Multifamily analysts take a look at apartment supply from both sides, predicting the market will work through its current supply overhang by 2026/2027.

In his latest blog on LinkedIn, RealPage market analyst Carl Whittaker said the most frequent question he’s heard over the past month or so is some version of, “How long will the supply overhang last?”

Admitting he knows of no scientific way to model an accurate answer, Whittaker provided instead a few supporting data points around construction starts from RealPage Analytics.

He points out that starts are now below their 10-year average, down 40 percent year-over-year nationally. “That means there’s a likelihood that by 2026/2027 we see realized deliveries come in below the 2010’s normal level,” he said, with a reminder that the industry once viewed 2010 levels of supply as being “crazy high.”

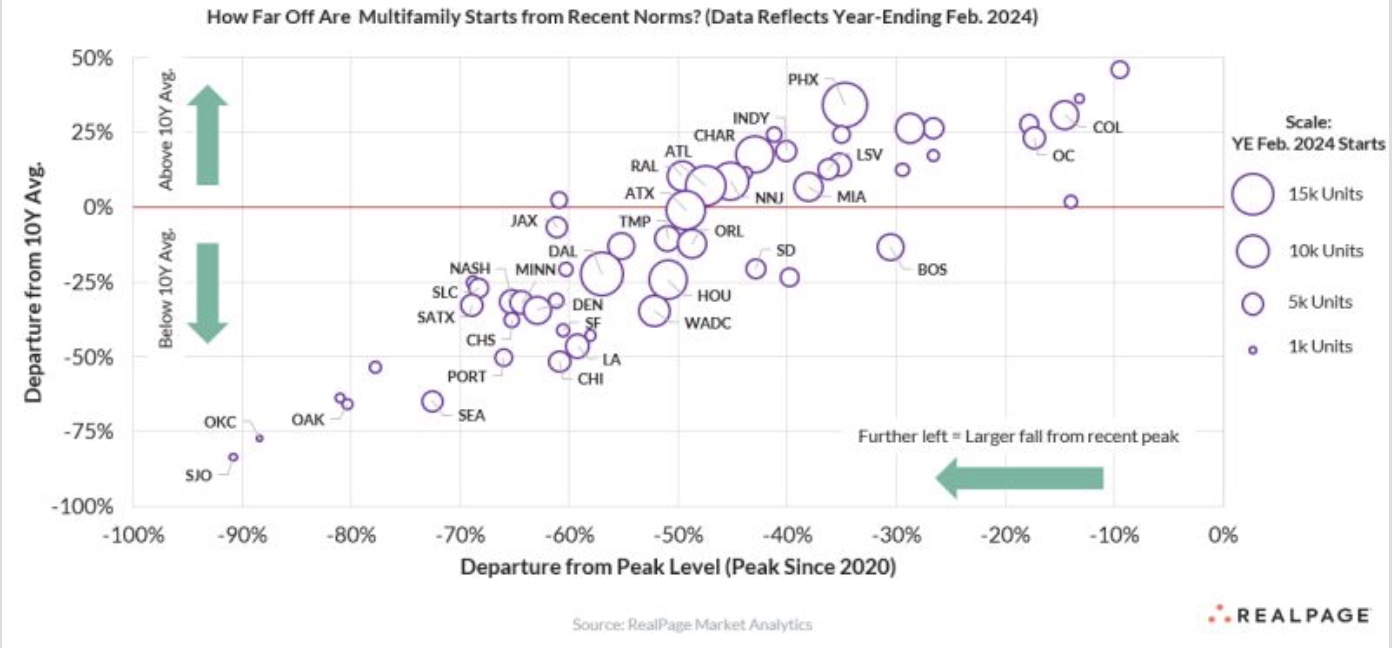

Reading right to left in the X-axis of the chart below shows that every major market in the U.S. is currently starting fewer units than the post-2020 peak level.

“But a key factor in solving for the supply overhang variable might well be how far starts are from their norm. And even though many markets are below normal levels, there are more than a handful where today’s construction environment feels higher than usual. Those are markets above the red line here,” said Whittaker.

On his LinkedIn page, Jay Parsons, head of investment strategy and research, at Texas-based Madera Residential, looks at supply from the number of apartments delivering into markets across the nation.

He sees overall supply peaking this year, dropping from there, and plummeting by 2026 due to so few new starts occurring.

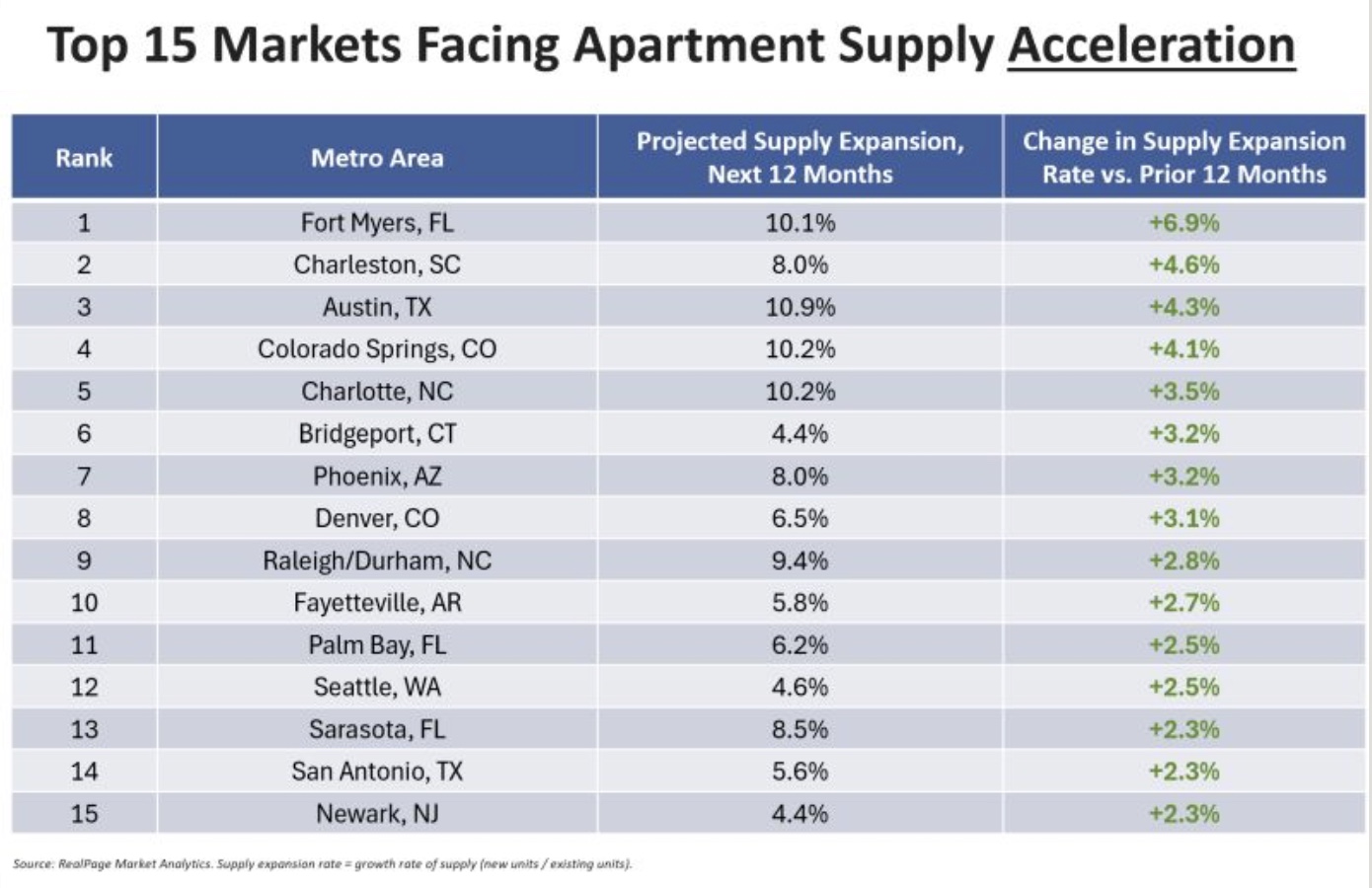

“Apartment supply today is at 40-year highs, and we’ll hit a 50-year peak in the second half of 2024. That means a lot of markets have even more supply hitting the market this year,” said Jay Parsons.

The chart below shows the top 15 markets experiencing the most acceleration in new apartment completions.

The next chart features 15 markets that will see less apartment supply delivering next year than they added over the past year.

“The drops aren’t massive yet, and won’t be until 2025. But some of these markets coming off supply peaks earlier could see faster rebounds in occupancy and rent,” said Parsons. Rents fall most in markets adding the most supply, while the biggest rent gains are seen in low-supply markets.

For more detail, check the LinkedIn page links provided within this piece.