National apartment occupancy hit a 10-year low at the end of 2023, while demand reached its highest point since Q2 2022 and continues to be strong. The number of occupied apartments in the U.S. grew by more than 1.1 million units since the onset of the COVID pandemic, according to RealPage Analytics in February.

In the months preceding the outbreak of the pandemic, average national occupancy stood at about 96.3 percent in Q3 2019, just shy of the all-time high of 96.4 percent recorded in late 2000.

Then the pandemic struck. Stay-at-home orders brought job uncertainty as many businesses were deemed non-essential and forced to close. After an initial period of moving when renters scrambled for a safe place to hunker down, they settled in and became reluctant to move. Vacancy rates dropped 15 percent between March and April 2020, while renewals increased by four percent.

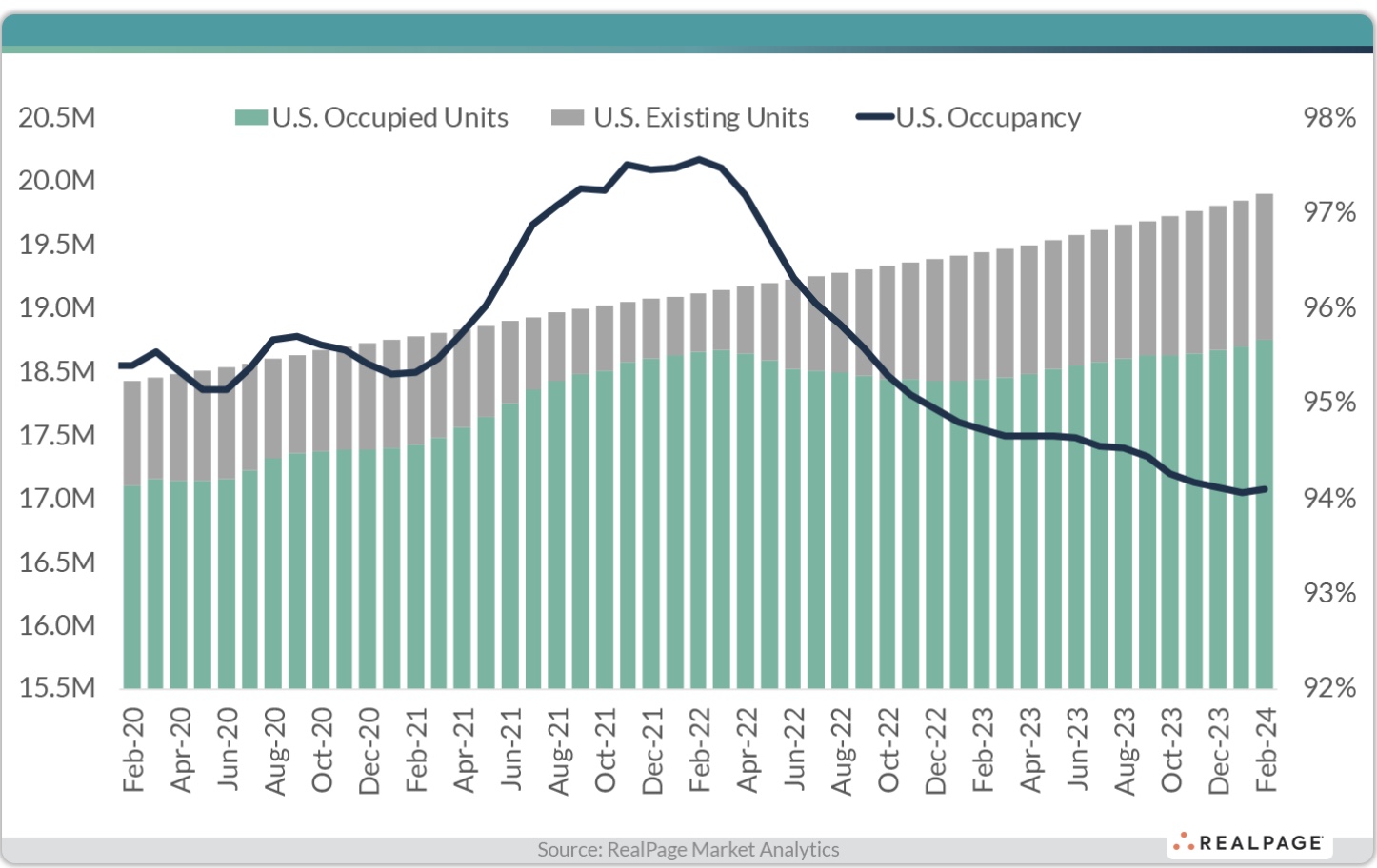

The lockdowns dragged on, continuing to slow moveouts. Occupancy and rents rose to an all-time high in December 2021, when 97.5 percent of professionally managed apartments were occupied, according to RealPage.

Developers responded eagerly during this period by applying for construction permits and ramping up starts. Eventually the market changed under the wave of completions. By December 2023, the average occupancy rate of professionally managed apartments in the nation was 94.1 percent, the lowest recorded since January 2014.

Despite the onslaught of new supply, demand for apartments has remained relatively strong. In Q4 2023, apartment demand hit its highest point since Q2 2022, after vacancies increased the previous quarter. In addition, annual absorption doubled from the previous quarter, amounting to about 233,700 units, according to RealPage. Despite the substantial increase, demand was still outpaced by supply, which surged to its highest level since 1987, representing a 36-year high.

Since the start of the pandemic in 2020, total inventory of occupied professionally managed apartments has grown by more than one million units. Of the approximately 19.4 million market-rate, professionally managed apartments across the U.S. as of February, more than 18.2 million were occupied, compared to the same period in 2020, when the nation’s total of 17.9 million professionally managed units were 95.4 percent occupied, or 17.1 million occupied units.

About 1.5 million apartment units have delivered across the U.S. since early 2020. Although occupancy has come down from highs recorded in 2021 and 2022, the number of occupied units has remained near all-time highs, testament to the apartment industry’s strength and resiliency.