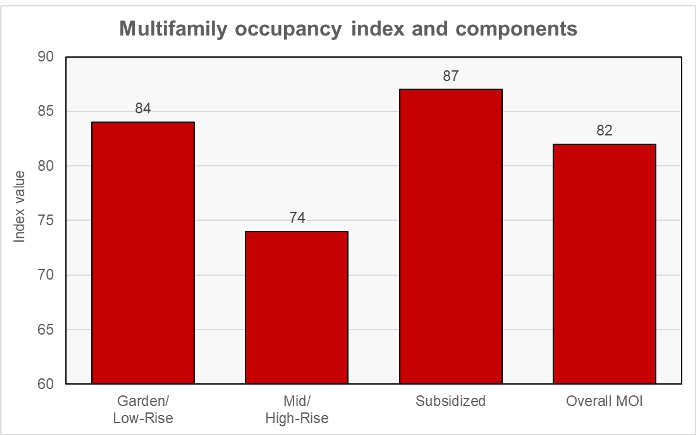

The second index is called the Multifamily Occupancy Index. It focuses on rental housing and assesses sentiment around occupancy. In this index, respondents rate conditions for each of 3 sub-markets: garden/low rise, mid/high-rise and subsidized. As before, the 3 sub-indexes are reported individually, and an overall index is calculated. The results are shown in the next chart.

Respondents judged occupancy conditions to be very positive for all three sub-markets, although they assessed conditions for mid/high-rise properties to be somewhat less positive. These results are consistent with other reports that indicate that multifamily housing recently experienced a period of very high occupancy rates.

Bonus questions

This quarter, NAHB also asked respondents about the availability of loans on multifamily property. Fully 35 percent of respondents said that recent bank failures and financial market stress had made a major increase in the difficulty of obtaining financing. Another 42 percent said that market stress had made obtaining financing more difficult to a minor extent. Only 5 percent of respondents said that loans are not any more difficult to obtain than in the past, with the balance of respondents not expressing an opinion.

The survey also asked respondents to rate the difficulty of obtaining multifamily financing compared to that of obtaining financing on single-family projects. Three times as many respondents, 36 percent to 11 percent, said that financing of multifamily projects was more difficult to obtain.

The NAHB survey is available here.