The Federal Open Market Committee (FOMC) met this week and decided to keep interest rates unchanged. However, the Federal Reserve’s updated forecasts for key economic metrics indicated that higher interest rates may be coming than they had projected at the last meeting.

The FOMC meets 8 times per year but only releases an economic forecast at 4 of the meetings. The Fed forecast presents estimates for economic metrics by year, now through 2025, and a “longer run” forecast which reflects their view of the output of the economy if operating at equilibrium. The consensus Fed forecast is developed by the combining the forecasts of 18 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast, although their individual ideas of what that policy is may vary.

Interest rates unchanged but increases may be coming

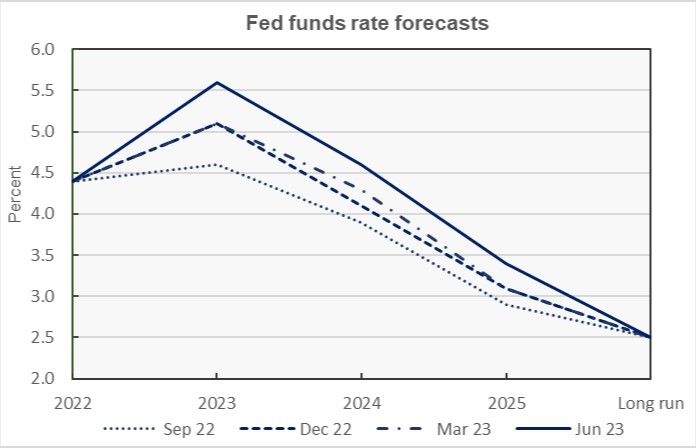

The headline news coming out of the recent FOMC meeting was their decision to keep interest rates unchanged for now. However, they raised their estimate of the appropriate Federal Funds interest rate for year-end 2023 by 0.5 points to 5.6 percent. This is a signal that the Fed may not be done raising interest rates this year, but the timing of any future rate increases is unclear.

The Fed now predicts that the appropriate Federal Funds rate for 2024 will be 4.6 percent, up 0.3 percentage points from their last projection. Their prediction of the appropriate Federal Funds rate for 2025 is now 3.4 percent, also up 0.3 percentage points from their last projection.

A history of the forecasts for the federal funds rate is given in the first chart, below.

GDP: 2023 outlook improves

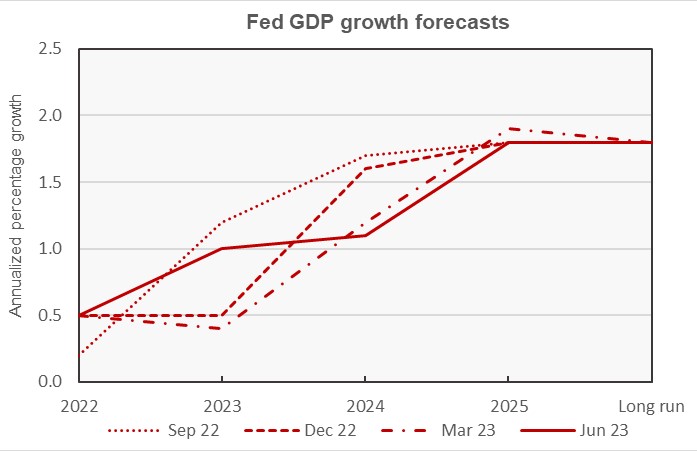

The Fed’s current forecast for GDP growth in 2023 was raised to 1.0 percent, up from the 0.4 percent they forecast in March. However. the Fed lowered its 2024 GDP forecast slightly from the 1.2 percent predicted in their March forecast to 1.1 percent. The Fed also made a 0.1 percentage point reduction to their GDP forecast for 2025, bringing it to a forecast rate of 1.8 percent.

Given that the Fed does not release quarterly estimates of GDP growth, it is unclear whether they foresee a recession occurring in their forecast horizon.

Recent Fed GDP forecasts are illustrated in the next chart, below.

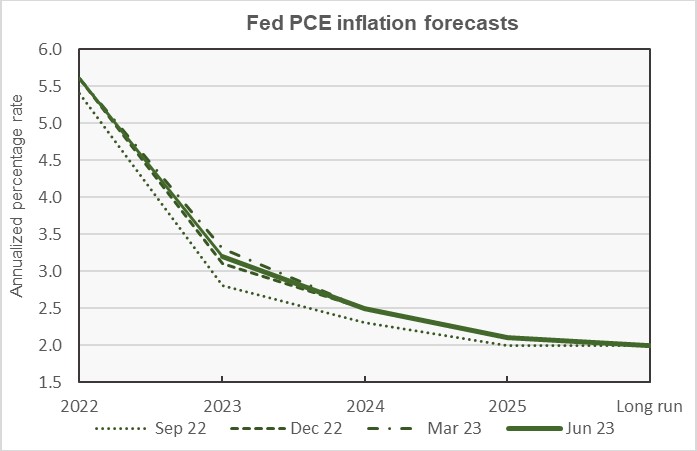

Inflation outlook nearly unchanged

The Federal Reserve’s preferred inflation measure is based on the Personal Consumption Expenditures (PCE) survey, rather than the more familiar Consumer Price Index (CPI). The Fed now expects year-end PCE inflation in 2023 to come in at 3.2 percent, down marginally from their March forecast of 3.3 percent. PCE inflation forecasts for 2024 and 2025 were left unchanged at 2.5 percent and 2.1 percent respectively. The Federal Reserve’s target for PCE inflation is 2.0 percent.

The history of the Fed’s recent PCE inflation forecasts is shown in the next chart.

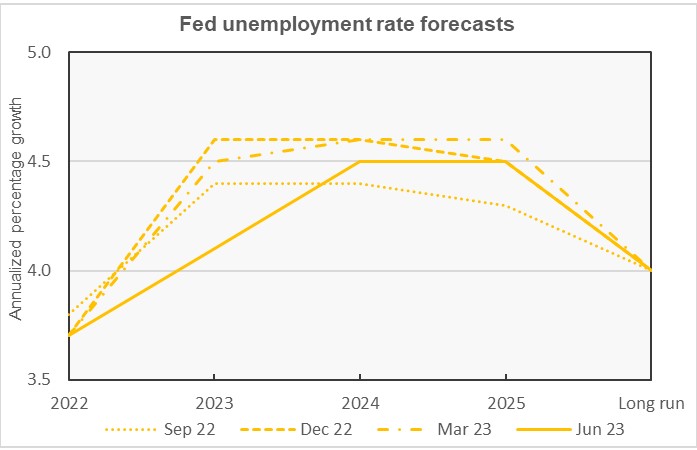

Unemployment forecasts to be lower

The current Q4 2023 unemployment rate is forecast to be 4.1 percent, down 0.4 percentage points from the March forecast. The Fed forecasts that the Q4 unemployment rate will rise to 4.5 percent in 2024 and remain at that level in 2025. Both values are up 0.1 percentage points from their last forecast.

The history of the Fed’s recent unemployment rate forecasts is shown in the next chart.

The next updates to the Federal Reserve’s forecasts for the economy will come after the September 2023 FOMC meeting.