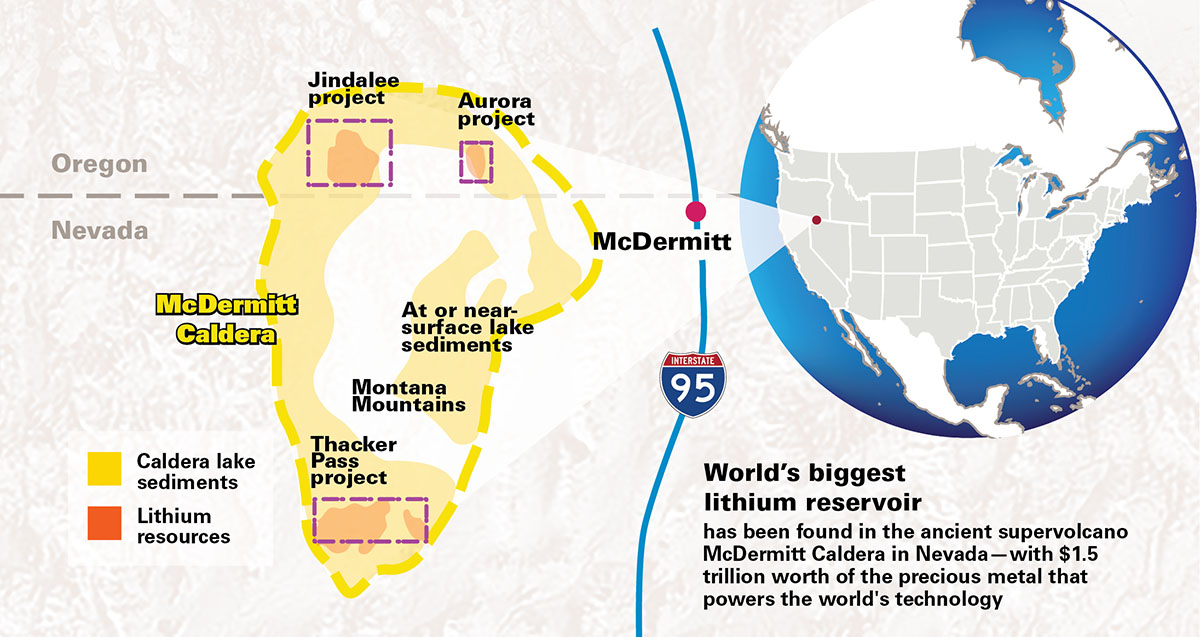

A new discovery of lithium in September led to a flurry of headlines touting the finding as one of the biggest lithium deposits in history. The discovery comes amid fears that a shift towards electric vehicles would exhaust too much of the world’s supply of lithium—an important component in batteries.

Fear about the availability of lithium is only the latest doom and gloom prediction about humanity’s access to resources. Throughout the 20th century, experts predicted that we would run out of food, land, and oil among other things. Consider for example the history of “peak oil” predictions in the U.S.

As the timeline above shows, we’ve been on our last 13 years of oil for 84 years now.

Why are predictions about resource availability so biased in the direction of doom and gloom? To see why, we need to turn to one of my favorite economists—Julian Simon.

The failure of technical forecasts

Over the course of your life, you’ve probably heard that we’re “running out” of a particular resource. In fact, sometimes experts even boldly make predictions about how we have a specific number of years left before we run out. Where does this information come from?

Well, technical forecasts of resource availability rely on two factors: the quantity of a resource available and the rate of consumption.

For example, if a community only has 100 gallons of oil, and they use 10 gallons per day in their cars, the oil will only last 10 days.

PAIUTE, SHOSHONE AND BANNOCK NATIVE AMERICANS ARE PUSHING BACK ON MINING. THE TRIBES SAID THERE ARE 91 SIGNIFICANT CULTURAL SITES IN THE AREA CALLING THE WORK GREEN COLONIALISM.

In the late Julian Simon’s book, The Ultimate Resource 2, he highlights that this approach is fundamentally flawed. The problem is that experts don’t have access to either the physical quantity of a resource available or the future rate of consumption for resources.

To substitute for this, technical forecasts use the data that are available. The problem is, those data always underestimate the availability of resources.

One such data point used to figure out the amount of resources available is known reserves. That is, the amount of a resource that we know exists. The problem with this can be seen by considering incentives.

A significant amount of known reserves are discovered by private businesses searching for more of a scarce resource. If you are a lithium mining company with 10 years of supply on hand, there is no need to seek out more. Businesses will only spend to search for new deposits as long as the benefits from discovery are greater than the costs.

However, as supplies start to run short, prices for raw materials rise. When the price of a resource rises, the benefits to discovering more of the resource rises. As a result, businesses will begin to search for new reserves when they start to run out.

In practice, this means estimates on resource availability will always appear to stay barely ahead of short-term consumption needs. Since businesses only look for more of a resource when the known reserves start to run out, the known reserves will always appear to be running out, even though total reserves (known + unknown) are likely not.

Substitutes in everything

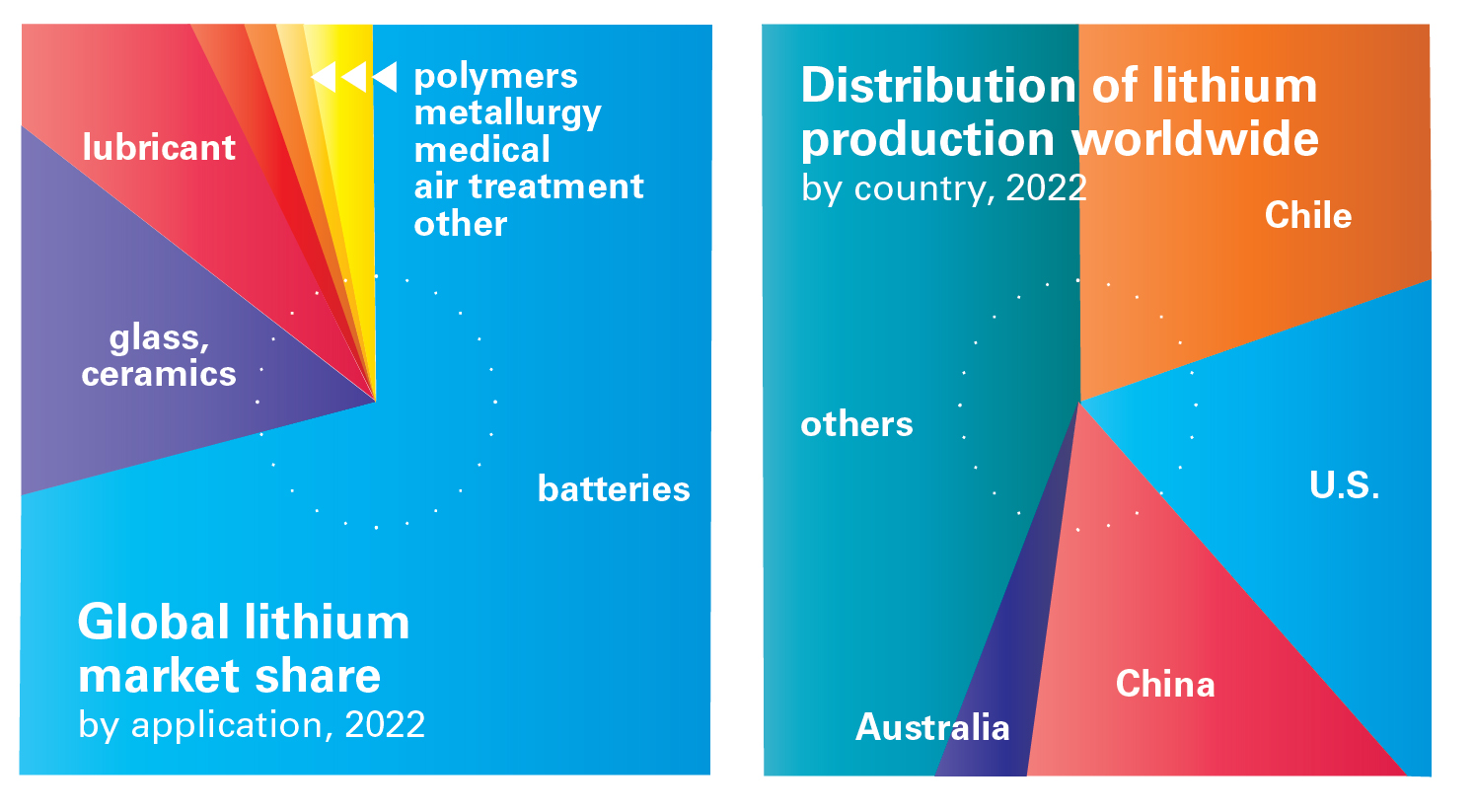

The other factor, the consumption rate, has a similar problem. As resources become more scarce, prices rise, which forces consumers to economize. For example, when gas is more expensive, people buy less gas. When consumers cut back their consumption of resources like gas they try to find substitute goods. Someone may choose to bike to work or finally spend the time to figure out the public transit paths.

Meanwhile, companies try to innovate and create new products which solve consumers’ problems. These innovations often replace the original desire for the increasingly scarce resource. For example, Zoom, in many cases, has replaced the use of gasoline.

So as we run out of a particular resource, we should expect consumers will consume less of it. As such, technical forecasts will always assume consumers will over-consume relative to reality.

So large discoveries of lithium should be no surprise. As demand increases, I expect the known reserves to continue to increase. And even as lithium reserves do begin to diminish, the profit motive strengthened by increasing prices will drive self-interested businesses to create clever new substitutes. I’ll conclude with Simon’s brilliant illustration of this tendency.

“People’s response to the long trend of falling raw-material prices often resembles this parody: We look at a tub of water and mark the water level. We assert that the quantity of water in the tub is ‘finite.’ Then we observe people dipping water out of the tub into buckets and taking them away.

Yet when we re-examine the tub, lo and behold the water level is higher (analogous to the price being lower) than before. We believe that no one has reason to put water into the tub (as no one will put oil into an oil well), so we figure that some peculiar accident has occurred, one that is not likely to be repeated. But each time we return, the water level in the tub is higher than before—and water is selling at an ever cheaper price (as oil is). Yet we simply repeat over and over that the quantity of water must be finite and cannot continue to increase, and that’s all there is to it.

Would not a prudent person, after a long train of rises in the water level, conclude that perhaps the process may continue—and that it therefore makes sense to seek a reasonable explanation? Would not a sensible person check whether there are inlet pipes to the tub? Or whether someone has developed a process for producing water? Whether people are using less water than before? Whether people are restocking the tub with recycled water? It makes sense to look for the cause of this apparent miracle, rather than clinging to a simpleminded fixed-resources theory and asserting that it cannot continue.”

Author Peter Jacobsen is a Writing Fellow at the Foundation for Economic Education