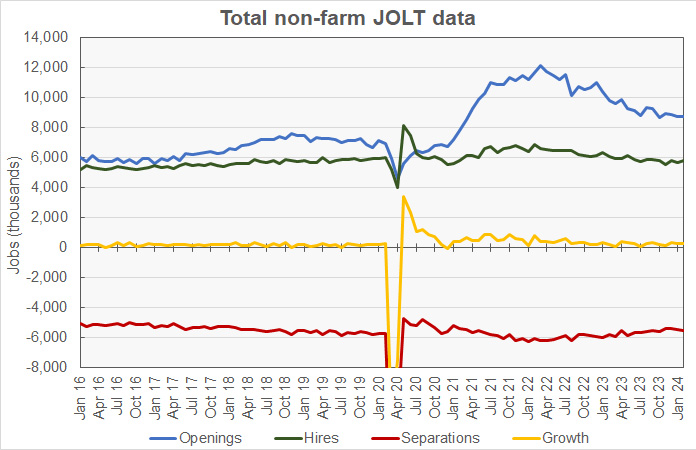

The Job Openings and Labor Turnover (JOLT) report from the Bureau of Labor Statistics (BLS) said that the number of job openings in February was 8.76 million. This was reported to be down 8,000 openings month-over-month. However, the openings figure for January was also revised lower by 115,000 openings. Job openings were down 1,093,000 openings from the year-ago level.

Hiring was up from last month’s revised (+11,000) figure for the economy as a whole, rising 120,000 to a level of 5.82 million hires. Total separations rose 110,000 from last month’s revised (+108,000) figure to a level of 5.56 million. Within total separations, quits were reported to rise 1.1 percent while layoffs rose 8.0 percent. Quits represented 62.7 percent of total separations for the month.

Overall job openings continue slow decline

For a discussion of the JOLT report and how it relates to the Employment Situation Report, please see the paragraph at the end of this article.

The February job openings figure represents 5.3 percent of total employment plus job openings. For comparison, the unemployment rate in February was reported to be 3.9 percent and 6.46 million people were unemployed. Another 5.67 million people said that they would like a job but were not counted as being in the labor force since they were not actively seeking employment.

The excess of hiring over separations in the February JOLT report implies an employment increase of 259,000 jobs for the month. Last month’s employment increase was revised to 249,000 jobs, down by 97,000 jobs from the gain reported last month.

Of those leaving their jobs in February, 3.48 million quit voluntarily, while 1.72 million people were involuntarily separated from their jobs. The remainder of people leaving their jobs left for other reasons, such as retirements or transfers. The portion of people quitting their jobs was up 0.1 percentage point from last month’s figure at 2.2 percent of the labor force. The involuntary separations rate was up 0.1 percentage point from last month’s figure at 1.1 percent.

Total non-farm JOLT data since January 2016 is shown in the first chart, below.

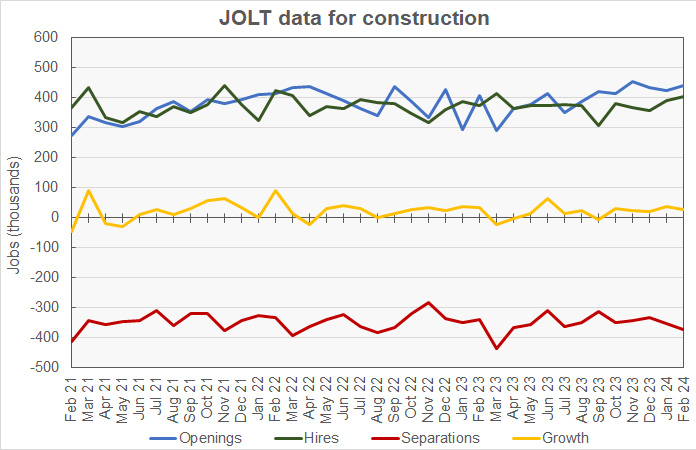

Construction employment rises

The next chart, below, shows the employment situation for the construction jobs market over the last 37 months. It shows that February saw a net gain of 28,000 construction jobs compared to last month’s revised gain of 37,000 jobs.

Construction jobs openings in February were reported to be 441,000 jobs, 32 percent higher than last year’s level. The number of job openings in February was only exceeded by the 454,000 openings recorded in November 2023. On a month-over-month basis, openings for construction jobs were reported to rise by 16,000 openings from January’s revised (+12,000) job openings figure. Job openings in the construction category represent 5.1 percent of total employment plus job openings, up from the 4.8 percent level reported last month.

Hiring was reported to be up by 13,000 jobs in February from the prior month’s revised (+10,000) jobs figure at 403,000 new hires. The number of construction jobs that were filled in February was reported to be up 7.5 percent year-over-year.

Construction jobs total separations were reported to rise by 22,000 jobs from the prior month’s revised (-19,000) figure to 375,000 jobs.

Quits were reported to be rise by 1,000 jobs from January’s revised (+3,000) figure at a level of 152,000 jobs. Quits represented 40.5 percent of separations for the month, down by 2.3 percentage points from the revised level of last month and well below the level for the economy as a whole.

Layoffs were reported to rise by 27,000 from January’s revised (-23,000) figure to 214,000 jobs. “Other separations” which includes retirements and transfers, were reported to be down 5,000 at 9,000 jobs.

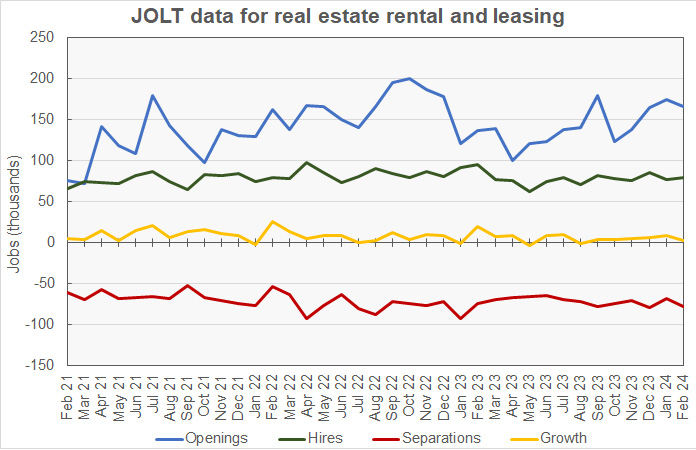

RERL openings rate above overall level

The last chart, below, shows the employment situation for the real estate and rental and leasing (RERL) jobs category. Employment in this jobs category was reported to rise by 6,000 jobs in February.

The number of job openings in the RERL category was reported to be 166,000 jobs at the end of February. This was down 9,000 job openings from the revised (-3,000) level of the month before. Job openings in February were 21.1 percent higher than the year-earlier level. Job openings in the RERL category represent 6.2 percent of total employment plus job openings.

Hiring in February was up 3,000 jobs from January’s revised (-7,000) figure at 80,000 jobs. The hiring figure was 15.8 percent below the year-earlier level.

Total separations in the RERL jobs category in February were up by 10,000 from January’s revised (-7,000) figure at 78,000 jobs.

Quits were up by 13,000 from January’s unchanged figure at 49,000 jobs. Quits represented 62.8 percent of total separations in February. Layoffs were reported to fall by 8,000 from January’s revised (-7,000) figure to 22,000 jobs.

The numbers given in the JOLT report are seasonally adjusted and are subject to revision. It is common for adjustments to be made in subsequent reports, particularly to the data for the most recent month. The full current JOLT report can be found here.

Comparing the reports

The US labor market is very dynamic with many people changing jobs in any given month. The JOLT report documents this dynamism by providing details about job openings, hiring and separations. However, it does not break down the jobs market into as fine categories as does the Employment Situation Report, which provides data on total employment and unemployment. For example, while the Employment Situation Report separates residential construction from other construction employment, the JOLT report does not. The Employment Situation Report separates residential property managers from other types of real estate and rental and leasing professionals, but the JOLT report does not. However, the JOLT report provides a look at what is driving the employment gains (or losses) in broad employment categories.