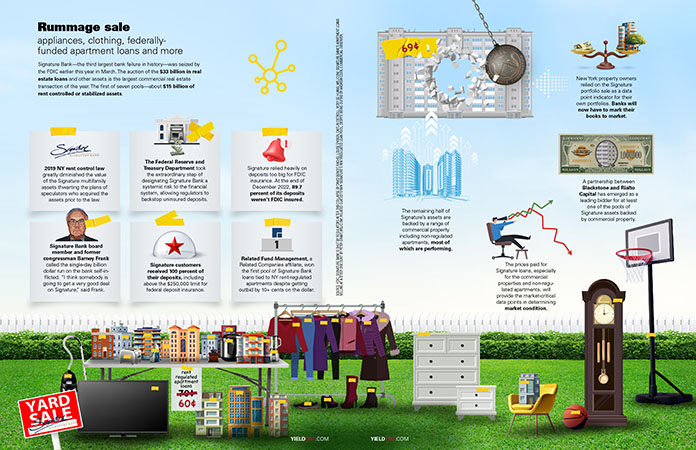

Signature Bank—the third largest bank failure in history—was seized by the FDIC earlier this year in March. The auction of the $33 billion in real estate loans and other assets is the largest commercial real estate transaction of the year. The first of seven pools—about $15 billion of rent controlled or stabilized assets.

Signature Bank—the third largest bank failure in history—was seized by the FDIC earlier this year in March. The auction of the $33 billion in real estate loans and other assets is the largest commercial real estate transaction of the year. The first of seven pools—about $15 billion of rent controlled or stabilized assets.

2019 NY rent control law greatly diminished the value of the Signature multifamily assets thwarting the plans of speculators who acquired the assets prior to the law.

The Federal Reserve and Treasury Department took the extraordinary step of designating Signature Bank a systemic risk to the financial system, allowing regulators to backstop uninsured deposits.

Signature relied heavily on deposits too big for FDIC insurance. At the end of December 2022, 89.7 percent of its deposits weren’t FDIC insured.

Signature Bank board member and former congressman Barney Frank called the single-day billion dollar run on the bank self-inflicted. “I think somebody is going to get a very good deal on Signature,” said Frank.

Signature customers received 100 percent of their deposits, including above the $250,000 limit for federal deposit insurance.

Related Fund Management, a Related Companies affiliate, won the first pool of Signature Bank loans tied to NY rent-regulated apartments despite getting outbid by 10+ cents on the dollar.

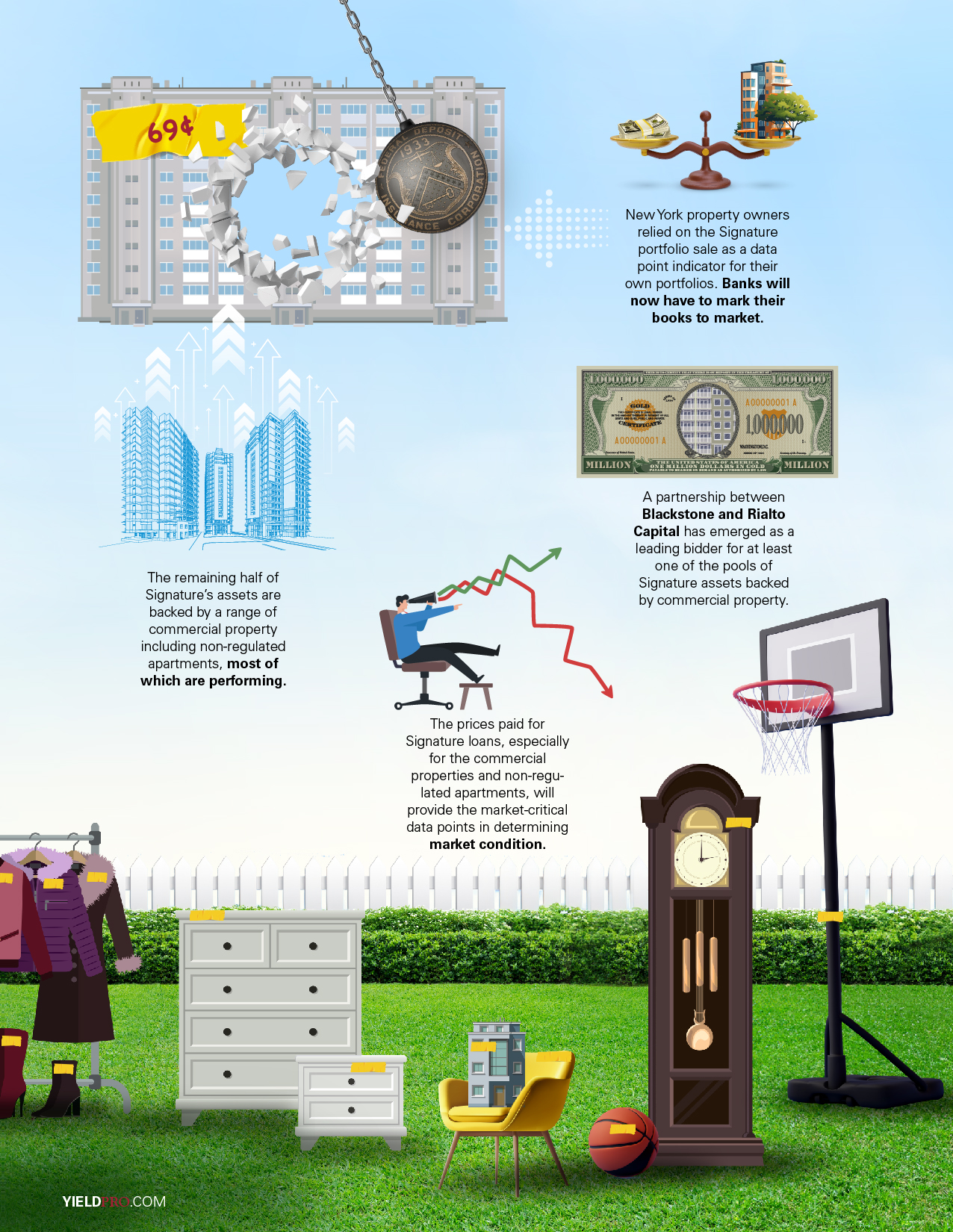

New York property owners relied on the Signature portfolio sale as a data point indicator for their own portfolios. Banks will now have to mark their books to market.

The remaining half of Signature’s assets are backed by a range of commercial property including non-regulated apartments, most of which are performing.

A partnership between Blackstone and Rialto Capital has emerged as a leading bidder for at least one of the pools of Signature assets backed by commercial property.

The prices paid for Signature loans, especially for the commercial properties and non-regulated apartments, will provide the market-critical data points in determining market condition.

SOURCE: FDIC, SIGNATURE BANK IS SHUT BY REGULATORS AFTER SVB COLLAPSE BY DAVID BENOIT, RACHEL LOUISE ENSIGN, CAITLIN OSTROLL, VICKY GE HUANG, WSJ.COM; SIGNATURE BANK’S APARTMENT LOANS SELLING AT A STEEP DISCOUNT BY PETER GRANT, WSJ.COM; RELATED SLATED TO WIN SIGNATURE’S RENT-REGULATED LOAN POOL, DESPITE BEING OUTBID BY ANDREW COEN, COMMERCIAL OBSERVER.