Fannie Mae’s November economic and housing forecast still predicts that GDP growth will turn negative, but not until later than in their prior forecasts.

With the November forecast, Fannie Mae’s forecasters are now providing estimates for key economic metrics through 2025, one year later than before.

Multifamily starts about the same

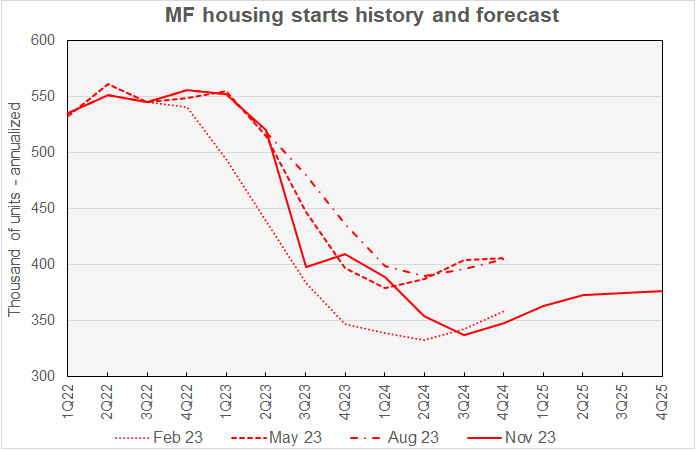

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

While the latest forecast makes only small changes in the yearly multifamily starts numbers, the quarterly number of starts saw more significant revisions compared to last month’s projections. The Q3 2023 starts estimate was revised lower by 19,000, the Q4 2023 through Q2 2024 estimates were revised higher by an average of 25,000 units and the Q3 and Q4 2024 estimates were revised lower by 17,000 units and 18,000 units respectively. The quarterly estimates for multifamily starts in 2025 show the number of starts increasing slowly throughout the year, reaching 377,000 annualized units by the end of the year. This is well below the rates seen in recent years.

Compared to last month’s forecast, the predicted number of multifamily starts in 2023 was revised higher by 2,000 units to 470,000 units. The predicted number of multifamily starts for 2024 was revised higher by 4,000 units to 357,000 units. The inaugural forecast for multifamily starts in 2023 was 372,000.

Single-family starts shift earlier

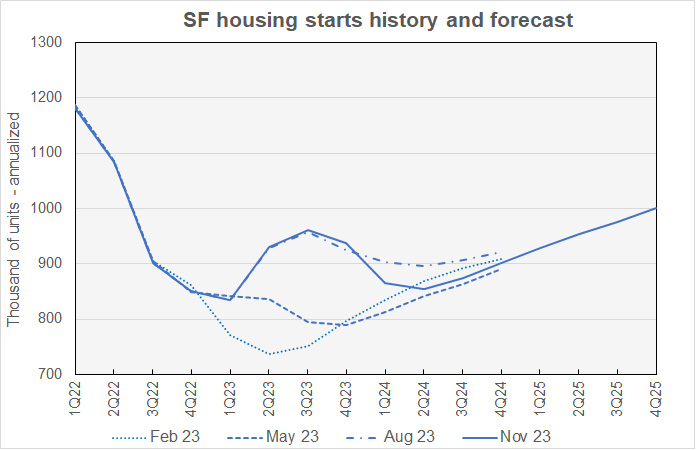

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

In the November forecast, Fannie Mae’s forecasters raised their forecast for Q4 2023 single-family starts, basically reversing last month’s revision. They also lowered their starts forecast for the last 3 quarters of 2024. Starts forecast for these quarters are now the lowest they have been since the June forecast.

Fannie Mae now expects single-family starts to be 916,000 units in 2023, up 14,000 units from the level forecast last month. Fannie Mae now expects single-family starts to be 874,000 units in 2024, down 7,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 965,000 units.

2024 expected to be a down year for GDP growth

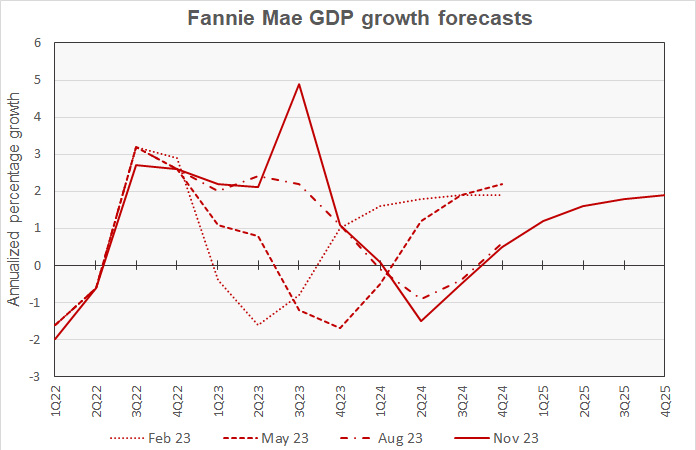

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

Fannie Mae’s forecasters have been predicting that the U.S. economy would slip into recession since their April 2022 forecast, although the expected timing of the recession has changed from forecast to forecast. Despite some economists suggesting that the Federal Reserve may pull off the difficult feat of guiding the economy to a soft landing, Fannie Mae’s latest forecast still projects a recession. It is now expected to come slightly later than forecast last month, with the first quarter of negative GDP growth being Q2 2024. Fannie Mae is calling for the economy to shrink in Q2 and Q3 2024 with growth returning in Q4.

The full year forecast for GDP growth for 2023 was revised upward by 0.1 percentage points to 2.6 percent. The full year GDP forecast for 2024 was revised downward by 0.3 percentage point to -0.4 percent. The GDP growth forecast for 2025 was 1.6 percent.

Inflation forecast to revive in 2025

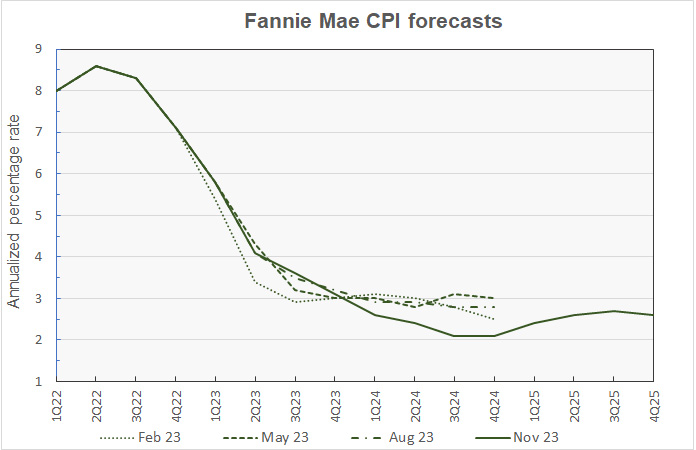

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Fannie Mae’s quarterly inflation forecasts were only tweaked slightly this month, with no quarterly revision of more than 0.1 percentage point. While, the forecast calls for inflation to fall to near 2 percent by the end of 2024, it also calls for CPI inflation to rise again in 2025.

Looking at whole-year forecasts, the forecast for year-over-year CPI growth in Q4 2023 was left unchanged from last month’s forecast level at 3.1 percent. The Q4 2024 year-over-year inflation forecast was revised downward by 0.1 percentage point to 2.1 percent. The Q4 2025 year-over-year CPI change is expected to be 2.6 percent.

Higher job losses expected in 2024

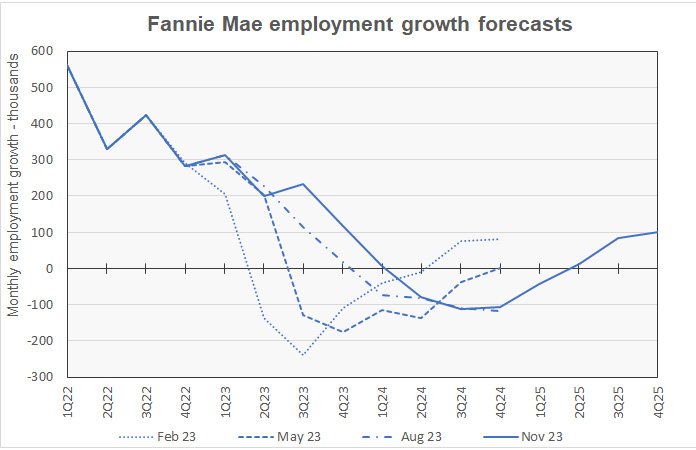

The next chart, below, shows Fannie Mae’s current forecast for the employment growth, along with two earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth.

The revisions to Fannie Mae’s forecast for job growth are consistent with a slightly later economic downturn. Employment growth is not expected to turn negative until one quarter later than called for in the last forecast, in Q2 2024.

Compared to last month’s forecast, the expected full year forecast for employment growth in 2023 was revised upward from a gain of 2.5 million jobs to a gain of 2.6 million jobs. The employment growth forecast for 2024 was revised from a loss of 700,000 jobs to a loss of 900,000 jobs. The economy is predicted to gain 500,000 jobs in 2025.

The Fannie Mae forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.