The multifamily distress anticipated last year is finally starting to materialize. Although multifamily loan defaults remain relatively low, the multifamily distress rate rose as lenders push maturities forward, wrote Yardi Matrix in a report dated March 12.

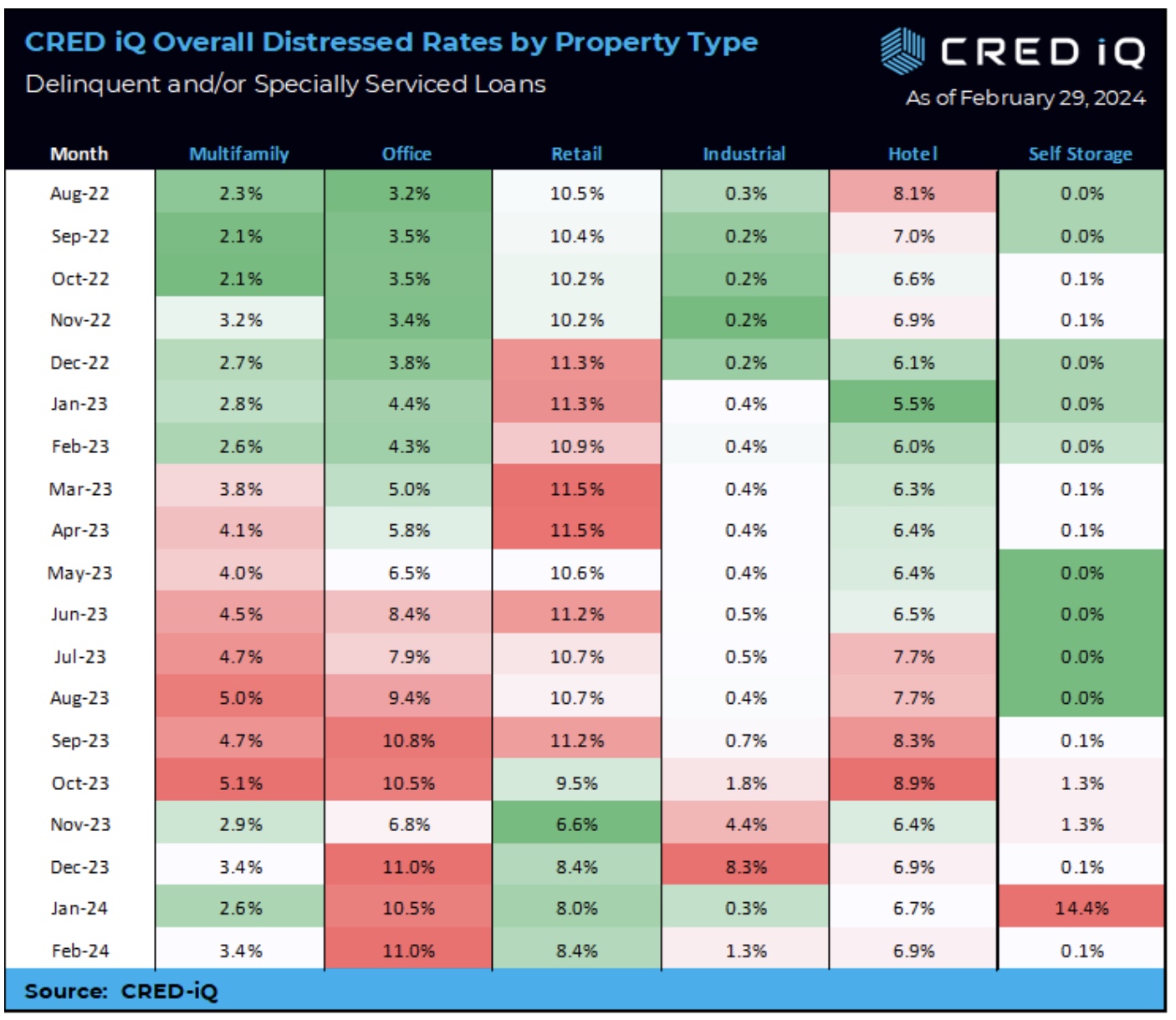

The multifamily distress rate hit its highest level in 18 months as of February 29, as reported by CRED iQ, which tracks and analyzes data and valuations of more than $2 trillion in commercial real estate.

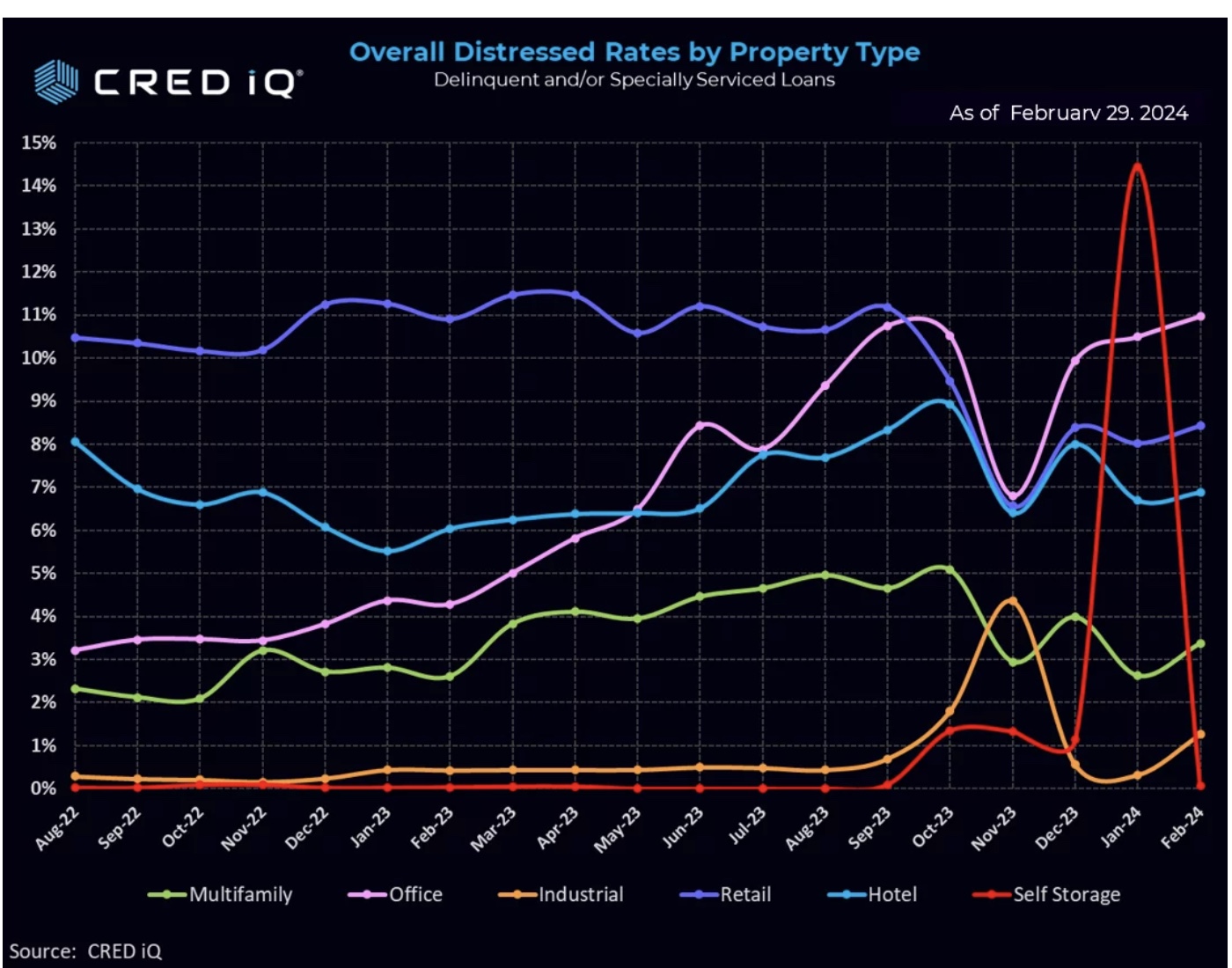

CRED iQ tracks the distress rate for all property types on a monthly basis by aggregating the entirety of payment statuses reported for each loan, along with special servicing status to arrive at the Distress Rate.

The Distress Rate for all property types dropped four basis points (bps) in February to 7.35 percent from 7.39 percent the previous month. “Our distress rate has logged modest decreases in three of the last four months, net reduction of 18 bps during that period,” wrote CRED iQ.

The overall distress rate declined primarily because the payment status of a loan on a $2.1 billion self-storage portfolio became current in March after being delinquent last month.

Despite the overall distress rate being slightly down, five of the largest property types each increased this month, with the multifamily sector seeing the largest monthly increase in distress in well over 18 months –an 80 bps increase, reported CRED IQ.

CRED iQ provided an example of the multifamily issues it tracks. A $94.1 million loan backing the 982-unit The Reserve at Brandon in East Tampa, Fla., fell 30 days delinquent in February.

CRED iQ aggregates the delinquency rate and specially serviced rate to yield the Distress Rate, which includes any loan with a payment status of 30 plus days or worse, any loan actively with the special servicer and any non-performing and performing loans that have failed to pay off at maturity.

CRED iQ provided an example of the multifamily issues it tracks. A $94.1 million loan backing the 982-unit The Reserve at Brandon in East Tampa, Fla., fell 30 days delinquent in February.

The loan’s rate cap expiration and initial maturity dates are April 2024 and there were three, 12-month extension options at securitization. The loan was added to the watch list in May 2023 due to low occupancy and DSCR, most recently reported in September at 82.3 percent and 0.41, respectively.

The as-is appraisal at underwriting was $232.5million, or $262,762 per unit, with an as-stabilized value of $312.6 million, with stabilization anticipated for March 2025. The servicer indicates they are in discussions to extend the April 2024 maturity date.

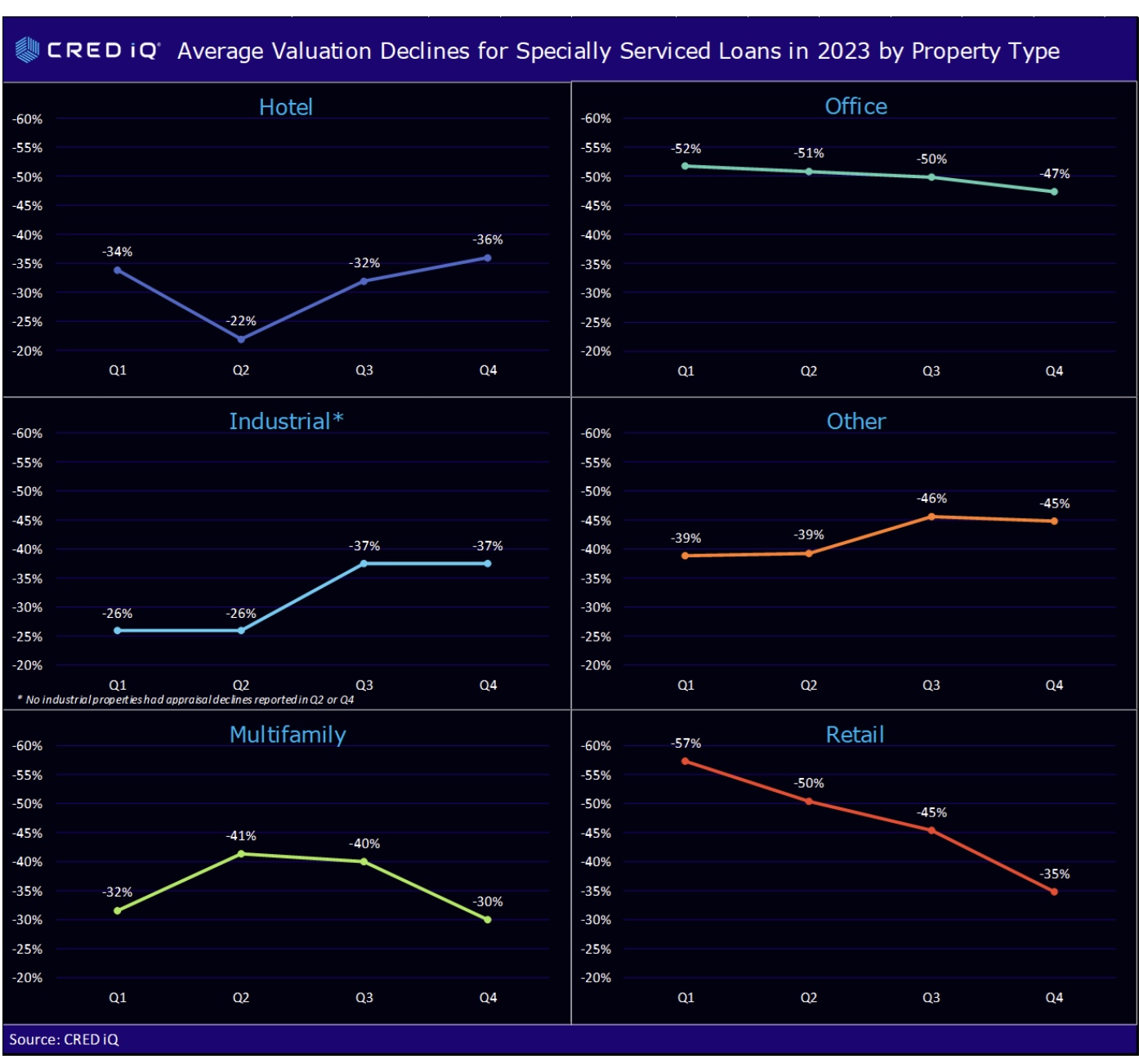

CRED iQ also tracks property valuation trends. CRED iQ analyzed 556 properties that were re-appraised during 2023 to determine the overall value impacts by quarter and property type and issued a report in February.

“The top 25 valuation declines all received an updated appraisal and we dug into that data. Each of these properties were either delinquent and/or transferred to a special servicer,” said CRED iQ analysts.

Multifamily was in third place last year with a 35 percent valuation decline but seems to be more unpredictable so far this year.