The IRS released new federal income tax brackets in November. Though marginal tax rates did not change, federal law requires brackets be adjusted for inflation.

The IRS released new federal income tax brackets in November. Though marginal tax rates did not change, federal law requires brackets be adjusted for inflation.5.4%

this year’s rise in tax brackets due to inflation. Last year’s increase across all brackets was 7%

Ronald Reagan’s Economic Recovery Tax Act (ERTA), enacted in 1981, was the biggest tax cut in American history. It was remarkably durable, reshaping the federal tax system—and American politics—for decades to come

Before 1981, inflation regularly pushed taxpayers into higher brackets boosting government revenue through inflation, rather than real increases in income, pushing people into higher income tax brackets reducing the value they receive from credits and deductions

ERTA ended bracket creep by requiring that 60 sections of the tax system be indexed for inflation. That ended easy financing forcing lawmakers to confront unpleasant realities and make hard choices. It permanently changed fiscal politics.

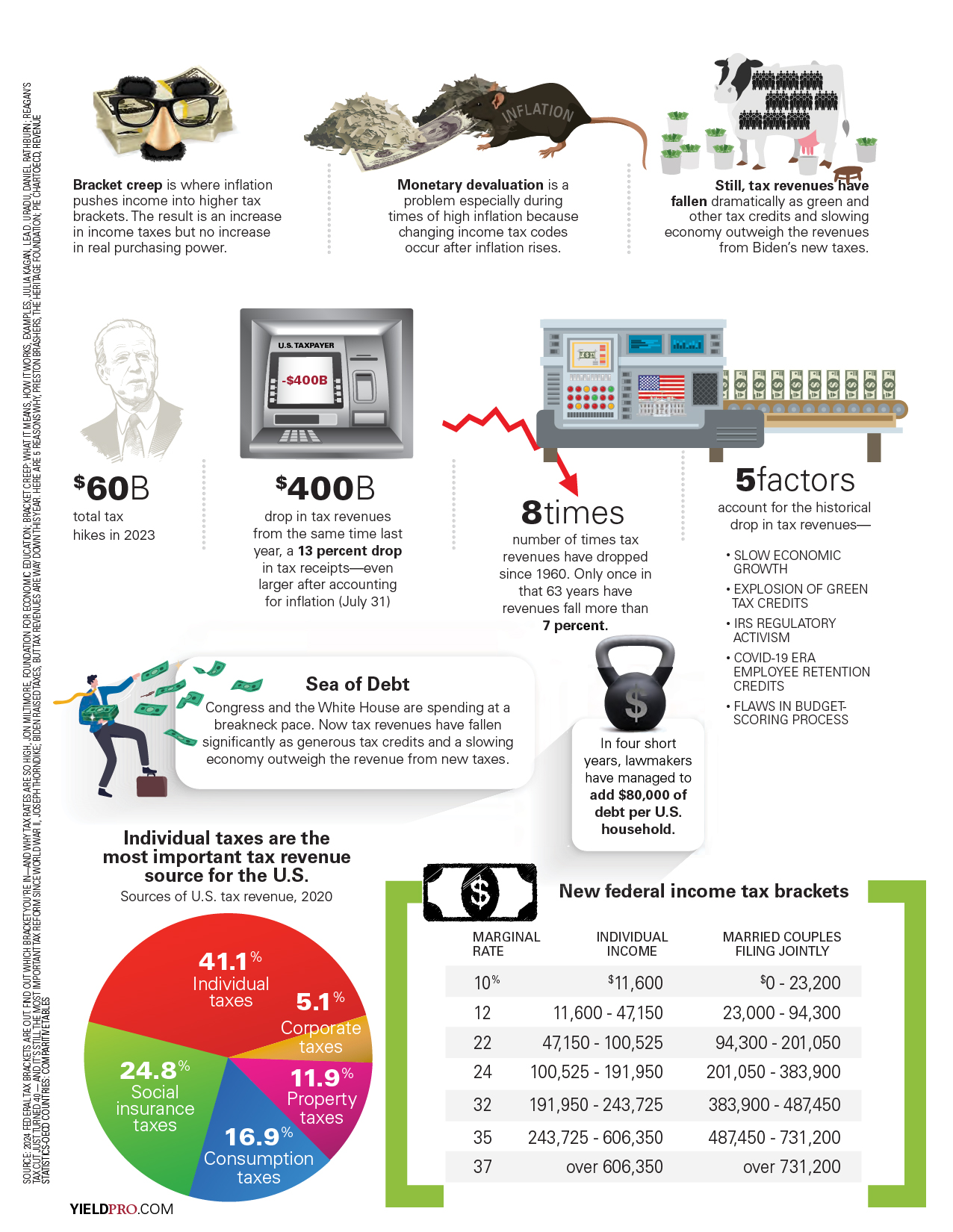

Bracket creep is where inflation pushes income into higher tax brackets. The result is an increase in income taxes but no increase in real purchasing power.

Monetary devaluation is a problem especially during times of high inflation because changing income tax codes occur after inflation rises.

Still, tax revenues have fallen dramatically as green and other tax credits and slowing

economy outweigh the revenues from Biden’s new taxes.

$60B total tax hikes in 2023

$400B drop in tax revenues from the same time last year, a 13 percent drop in tax receipts—even larger after accounting for inflation (July 31)

8 times number of times tax revenues have dropped since 1960. Only once in that 63 years have revenues fall more than 7 percent.

5 factors account for the historical drop in tax revenues—

• SLOW ECONOMIC GROWTH

• EXPLOSION OF GREEN TAX CREDITS

• IRS REGULATORY ACTIVISM

• COVID-19 ERA EMPLOYEE RETENTION CREDITS

• FLAWS IN BUDGET-SCORING PROCESS

Sea of Debt

Congress and the White House are spending at a breakneck pace. Now tax revenues have fallen significantly as generous tax credits and a slowing economy outweigh the revenue from new taxes.

In four short years, lawmakers have managed to add $80,000 of debt per U.S. household.

Individual taxes are the most important tax revenue source for the U.S.

Sources of U.S. tax revenue, 2020

41.1% individual taxes

24.8% social insurance taxes

16.9% consumption taxes

11.9% property taxes

5.1% corporate taxes

New federal income tax brackets

Marginal rate Individual income Married couples filing jointly

10% $11,600-47,150 $0-23,200

12 11,600 – 47,150 23,000 – 94,300

22 47,150 – 100,525 94,300 – 201,050

24 100,525 – 191,950 201,050 – 383,900

32 191,950 – 243,725 383,900 – 487,450

35 243,725 – 606,350 487,450 – 731,200

37 over 606,350 over 731,200

SOURCE: 2024 FEDERAL TAX BRACKETS ARE OUT. FIND OUT WHICH BRACKET YOU’RE IN—AND WHY TAX RATES ARE SO HIGH, JON MILTIMORE, FOUNDATION FOR ECONOMIC EDUCATION; BRACKET CREEP: WHAT IT MEANS, HOW IT WORKS, EXAMPLES, JULIA KAGAN, LEA D. URADU, DANIEL RATHBURN; REAGAN’S TAX CUT JUST TURNED 40 — AND IT’S STILL THE MOST IMPORTANT TAX REFORM SINCE WORLD WAR II, JOSEPH THORNDIKE; BIDEN RAISED TAXES, BUT TAX REVENUES ARE WAY DOWN THIS YEAR. HERE ARE 5 REASONS WHY, PRESTON BRASHERS, THE HERITAGE FOUNDATION; PIE CHART OECD, REVENUE STATISTICS-OECD COUNTRIES: COMPARATIVE TABLES