CoreLogic reported that their single-family rent index (SFRI) for May rose 3.4 percent from its year-earlier level. This is down from the 3.7 percent year-over-year SFRI growth reported last month. The year-over-year SFRI growth rate has now declined in 13 straight reports.

The long view

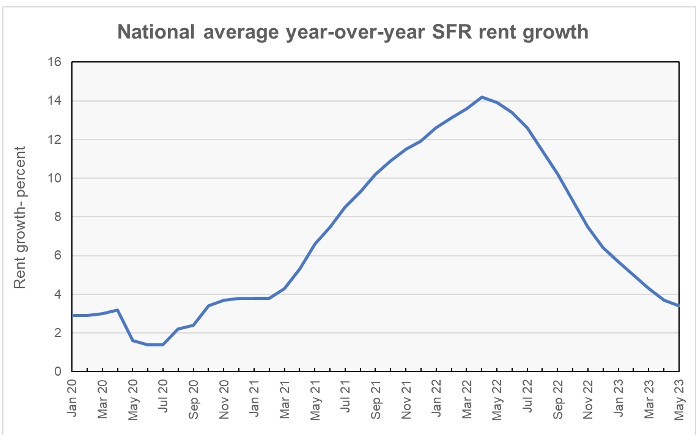

The recent history of the overall SFRI is shown in the first chart, below.

The chart shows that the rate of growth in single-family rents was about 2.9 percent in the months leading up to the COVID pandemic. The recent decline in the rate of growth of the SFRI has brought it down to be close to the pre-pandemic rate.

For comparison, Yardi Matrix found that single-family rent growth in May was 2.1 percent. However, Yardi Matrix focuses on properties of 50 or more units while CoreLogic takes a broader look at the single-family rental market.

Price tiers behave differently

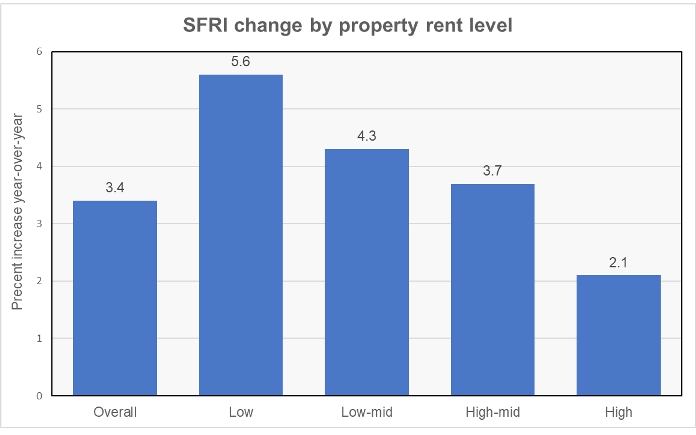

In addition to the overall SFRI, CoreLogic calculates rent growth by the relative asking rent for the properties it covers. It divides the properties into 4 groups: those priced at 75 percent or less than the regional median (Low), those priced at 75 to 100 percent of regional median (Low-mid), those priced at 100 to 125 percent of regional median (High-mid) and those priced above 125 percent of regional median. The results for May 2023 are shown in the next chart, below.

The chart shows that rent growth is higher for lower priced properties with the rate of rent growth for the lowest-priced tier of properties being over twice that of the highest-priced tier.

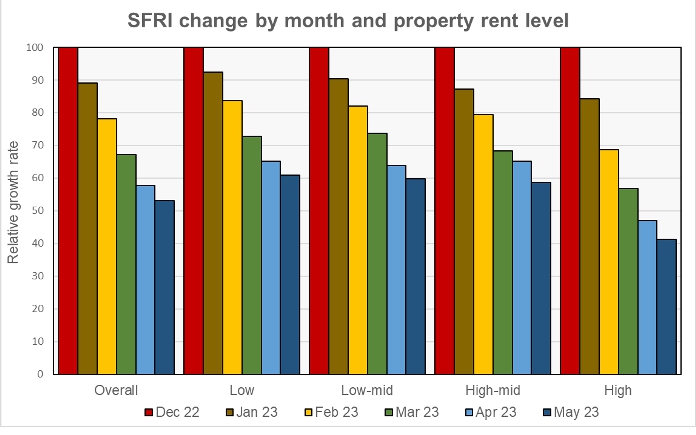

The last chart shows the relative rate of decline in rent growth over the last 6 months by rent level. Each cluster of bars shows the ratio of the rates of rent growth measured for that property rent level for the last 6 months compared to its level 6 months ago. It shows that the 6-month decline in the rates of rent growth for the low, low-mid and high-mid property rent levels are all between 39 and 41 percent. However, the relative decline in the rate of rent growth for the high-rent level properties over the last 6 months is significantly greater at 59 percent.

Looking at metros

CoreLogic reports the year-over-year rate of growth in the SFRI for a select group of metropolitan areas. Chicago displaced Charlotte at the top of the list this month with rent growth of 6.6 percent. Charlotte dropped to second place with rent growth of 5.9 percent. Boston (5.7 percent), New York (5.7 percent) and Orlando (5.7 percent) and round out the top 5 metros. At the other end of the scale are Las Vegas (-1.3 percent) and Phoenix (0.6 percent). Las Vegas was the only one of the 20 listed metros to see single-family rents fall year-over-year this month.

CoreLogic is a data and analytics company. It calculates the SFRI using “a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service.” The CoreLogic report is available here.