Although it might defy conventional wisdom, Class A apartments in high-supply markets are outperforming upper tier Class B assets on year-over-year rent growth, according to RealPage Analytics.

New apartment supply is at its highest annual level since 1986, when approximately 550,000 new units were delivered, and continues to be the primary influence on national apartment performance, per data from RealPage.

RealPage multifamily market analyst Carl Whittaker points out that in theory today’s record supply would be a detriment to Class A properties.

“After all, aren’t all these new properties going to be competing for an inherently limited pool of renters?” he asks.

But rent pressure from newly delivered Class A properties in high supply markets has been substantial enough that these luxury assets have become competitive with the upper-tier Class B property set.

But the numbers differ by market, since the multifamily sector is not in lock step. Last year, Class A multifamily outperformed in markets with a prevalence of Gen Xers, those in the age bracket of 25 -44. Home prices were out of reach for that demographic, as noted in Institutional Property Advisors report Q3 2023.

Young renters today have the highest income ever, according to Federal Reserve data. Yet homeownership is still so far out of reach for first-time homebuyers, the next best thing is a Class A rental unit, said Whittaker, adding that the lack of starter home inventory is another issue—one that apartment supply cannot solve.

With rent-to-income ratios nationally at approximately 23 percent, a renter may have some incentive to move from an upper tier Class B unit into a Class A unit when the rent difference between the two asset classes is small enough, “say around $80 per month,” said Whittaker.

Class B then has to get competitive to stabilize its occupancy, then that flows down into Class C, he said.

Renters moving up from Class B and C units in high-supply markets leads to rent cuts in those assets in order to backfill the units.

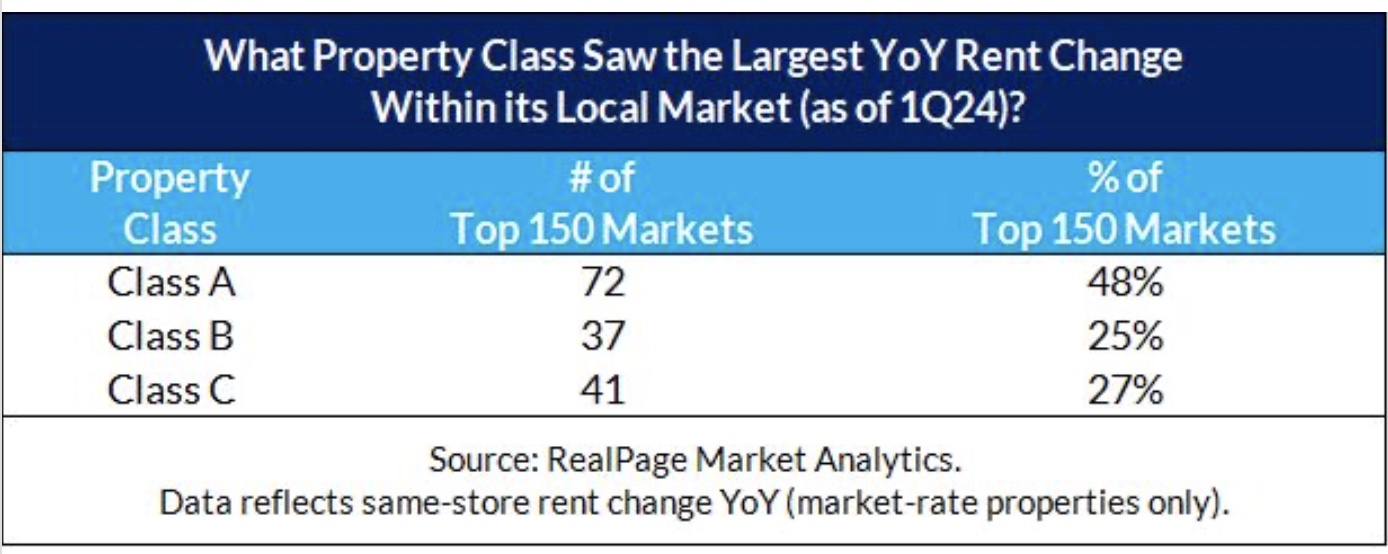

There were 19 major U.S. metros where less than five percent of all existing apartment supply delivered in the past 12 months. Among those, 12 markets saw Class A rent growth outpace that of Class B and Class C properties in their respective market, according to RealPage. Noteworthy inclusions are Austin, Boise, Jacksonville, Raleigh, Salt Lake City, and Wilmington. And out of 150 total markets, Class A rent growth lead in 72 of those markets. See the chart below:

Whittaker acknowledges that overall new supply does help increase rental affordability.

“I think the reason that today’s market defies that conventional wisdom is because this is the first time in more than 40 years that we’ve seen this degree of supply pressure. So yes, supply might raise the base rent of a market due to the cost of development alone,” he said adding that enough new supply slows same-store rent growth across all unit classes and price spectrums.