The lack of affordable insurance options for property owners of all types increasingly puts needed insurance coverage out of reach and limits the ability of property owners to make needed investments in their properties.

As a result, this stressed insurance market, stubborn inflationary pressures, and rising interest rates have disrupted transactions and negatively impacted valuations.

In turn, “this harms the industry’s ability to attract the investments required to meet the nation’s housing needs and help address its housing affordability crisis,” according to the 2023 State of Multifamily Risk Survey and Report, issued in June based on a survey of National Multifamily Housing Council members.

Property insurance costs have risen 26 percent on average for respondents over the past year, according to the report.

Notably, this 2023 survey had a higher response rate than all prior NMHC insurance surveys, indicating that the industry views these challenges as serious, NMHC said.

CoreLogic’s 2023 Hurricane Risk Report said there is a potential danger for 33 million U.S. homes, with $11.6 trillion total reconstruction cost at risk this hurricane season, GlobeSt.com reported.

Insurance prices have been volatile and costly for years, and those challenges have seemingly come to a head, as owners, operators, and developers of all types of multifamily rental housing have been hit particularly hard, as all lines of insurance costs (e.g., property, liability and cyber) have risen dramatically.

“Additionally, coverage limitations, deductible increases and, in some cases, the absence of an affordable or viable private insurance market altogether have increased the financial risk borne by housing providers directly and strained property operations,” NMHC said.

Vacating some markets altogether

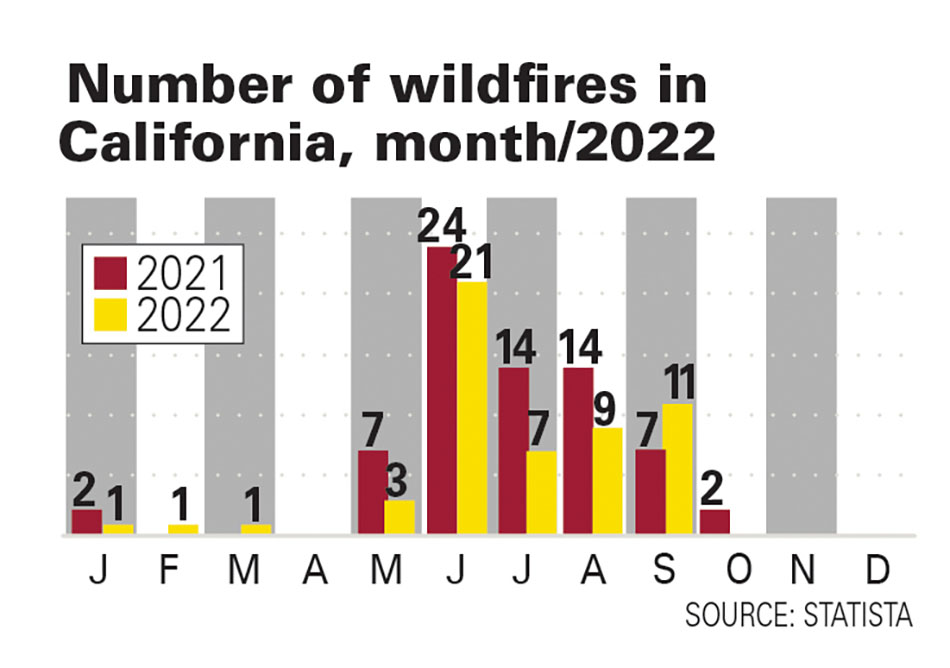

State Farm has announced it is no longer accepting accept new applications for property and casualty coverage in California, citing growing “catastrophe exposure” in the Golden State, which has averaged 7,000 wildfires encompassing more than 2 million acres in each of the past five years, GlobeSt.com reported.

In the past three years, 61 percent of the NMHC respondents had to increase their deductibles to maintain affordability, with property coverage being the most affected line at 84 percent.

Additionally, the report found that 57 percent of the respondents indicated that their insurance carriers included new policy limitations to reduce their exposure, with property coverage again being the most affected line (73 percent). Furthermore, 34 percent reported that their insurance carriers limited, or reduced coverage amounts, with property coverage again being the most affected line (73 percent).

The Council of Insurance Agents & Brokers reports that the average increase in commercial property premiums spiked to 20.4 percent in Q1, which is the first time since 2001 that this line recorded an increase higher than 20 percent.

According to a Swiss Re report on natural catastrophes and inflation, insured losses in 2022 were well above the 10-year average, with $132 billion in total insured losses and $125 billion in natural catastrophe insured losses.

As of Q1, there have been 22 consecutive quarters of property insurance rate increases. According to Marsh’s May 2023 market update, Q1 2023 rate increases trended near 15 percent plus additional building cost increases (+10 percent average), culminating in +25 percent premium increases.

No improvement on the horizon

All signs suggest that renewals in Q2 and the remainder of 2023 will likely be the same or worse.

The situation has greatly impacted carrier appetite and capacity viability. Insurance carriers are scrutinizing portfolio values when reviewing submissions and providing a quote. This is in response to rising materials and labor costs and recent claims where buildings were undervalued compared to the amount claimed by the insured.

Certain carriers have been restricted to either not providing quotes if a portfolio’s dollars-per-sq.-ft. estimate is too low or manually inflating clients’ portfolio values and assigning pricing of an increased portfolio value set.

“If a firm’s values are not up to a standard accepted in the marketplace, carriers may restrict capacity and impose coverage limitations on policies that will impact recovery in the event of a severe casualty,” according to NMHC’s report.

Source Richard Berger, globest.com