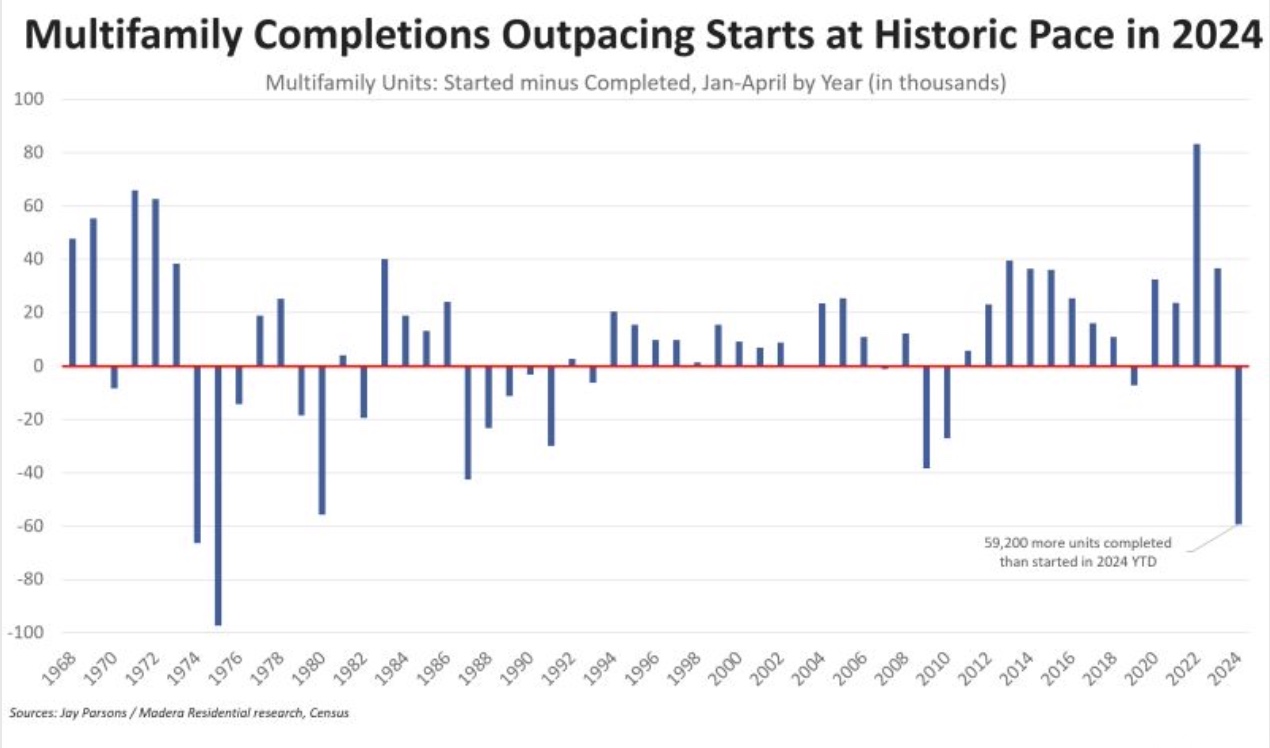

Multifamily analysts predict supply will continue to exceed demand this year, keeping vacancy elevated and putting downward pressure on rents. So far in 2024, U.S. multifamily completions are outpacing new starts at the widest levels since 1975, Madera Residential Head of Investment Strategy Jay Parsons pointed out in a recent LinkedIn report.

Through April 2024, multifamily completions are at multi-decade highs, while starts continue to rapidly plunge due to high interest rates, flat-to-falling rents for lease-ups (depending on the market), and construction costs often coming in above replacement value, Parsons writes.

“Simply put, it’s very difficult to start new unsubsidized apartment projects right now,” said Parsons.

According to CB Richard Ellis (CBRE), the large volume of apartment units delivered so far this year helped squash property owners’ ability to raise rents, which remained flat when compared with Q4 2023, at an average of $2,163, writes Trepp in its blog The Rundown.

The construction boom of recent years was spurred by record low interest rates. But in March 2022, the Fed made its first interest rate increase since 2018, and raised them an additional 10 times since.

A record 438,500 units were delivered last year, according to the U.S. Census Bureau. As rates increased, construction starts have slowed markedly, peaking at 147,026 units in Q2 2022, according to CBRE, putting them on an annualized run rate of just more than 588,000 units. That pace has declined by more than 67 percent to 47,758 units in the latest quarter to a run rate of 191,000 units.

The average length of time to complete construction of a multifamily building, after obtaining permits, was 19.8 months, according to the 2022 Survey of Construction from the Census Bureau.

Based on the number of permits that were previously issued and historical completion rates, Northmarq earlier this year had projected that 550,000 units would be delivered in 2024, noting that the number of permits issued last year had declined by more than 20 percent year over year.

Northmarq also projects that the national vacancy rate will peak at 7.3 percent by the end of this year before excess units start to get absorbed.

Trepp expects rent growth will remain soft while the supply that’s coming online gets absorbed. Then, all other factors remaining unchanged, rent growth ought to return.

Parson’s agrees. “In the mid- and longer-term, you can see how (assuming the job market stays healthy) demand could exceed supply again, perhaps even by next year in some markets, which would in turn put upward pressure on rents, though unlikely to the sky-high growth levels of 2021-22.”

“Ironically, cheap debt helped fuel the multifamily construction boom, which in turn tamed rental inflation. And now expensive debt is helping tame the multifamily construction boom, which could fuel renewed rent inflation,” he writes.

But he thinks multifamily starts won’t meaningfully accelerate until the second half of 2025 and more likely in 2026.

“Even if the Fed trimmed rates a bit, equity and debt players will want to see the current wave of lease-ups stabilize and rent growth return even at moderate levels. Plus, we’ll likely also need to see stabilized asset values rebound enough to bring back the discount to build versus buy (at scale),” he said.

Trepp notes that as supply numbers vary across the country, so do vacancies. The Midwest and Northeast, which weren’t saddled with too much supply while the liquidity spigots were wide open, have maintained a relatively balanced supply-demand picture. The Sunbelt, on the other hand, could see vacancy skyrocket to 8.5 perecent, or even more, according to Northmarq, as it had more than its share of unit deliveries, said Trepp.

Trepp takes a look at what this has meant for cap rates. According to Northmarq, the median price for an apartment unit last year declined by 15 percent to $240,000/unit and cap rates increased by at least 100 basis points to 5.2 percent or more. In some markets, they’re as high as 5.75 percent.