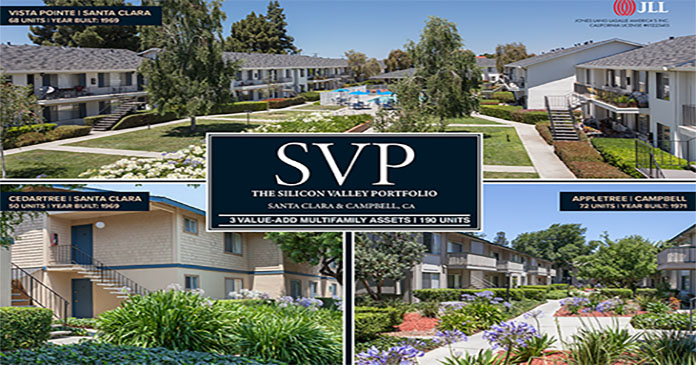

JLL Capital Markets announced that it closed on the sales of three value-add, garden-style multihousing assets in Silicon Valley, including the 72-unit Appletree in Campbell, California, the 68-unit Vista Pointe and 50-unit Cedartree in Santa Clara, California, for a total of approximately $70 million.

JLL worked on behalf of the private seller and procured three unique buyers for the portfolio.

The portfolio contains a desirable unit mix with 37 percent one-bedroom units that average 731 square feet and 63 percent two-bedroom units that average 1,004 square feet. Each of the three assets present the opportunity for value-add renovations, with increased rent potential.

The three assets are within a seven-mile radius of each other and are situated near US 101, I-880 and I-280, providing immediate access to the entire Bay Area. Residents of the portfolio will also enjoy access to the continually expanding public transit system of the Bay Area, including Cal-train, the most accessible form of public transportation.

The JLL Capital Markets Investment Sales and Advisory team representing the seller was led by Senior Managing Directors Ryan Wagner, Brandon Geraldo and Matt Kroger.

“Amidst market fluctuations and choppy debt markets, our extensive process proved that well-priced and high-quality multihousing assets still have a large investor audience with ample liquidity,” according to Ryan Wagner. “Institutional core funds are still waiting for more data points to emerge to become more active, while middle-market and private-equity investors have been the most active players in the last six to nine months.”

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients—whether investment sales and advisory, debt advisory, equity advisory or a recapitalization. The firm has more than 3,000 Capital Markets specialists worldwide with offices in nearly 50 countries.