According to a new study from New York-based listing service RentHop, single renters are faced with widely varying housing burdens dependent on the median rent and income in a given area. Of all single renters living alone, 19.7 percent are women and 18.6 percent are men, based on data from iProperty Management.

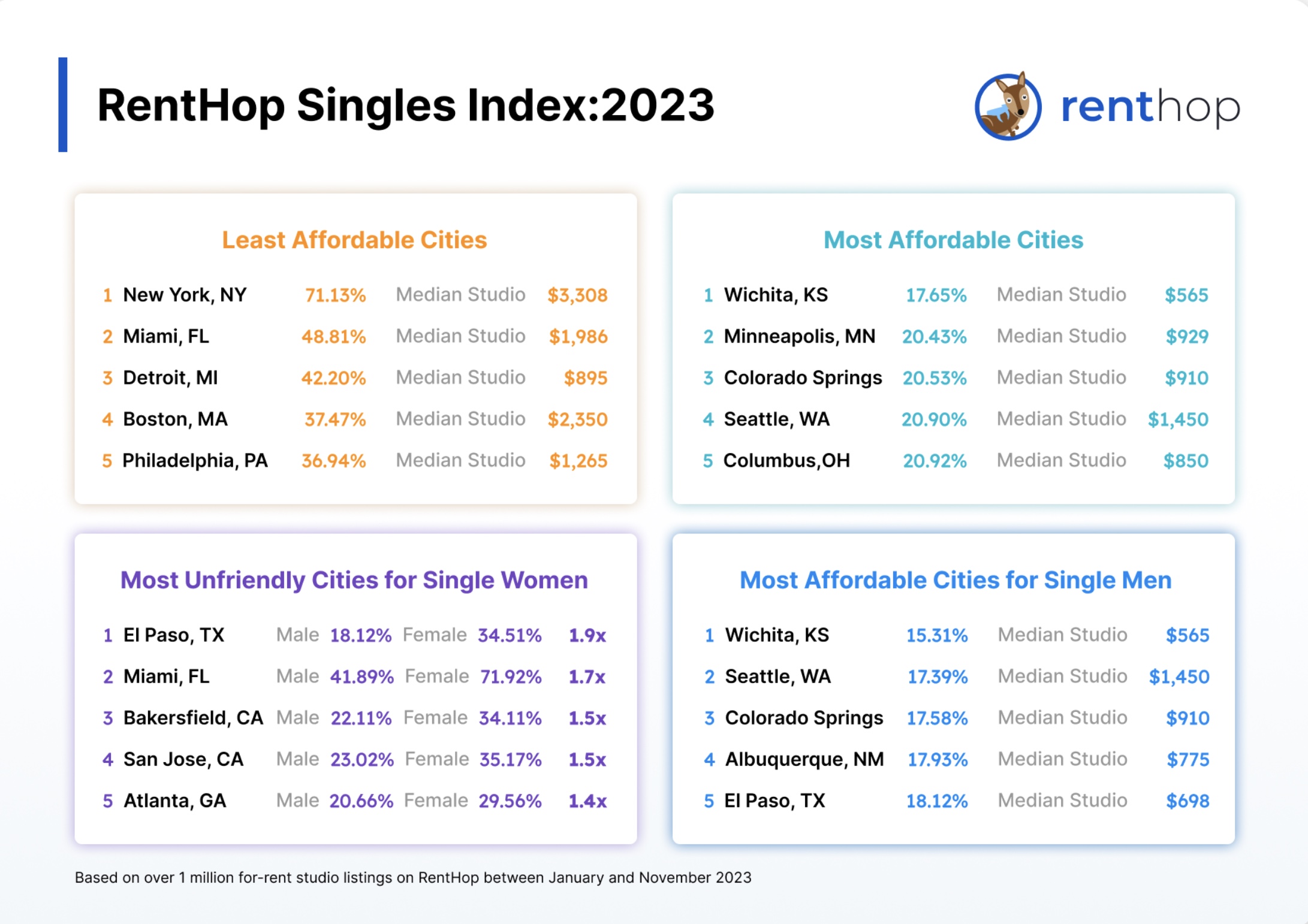

RentHop annually updates its Singles Index to calculate the housing burden—the percentage of income a single renter must allocate each month to rent a studio apartment in the nation’s largest cities.

In its most recent edition, RentHop broke the data down further to understand renters’ struggles, using median non-family income and non-family household income by sex data from the U.S. Census Bureau.

The most and least affordable

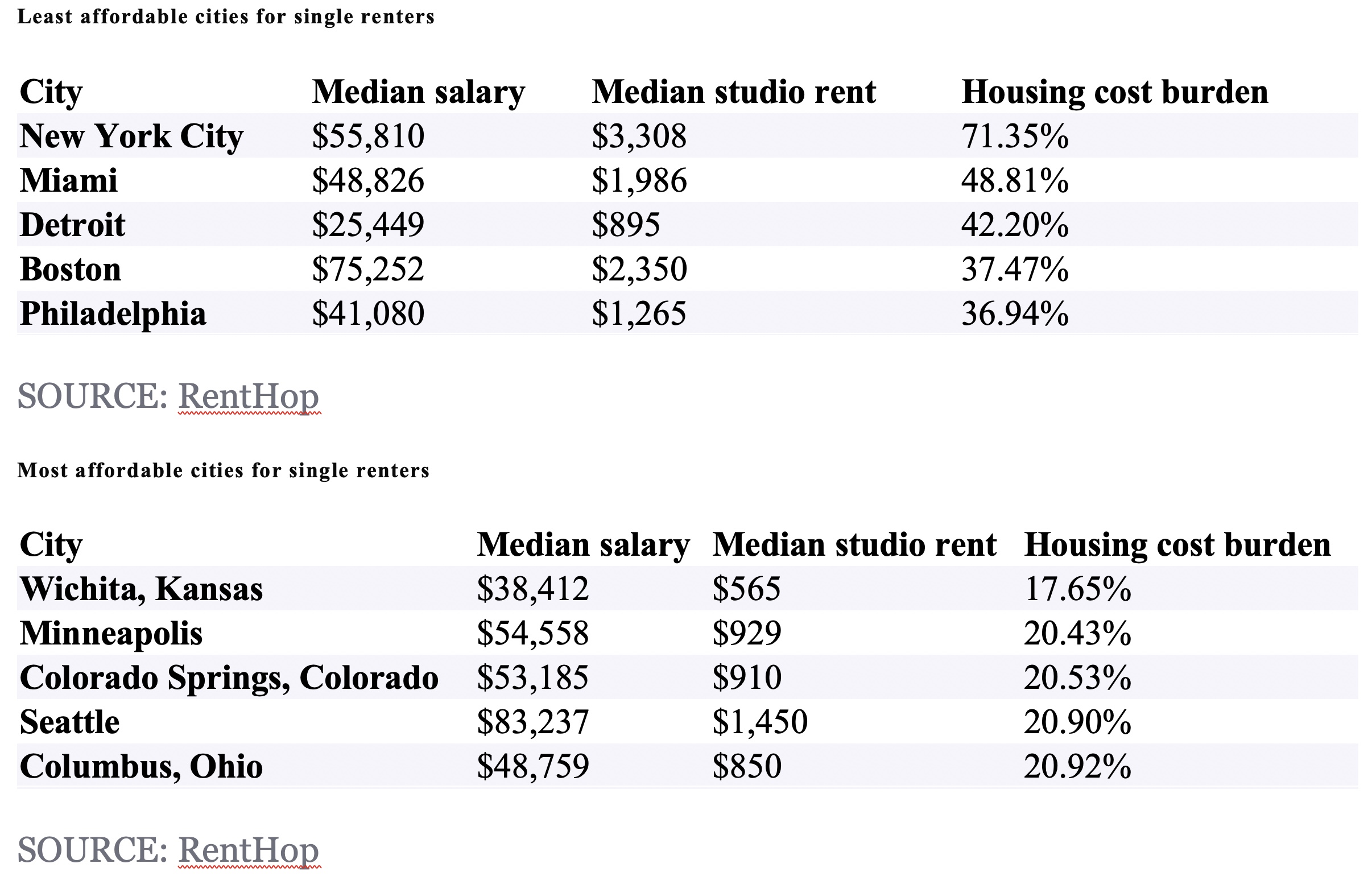

The chart below highlights the median rents of studio apartments in the nation’s most and least affordable cities.

Witchita, Kansas, is the nation’s most affordable city for single renters. The housing burden there is only 17.65 percent while the median rent for a studio apartment is $565.

On the other hand, New York is the nation’s least affordable city for single renters. The median rent for a studio apartment is $3,308 and, with a median non-family income of $55,810, a single renter in the city may have to spend 71.13 percent of their income on housing.

Broken down by gender, women could end up spending 79.42 percent of their median income on the median studio apartment in the Big Apple, while single men would spend only 60.99 percent.

This is because men’s median income is higher than that of women’s, according to RentHop.

The gender gap

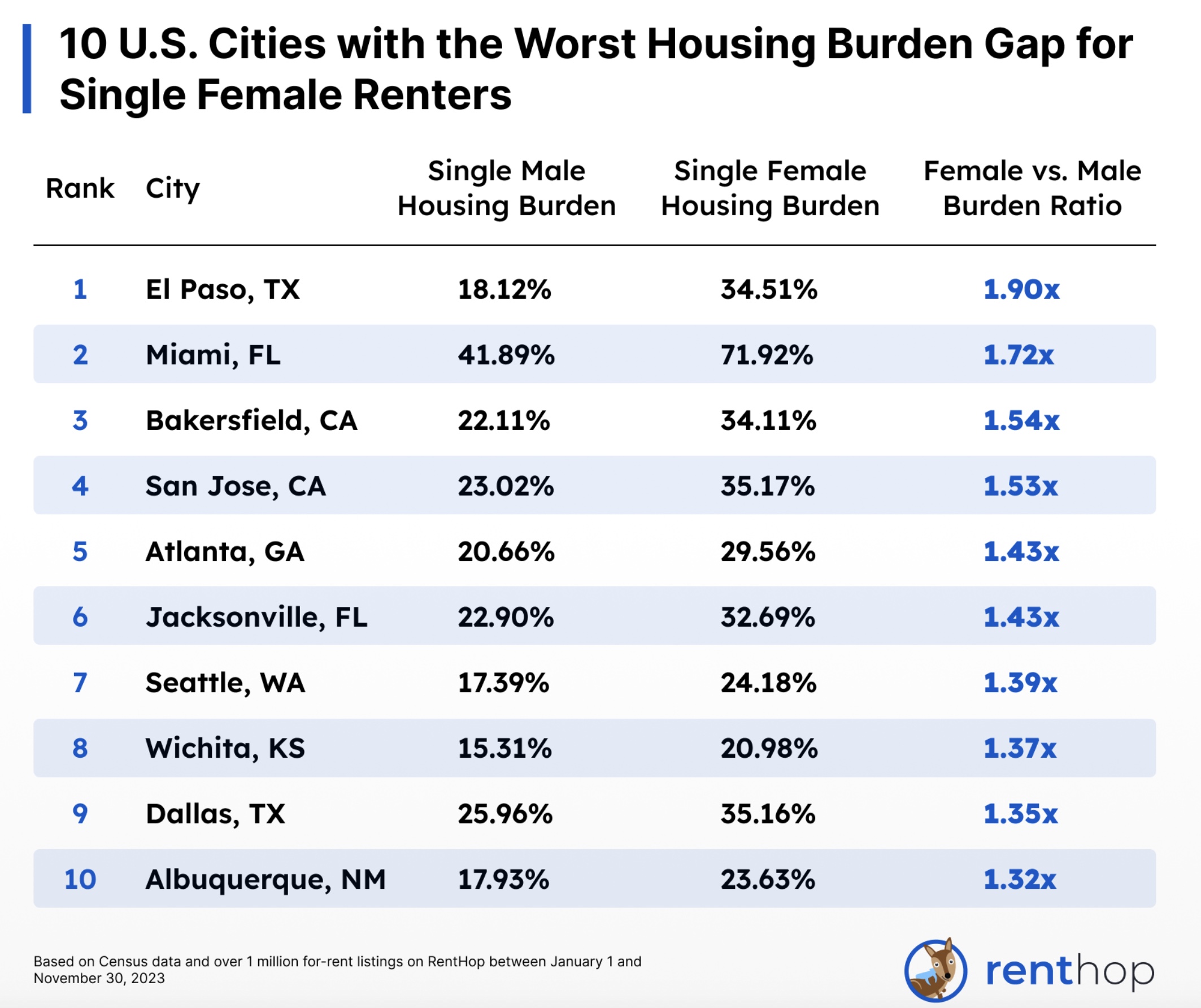

As of 2023, women earned 82 cents to every dollar earned by a man and this diversity is even more pronounced among people of color, according to the U.S. Department of Justice. Translated to housing, this gap means it is harder for a single women to buy or even rent a home.

Analysis from Pew Research indicates that the gender pay gap–the difference between the earnings of men and women–has resulted in a greater rent burden for women than men in major U.S. cities. This gap has barely closed over the past two decades.

In El Paso, Texas, single women would have to spend 34.51 percent of their income on housing to live alone in a studio apartment, while the commonly known standard for housing affordability is 30 percent. Meanwhile, single men would only need to spend 18.12 percent of their income to live alone in the same rental unit.

New York City, Detroit, Miami, and Boston ranked as the top four unaffordable cities in the nation for single people of both sexes given their high rental prices and relatively low single incomes.

Below is a chart that highlights the least and most affordable cities, including housing cost burden and median salaries for all single renters.

The story changes when the cities are ranked by the housing gap burden. The list below highlights the 10 U.S. cities with the worst housing burden gap among single renters. Singles who live alone generally pay a premium to rent and cover household bills. This premium is known as the singles tax. Zillow‘s latest findings reveal that the cost to rent alone (based on a one-bedroom apartment) increased this year to $7,110, an increase of more than $100 from last year’s already staggering figure.

Singles who live alone generally pay a premium to rent and cover household bills. This premium is known as the singles tax. Zillow‘s latest findings reveal that the cost to rent alone (based on a one-bedroom apartment) increased this year to $7,110, an increase of more than $100 from last year’s already staggering figure.

Meanwhile, cohabitating renters collectively save $14,220 annually on average by living together, but that can be as much as $40,200 in New York City, says Zillow.