Analysts predict how multifamily will thrive in 2025

As we enter the New Year, analysts are peering into their crystal balls to predict how multifamily will thrive in 2025.

Yardi Matrix sees the multifamily market poised for modest growth, driven by...

Which multifamily market will see the highest rent growth in 2025?

Moody’s Analytics associate director and economist Nick Villa gazes into his crystal ball to determine which markets will see the highest apartment rent growth in 2025.He leans on Moody’s Q3 2024 Preliminary...

Student housing sector ends stellar 2024 leasing season

The student housing sector ended a stellar 2024 leasing season, according to the October national student housing report from Yardi Matrix. Preleasing and rent growth both were close to last year’s historic...

The U.S. does not have a housing shortage

The word “shortage” has a very specific meaning. It refers to the inability to purchase a good at the current market price (or at any price). Rent control, which restricts the legal price of...

Residents expect electronic access control

Properties see value in access control solutions’ core mission of enhancing community safety and security.

Parks Associates’ new study, Smart Properties: The Value of IoT for MDUs, finds many multifamily residents and staff now expect...

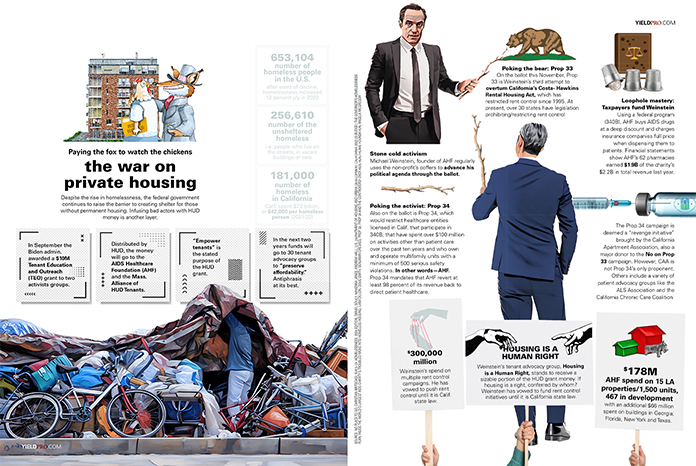

Paying the fox to watch the chickens: The war on private housing

Despite the rise in homelessness, the federal government continues to raise the barrier to creating shelter for those without permanent housing. Infusing bad actors with HUD money is another layer.

In September the Biden admin....

The price of disorder

I was once pitched a deal in the heart of the Amazon—Manaus, Brazil. What was I buying? Firstly, a commercial asset. But I couldn’t shake my concern around governance. The sanctity of a contract...

San Francisco city council targets free speech to cover up its own housing failures

The San Francisco city council is smashing the mirror because it doesn’t like the face staring back at it.

The council just approved a ban on websites that offer data about local rental markets and...

California to turn unused school land into millions of housing units

In an effort to address a lack of housing that officials say has contributed to a shrinking teaching workforce, the California Department of Education is planning on converting undeveloped school lots into affordable housing.

State...

Market set for recovery

The multifamily housing market is showing promising signs of recovery, with recent data from CoStar Group revealing a significant increase in demand and stabilization of vacancy rates.

Absorption rates have notably risen from 118,000 units...

Apartment market fundamentals stabilized in July, reports RealPage

According to data from RealPage Analytics, apartment fundamentals stabilized in July. Rent growth and occupancy remained relatively steady during the month. National occupancy was 94.2 percent for the third straight month, which...

Increasing apartment supply is slowing new lease-up velocity

Increasing apartment supply is slowing new lease-up velocity, said Madera Residential head of investment strategy and research Jay Parsons. Leasing velocity for newly built apartments is at its slowest pace in recent...

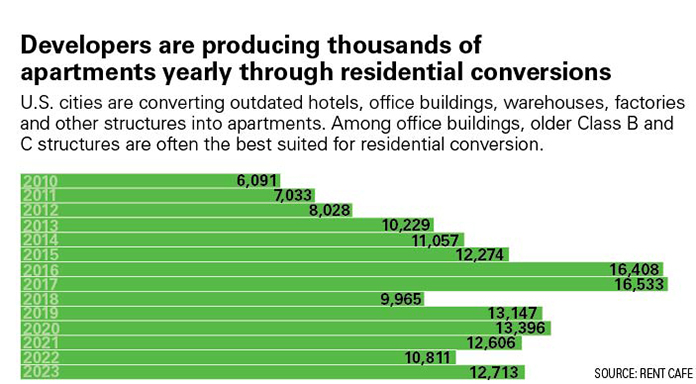

Office to apartments

download pdf

Hybrid work is likely here to stay. This shift isn’t just changing lifestyles—it’s also affecting commercial spaces. Office vacancy rates post-COVID shot up almost overnight, and they remain near 20 percent nationwide, the...

L.A. homeless tower building cost rings bells

Gym, balconies, restaurant, soundproof music studio, business center, located in downtown Los Angeles, and it’s pet friendly.

Sounds like a pretty good hotel, four-stars at least.

Sounds like it, but it isn’t. It’s the new Weingart...