Fannie Mae’s October economic and housing forecast predicts lower multifamily starts in both 2023 and 2024 than called for in last month’s forecast.

Multifamily starts predicted lower

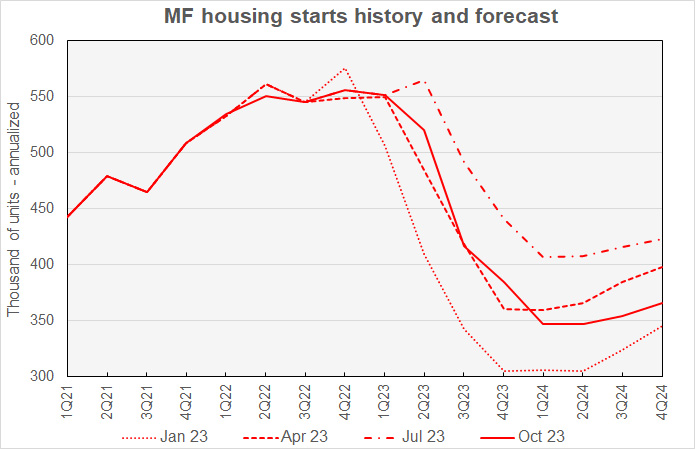

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

In July, Fannie Mae’s forecasters’ optimism about the production of multifamily housing hit a recent high. Since then, revisions to their forecast for multifamily starts have been trending lower. That was again the case in October, with Fannie Mae’s quarterly forecasts being revised lower for every upcoming quarter in their forecast window. As in last month’s forecast, factors cited as weighing on multifamily starts include slower rent growth, rising vacancies and tighter lending standards.

Compared to last month’s forecast, the predicted number of multifamily starts in 2023 was revised lower by 31,000 units to 468,000 units. The predicted number of multifamily starts for 2024 was revised lower by 36,000 units to 353,000 units.

While down from the mid-year levels, the current multifamily starts forecast is for more starts than was projected at the beginning of 2023 as the forecasters’ outlook for the economy has improved. The recent improvement in outlook is partly because the standard metrics for the economy (GDP, unemployment rate, etc.) have been coming in stronger than anticipated throughout the first three quarters of the year. In addition, a recent 10-year update to the National Income and Product Accounts by the Bureau of Economic Analysis also paints a brighter picture for the economy than did these data before the revision. However, in the current forecast, these improvements showed up more in other metrics than multifamily starts.

Single-family starts numbers edge higher

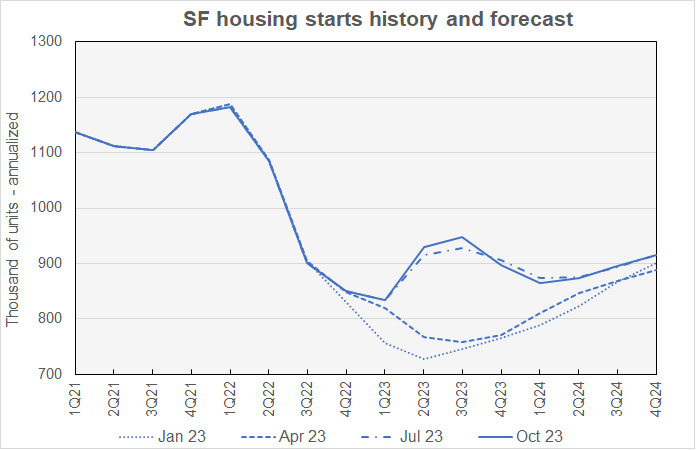

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

For most of 2023, Fannie Mae’s forecasters have been raising their predicted numbers for single-family starts as rising interest rates have not impacted single-family housing construction as much as expected. However, the October forecast reduces the predicted number of single-family starts from Q3 2023 through the end of 2024. The largest reduction was in Q1 2024, where the annualized forecast was reduced by 42,000 units, or 4.4 percent. That quarter represents the next low point in single-family starts at a level of 864,000 annualized units.

Fannie Mae now expects single-family starts to be 902,000 units in 2023, down 12,000 units from the level forecast last month. Fannie Mae now expects single-family starts to be 997,000 units in 2024, down 23,000 units from the level forecast last month.

GDP growth forecast revised upward

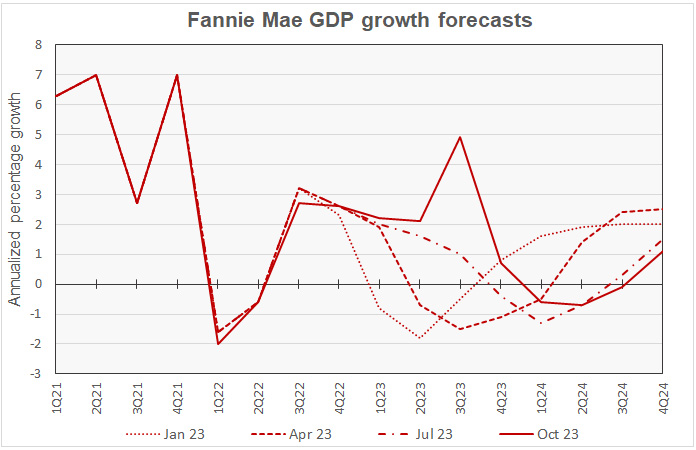

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

The most striking change in this month’s GDP forecast is the raising of the predicted year-over-year GDP growth for Q3 2023 to 4.9 percent. The April forecast for GDP growth for Q3 was negative 1.5 percent, but that quarter’s growth was revised upward in every subsequent forecast. From that blistering Q3 growth, Fannie Mae’s forecast calls for GDP to be shrinking two quarters later in Q1 2024, a remarkable turnaround.

As in last month’s forecast, Fannie Mae is calling for the economy to shrink in Q1 2024 through Q3 2024, with growth returning to positive 1.1 percent in Q4. However, the depth of the downturn is predicted to be smaller than was called for in last month’s forecast and the speed of the recovery is predicted to be faster. This is partly attributed to the revisions to the economic data discussed above.

The full year forecast for GDP growth for 2023 was revised upward by 0.3 percentage points to 2.5 percent. The full year GDP forecast for 2024 was revised upward by 0.1 percentage point to -0.1 percent.

Inflation forecast revised lower

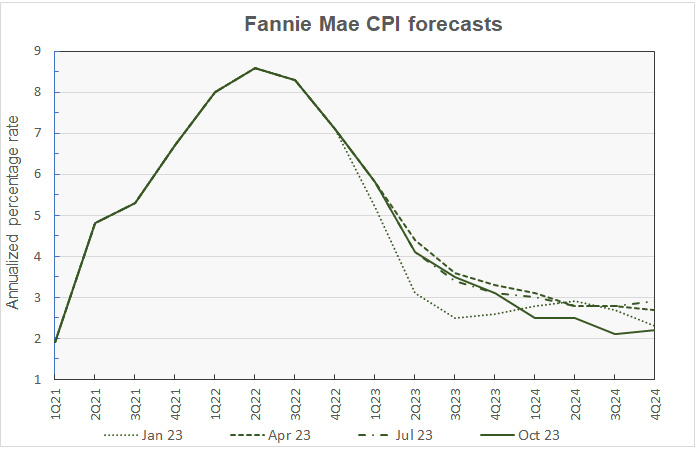

The next chart, below, shows Fannie Mae’s current forecast for inflation as measured by the Consumer Price Index (CPI), along with three other recent forecasts.

Fannie Mae’s forecasters revised their inflation forecast for Q3 2023 lower by 0.1 percentage point to 3.5 percent. This was the only change to their 2023 quarterly forecasts. However, their inflation forecasts for every quarter of 2024 were revised lower by 0.1 to 0.2 percentage points. They forecast inflation to fall to 2.1 percent year-over-year in Q3 2024 but to rise to 2.2 percent in Q4.

Looking at whole-year forecasts, the forecast for year-over-year CPI growth in Q4 2023 left unchanged from last month’s forecast level at 3.1 percent. The Q4 2024 year-over-year inflation forecast was revised downward by 0.2 percentage point to 2.2 percent.

Slower job growth declines foreseen

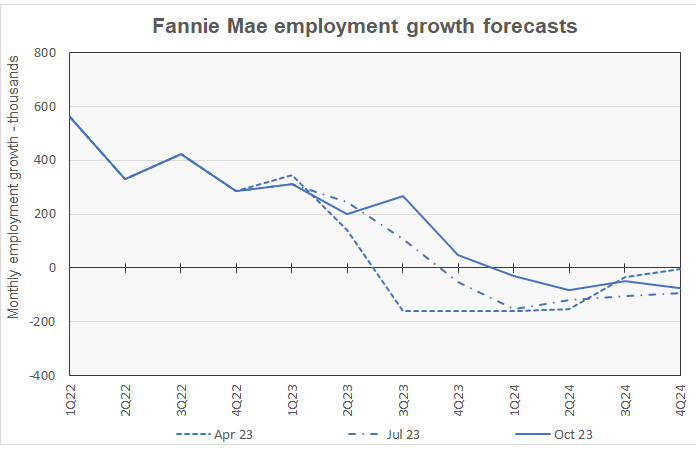

The next chart, below, shows Fannie Mae’s current forecast for employment growth, along with two earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth.

Fannie Mae revised the population base used for their forecasts in February 2023, so that is the earliest forecast whose employment numbers can be compared to those in the current forecast.

Revisions to Fannie Mae’s forecast for job growth in 2023 are similar to those made to the GDP forecast. Job growth was revised upward for Q3 2023. While job losses are still predicted for Q1 2024, the size of the forecast job losses in that quarter and throughout the year are smaller than those called for in other recent forecasts.

Compared to last month’s forecast, the expected full year forecast for employment growth in 2023 was revised upward from a gain of 2.3 million jobs to a gain of 2.5 million jobs. The employment growth forecast for 2024 was revised from a loss of 1.0 million jobs to a loss of 700,000 jobs.

The Fannie Mae forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.