Yardi Matrix reported that national average apartment rent was unchanged in January compared to the revised level of the month before at $1,710 per month. The national average year-over-year apartment asking rent growth was 0.5 percent in January, up 0.1 percent from the rate reported last month.

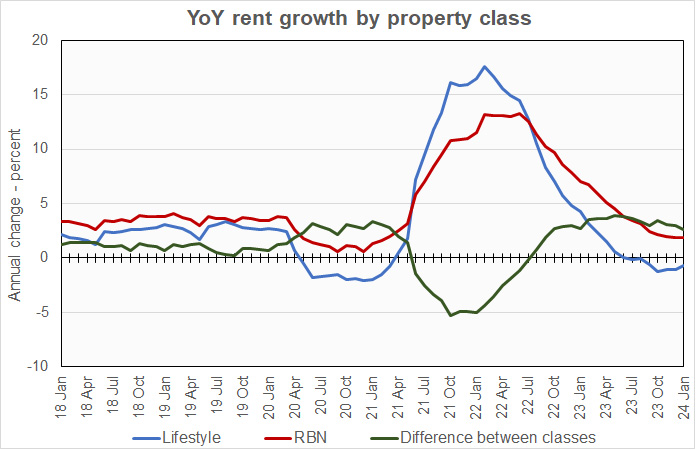

Rents in the “lifestyle” asset class, usually Class A properties, were down 0.7 percent year-over-year, while rents in “renter by necessity” (RBN) properties increased by 1.9 percent year-over-year. The chart, below, shows the history of the year-over-year rent growth rates for these two asset classes along with the difference between these rates.

The chart shows that the year-over-year rent growth rate for lifestyle properties seems to have stopped dropping and is now becoming less negative. At the same time, the year-over-year rent growth rate for RBN properties is trending lower. Both of these trends are moving in the direction of “normalcy”.

The national average lease renewal rate was 66.6 percent in November. New Jersey continued to be the leader in lease renewal rate with 81.8 percent of renters renewing. Philadelphia remained in second place with a lease renewal rate of 77.5 percent. Detroit, Miami and Kansas City also had lease renewal rates above 70 percent. At the other end of the spectrum, the lease renewal rate was only 48.6 percent in Los Angeles and 50.9 percent in San Francisco.

Year-over-year rent growth for leases that were renewed was 5.1 percent in November, down 0.1 percentage points from last month’s rate. As usual, individual metros varied significantly from the average. Year-over-year renewal rent growth was as high as 9.5 percent in Kansas City and as low as 0.4 percent in Phoenix.

Yardi Matrix reported that U.S. average occupancy rate dropped 0.1 percentage point in January to 94.6 percent. In January, only 3 of the 30 metros on which it reports saw occupancy rise during the month. This month, those metros were Seattle, San Francisco and New York.

Yardi Matrix also reported that single-family rental (SFR) rents rose $2 in January to $2,130 per month. The year-over-year SFR rent growth rate rose to 1.5 percent. Of the 34 metros tracked, 22 saw rents rise year-over-year.

The national occupancy rate for single-family rentals in January rose 0.1 percentage point from the level of the month before to 95.7 percent. However, Yardi Matrix forecasts 540,000 units to be delivered in 2024 and 460,000 units to be delivered in 2025, putting continued downward pressure on rents and occupancy.

Tabulating the data

Yardi Matrix reports on other key rental market metrics in addition to rent growth. These include the average rent to income ratio, the rent growth rate for residents who renew their leases and the portion of residents who renew. The metro averages are included in the tables below, but the report also includes the rent to income ratios for both lifestyle and for RBN properties.

Of the Yardi Matrix 30 metros, the 10 with the largest annual apartment rent increases are listed in the table below, along with their annual percentage rent changes, overall rent to income ratio, rent growth for renewed leases and renewal rate for the month. The data on asking rent growth and rent-to-income ratios are for January. The other data are for November.

| Metro | YoY asking rent growth % | Rent to income ratio % | YoY renewal rent growth % | Monthly lease renewal rate % |

| New York | 5.5 | 33.6 | 3.5 | 67.4 |

| New Jersey | 4.4 | 33.7 | 6.9 | 81.9 |

| Columbus | 4.2 | 27.3 | 6.0 | 66.0 |

| Kansas City | 3.4 | 25.7 | 9.5 | 71.2 |

| Indianapolis | 3.0 | 26.0 | 6.9 | 69.5 |

| Chicago | 2.9 | 29.9 | 4.1 | 66.7 |

| Boston | 2.6 | 31.2 | 6.8 | 66.4 |

| Twin Cities | 2.1 | 30.1 | 3.6 | 67.8 |

| Washington DC | 1.9 | 33.8 | 4.6 | 61.8 |

| Philadelphia | 1.5 | 29.9 | 7.0 | 77.5 |

Yardi Matrix reports most of its statistics for New Jersey for the state as-a-whole. However, it reports rent-to-income data for Northern New Jersey and for Central New Jersey as separate locales. The rent-to-income value for New Jersey listed above is the average of the Northern and Central values.

The major metros with the smallest year-over-year apartment rent growth as determined by Yardi Matrix are listed in the next table, below, along with the other data as in the table above.

| Metro | YoY asking rent growth % | Rent to income ratio % | YoY renewal rent growth % | Monthly lease renewal rate % |

| Austin | (6.0) | 25.9 | 0.6 | 58.0 |

| Orlando | (3.6) | 31.6 | 6.2 | 68.2 |

| Phoenix | (3.6) | 28.6 | 0.4 | 63.6 |

| Portland | (3.1) | 30.7 | 7.8 | 65.0 |

| Nashville | (2.4) | 31.8 | 3.2 | 60.9 |

| Raleigh | (2.4) | 27.1 | 5.2 | 67.5 |

| Atlanta | (2.3) | 29.8 | 6.0 | 65.8 |

| Las Vegas | (2.3) | 28.9 | 4.0 | 65.0 |

| Dallas | (1.9) | 28.0 | 3.3 | 64.8 |

| San Francisco | (1.9) | 30.5 | 1.2 | 50.9 |

The top metros for month-over month rent growth in January were Columbus, Indianapolis, Twin Cities and Los Angeles. The metros with the lowest month-over-month rent growth were San Diego, Detroit, Austin and Tampa. Only Columbus was on either list last month showing the volatility of these rankings.

SFR markets

Yardi Matrix reported on the top 34 metros for single family rentals. The leading metros for year-over-year rent growth were Boston, Raleigh, Indianapolis and Kansas City.

This month, 16 of the metros saw year-over-year occupancy increases. The metros with the largest year-over-year occupancy increases were Washington D.C., Tampa, Las Vegas and Houston. The metros with the greatest occupancy declines were Philadelphia, Orlando, Atlanta and Los Angeles.

The complete Yardi Matrix report provides information on some of the smaller multifamily housing markets. It also has more information about the larger multifamily markets including numbers on job growth and on completions of new units. It can be found here.